Bond yields at a glance | ||||

MBIS benchmark (~AA) | MBIS AAA | MMD AAA | U.S. Treasuries | |

10 year | 2.656 | 2.581 | 2.43 | 2.86 |

30 year | 3.117 | 3.034 | 2.97 | 3.14 |

|

MBIS indices are updated hourly on the Bond Buyer Data Workstation. | ||||

A lack of supply, price direction, and yield -- yet an abundance of uncertainty -- made for a manic Monday in the municipal market, according to one New York trader.

The day started out with a huge customer bid list of approximately $500,000, which the trader said was likely the result of a hedge fund that loaded up on municipals back in December and failed to make a profit on the bonds during the ill-fated January effect.

“That didn’t play out so well,” the trader said of the seasonal phenomenon.

Besides the mammoth bid list, investors were shaken up by a few market events on Monday, the trader said.

Treasury 10-years started out at 2.90%, but then settled back down to 2.85%, not to mention the bounces in the equity market.

“Retail is not sure what to do; there’s a lot of uncertainty,” he said. “Retail has not really been participating all that strongly out there,” he continued, “but with higher yields they will come back and play.”

The lack of supply also deterred investors on Monday.

“Supply gives a lot of people price direction -- and they need that price direction,” the trader added.

Institutions, meanwhile, were taking a page out of the retail market’s book -- some standing on the sidelines, parking available cash.

“I think they have money, but it’s smart money, and I think they are going to wait until they are sure,” he said. “They are afraid to make a mistake” in the current market climate.

With respect to the secondary market, he said “It’s easier to buy things in the secondary at the right price than it was in the past -- it was more brutal before -- but now you are not overpaying because there are people forced to sell right now,” he explained.

“When you have a period when they are cutting all the time, it shakes people up -- they don’t like uncertainty,” he said of the retail and institutional crowds.

John Donaldson, director of fixed income at Haverford Trust, agreed that it was a quiet Monday with little change from Friday’s close.

“The two most surprising aspects to the muni market have been the positive inflows to mutual funds each week in 2018 and the continued buying on the part of insurance companies,” he said.

Unlike the New York trader, Donaldson is seeing good institutional demand.

“We thought that insurance demand might have been muted after a year with record catastrophe losses and the reduction in corporate tax rate,” Donaldson explained. “From what we can tell, there has been steady buying.”

Investors beware as volatility lurks

The recent wave of market volatility and investor concern was addressed by a report released on Monday by the Wells Fargo Investment Institute.

“We expect both yields and volatility to increase as the markets digest strong economic growth and higher rates,” wrote George Rusnak, co-head of Wells’ global fixed-income strategy. “We believe that bond market volatility will rise this year, which may present opportunities for active investors.”

However, he said, Wells Fargo expects this year’s interest rate increases will “only be mild” due to low inflation expectations.

Rusnak said investors should focus on three things: Rebalancing their portfolios to prepare for higher volatility in 2018; capitalizing on opportunities if markets over-correct during this volatility; and avoiding investing complacency by active portfolio evaluation.

“While recent interest-rate and equity market volatility have been concerning to some investors, we believe that it is important to prepare for a higher volatility environment this year,” Rusnak wrote. “Given this expected change, we believe that investors should actively rebalance their portfolios, buy quality holdings on markets dips, broadly and globally diversify holdings across asset classes, and capitalize on market opportunities as they present themselves.”

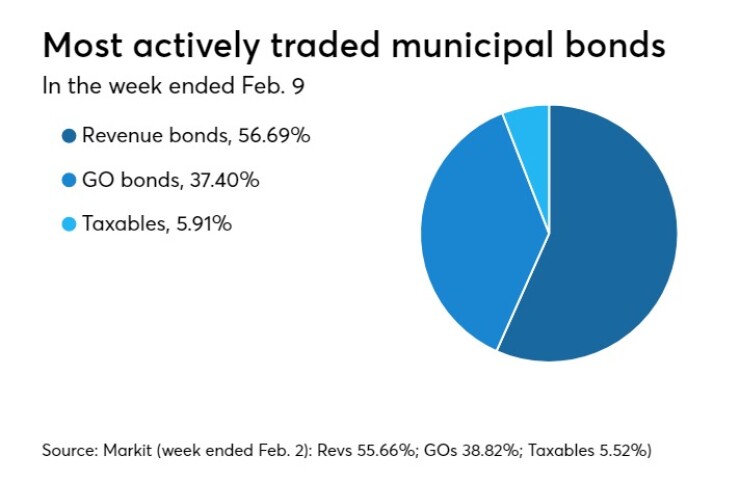

Prior week's actively traded issues

Revenue bonds comprised 56.69% of new issuance in the week ended Feb. 9, up from 55.66% in the previous week, according to

Some of the most actively traded bonds by type were from New York, Georgia and Illinois issuers.

In the GO bond sector, the New York City zeroes of 2042 traded 28 times. In the revenue bond sector, the Main Street Natural Gas Inc. of Ga.’s 4.125s of 2045 traded 25 times. And in the taxable bond sector, the Illinois 5.1s of 2033 traded 17 times.

S&P on tax reform

The Tax Cuts and Jobs Act of 2017 pushed the municipal bond market into a new era for 2018, according to a report released by S&P Global Markets on Monday.

“Certain tax advantages of municipal debt were whittled down or eliminated, and other new tax code provisions could have a negative impact on the taxing entities that make up most of public finance,” S&P said.

Some of the things S&P sees for this year in U.S. Public Finance:

A flurry of issuance at the end of 2017 should reduce volume in 2018;

Rating trends are expected to remain similar to 2017 which was almost identical to those trends seen in 2016; and

Local governments should continue to account for most upgrades, while states, higher education, and charter schools could experience more downgrades than upgrades.

S&P also said that while municipal defaults should remain rare this year, the number could remain close to that in the past two years because of the situation in Puerto Rico.

“Last year there were 20 defaults, which is a small number for a large universe but is unusually high for USPF. In fact, it was the most defaults in USPF since 1986,” S&P said. “Of the 20 defaults, 14 occurred in Puerto Rico. Based on the 28 ratings in the 'CCC' category and lower, the number of defaults could be similar in 2018. As in 2016 and 2017, the defaults will likely come disproportionately from Puerto Rico, which accounts for seven of the 'CCC' and lower ratings.”

The rating agency said that the repeal of advance refundings eliminated a technique issuers used to refund debt at an unspecified time more than 90 days after the issuance of the advance refunding issue. Issuers could get a lower rate on the advance refunding bonds and use the proceeds to refund higher-cost debt later.

“With today's low interest rates, advance refunding had become a common tool in the municipal bond market,” S&P said. “The loss of this option will require issuers to use other methods of refinancing to maintain flexibility, but these come with additional costs and risks. Bonds can have shorter or more frequent calls, for example, but these increase costs. Some methods involve derivative products, like interest rate swaps, which require additional expenses and introduce more risk.”

Primary market

This week’s volume is estimated at $3.5 billion, with the slate comprised of $2.7 billion of negotiated deals and $824 million of competitive sales.

Topping the week’s slate is the Pennsylvania Commonwealth Financing Authority’s $1.39 billion of tobacco master settlement payment revenue bonds.

Jefferies is expected to price the bonds on Tuesday. The deal is rated A1 by Moody’s Investors Service A by S&P Global Ratings and A-plus by Fitch Ratings.

Also on tap is a taxable corporate CUSIP deal from Community Health Network Inc. in Indiana.

Wells Fargo Securities is expected to price the $202 million of Series 2018 bonds as a 2058 bullet on Tuesday. The deal is rated A2 by Moody’s and A by S&P.

Bank of America Merrill Lynch is set to price the Board of Governors of Wayne State University of Mich.’s $120 million of Series 2018A general revenue bonds. The deal is rated Aa3 by Moody’s and A-plus by S&P.

In the competitive arena on Tuesday, the Mounds View Independent School District No. 621, Minn., is selling $153.58 million of Series 2018A general obligation school building bonds.

The bonds are insured by the Minnesota school district credit enhancement program. The deal is rated AA-plus by S&P.

Prior session's activity

The Municipal Securities Rulemaking Board reported 35,849 trades on Thursday on volume of $8.46 billion. California, Texas and New York were the three states with the most trades, with the Golden State taking 16.332% of the market, the Empire State taking 12.062% and the Lone Star State taking 8.443%.

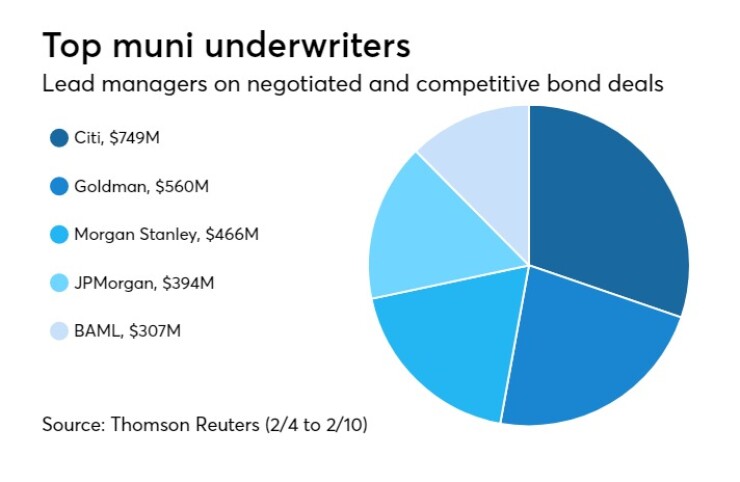

Previous week's top underwriters

The top municipal bond underwriters of last week included Citigroup, Goldman Sachs, Morgan Stanley, JPMorgan Securities and Bank of America Merrill Lynch, according to Thomson Reuters data.

In the week of Feb. 4 to Feb. 10, Citi underwrote $748.8 million, Goldman $559.9 million, Morgan Stanley $465.7 million, JPMorgan $394.0 million and BAML $307.4 million.

Treasury sells weekly bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 1.570% high rate, up from 1.500% the prior week, and the six-months incurred a 1.785% high rate, up from 1.650% the week before. Coupon equivalents were 1.598% and 1.826%, respectively. The price for the 91s was 99.603139 and that for the 182s was 99.097583.

The median bid on the 91s was 1.570%. The low bid was 1.500%. Tenders at the high rate were allotted 89.03%. The bid-to-cover ratio was 3.12.

The median bid for the 182s was 1.730%. The low bid was 1.695%. Tenders at the high rate were allotted 22.84%. The bid-to-cover ratio was 2.74.

Treasury to sell $50B 4-week bills, $50B 55-day CMBs

The Treasury Department said it will sell $50 billion of four-week discount bills Tuesday. There are currently $78 billion of four-week bills outstanding.

Treasury will auction $50 billion of 55-day bills cash management bills on Tuesday. The CMBs are dated Feb. 16 and due April 12.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.