Municipal bonds turned mixed Tuesday as buyers watched and waited for final results of the Federal Reserve’s monetary policy meeting.

Market participants will focus on the release of the Summary of Economic Projections and any announcement about balance sheet reduction in the statement following the conclusion of the Federal Open Market Committee’s two-day gathering on Wednesday.

It is unclear whether the Fed’s median projection will suggest one rate hike this year, or none, and the panel’s plan for ending balance sheet reduction.

“Investors are thirsting for details such as how they will end the reduction,” said Bryce Doty, senior vice president/senior portfolio manager at Sit Fixed Income Advisor. “Will the Fed stop cold turkey or taper? How will the reinvestment of maturing bonds be handled?"

“We expect the Fed to begin to taper this year, but unlike a growing consensus view, we do not expect the Fed to completely stop until early next year,” he said. With Fed Chair Jerome Powell on record as estimating $3.5 trillion as the right size for the balance sheet, and with it at $4.0 trillion, “even at the current rate reduction, it would take a full 12 months to get from $4 to $3.5 trillion so we can’t get into the camp of investors certain that they stop this year.”

And, in an effort to steepen the yield curve, the Fed will begin to reinvest “all proceeds from both mortgages and Treasuries” in “relatively shorter maturity treasuries,” Doty said.

“[B]ond investors should be careful what they wish for,” he cautioned “because if the Fed appears to be on the sidelines for too long and too eager to let the economy run hot (let inflation build up a head of steam before stepping in to cool things down), bond yields at the long end will actually rise.”

Primary market

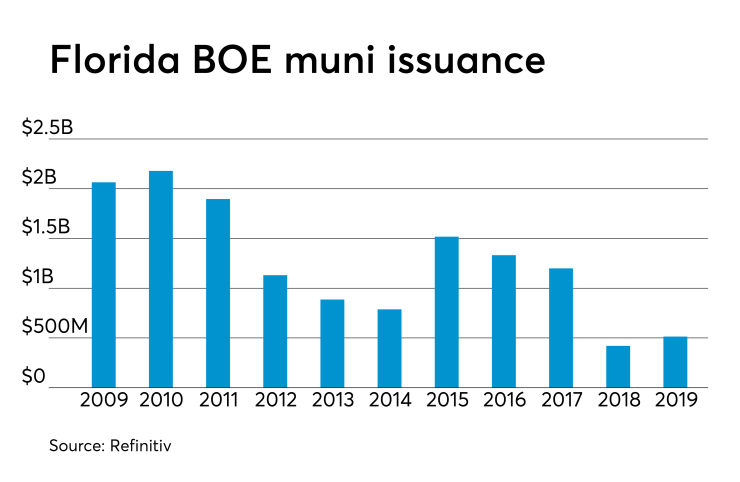

The Florida Board of Education (Aaa/AAA/AAA) competitively sold $438.9 million of Series 2019A unlimited tax public education capital outlay refunding GOs on Tuesday.

JPMorgan Securities won the bonds with a true interest cost of 1.6516%.

Florida’s Division of Bond Finance is the financial advisor; the bond counsel is Squire Patton.

Since 2009, the BOE has issued more than $14 billion of bonds with the most issuance occurring in 2010 when it offered $2.2 billion. It sold the least amount of bonds in 2018 when it issued $420.2 million.

Academy Securities released a premarketing scale on the Department of Veterans Affairs (Aa3/AA/AA-) of the State of California’s $78.22 million of Series 2019A home purchase non-AMT revenue bonds.

Academy said this is the largest deal ever senior managed by a military-disabled veteran-owned investment bank. The underwriter plans to hold a retail order period on Wednesday ahead of the institutional pricing on Thursday.

Piper Jaffray priced Prosper Independent School District, Texas (PSF: Aaa/AAA/NR)$176.5 million of Series 2019 unlimited tax school building bonds.

On Thursday, BofA Securities is expected to price the Indianapolis Local Public Improvement Bond Bank's (NR/NR/AAA) $623 million of community justice campus bonds for its courthouse and jail project.

Bond sales

NYC TFA to sell $1.8B

The New York City Transitional Finance Authority said it will issue $1.8 billion of future tax secured subordinate bonds in the next few weeks.

The deal is made up of about $850 million of tax-exempt fixed-rate bonds, $600 million of taxable fixed-rate bonds and $350 million of tax-exempt variable-rate demand bonds.

The tax-exempt fixed-rates are set to be priced on March 26 after a two-day retail order period starting on Friday. The deal will led by book-running lead manager Goldman Sachs, with BofA Securities, Citigroup, Jefferies, JPMorgan Securities, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co. as co-senior managers.

Also on March 26, the TFA expects to competitively sell $600 million of taxable fixed-rate bonds.

During the week of April 8, the TFA intends to issue $350 million of tax-exempt variable-rate demand bonds.

Proceeds from the bond sale will be used to fund capital projects, with the exception of proceeds from around $200 million of the tax-exempt variable rate demand bonds, which will be used to convert existing index-rate bonds into variable-rate demand bonds.

U.N. to consider muni defeasance, redemption

The Board of Directors of the United Nations Development Corp. said it will consider the potential defeasance or redemption of all of the corporation's outstanding Series 2009A bonds from the proceeds of an upcoming refunding bond sale during its annual meeting on March 27.

The Series 2009A bonds, maturing on and after July 1, 2020, are subject to optional redemption at par beginning on July 1, 2019. If the board approves, the corporation would sell $43.5 million of Series 2019A refunding bonds during the week of April 1.

Bond Buyer 30-day visible supply at $7.26B

The supply calendar rose $1.96 billion to $7.26 billion Wednesday, composed of $3.48 billion of competitive sales and $3.79 billion of negotiated deals.

Tight ratios and low yields

Ramirez & Co. expects the municipal market to begin to have relatively cheaper valuations — if expectations of accelerated new issuance come to fruition, equities continue to perform well, and/or fund flows slow down or reverse as investors reassess Tax Cuts and Jobs Act tax effects.

“The frenzied clamor for tax-exempts should maintain tight ratios and low yields through the April tax filing season,” Peter Block, Ramirez managing director of credit and market strategy, wrote in a weekly report released Monday.

Total year-to-date gross supply as of March 15 was $63 billion — a 13% increase year over year, Block said. He projects year-end gross supply to increase 8% year over year for an estimated total of $341.8 billion. In addition, he noted that the 30-day net supply is down $10.42 billion, composed of $6.48 billion in new issuance. The 30-day net supply is expected to be negative $10.42 billion — after the arrival of $6.48 billion new issuance offset by the loss of a total of $16.91 billion of maturing and announced calls combined.

The expected cheapening is already evident in the five-year slope of the yield curve, where Block is finding particular value.

“There is also the growing possibility that high-tax state investors could benefit from out-of-state tax-exempts if the after-tax yield is better versus in-state bonds,” he wrote.

Ramirez currently favors a barbell posture with effective duration of between eight and nine years consisting of 70% in one to six-year maturities and 30% in 18 to 21-year maturities, Block said.

The strategy includes laddered fixed-rate, non-call bonds and/or floating-rate bonds on the shorter duration portion, while the longer portion in 20 to 30 years has eight to 10-year calls, he noted.

Block said this strategy captures 95% of the yield curve, limits volatility, and maximizes credit spread and roll down in the seven to 13-year range, which he called “the historical sweet spot for roll.”

“High valuations amidst the tight spread backdrop also argues for conservative credit quality, but slightly more aggressive on duration, including bonds with lower coupons,” of sub-5%, he wrote.

In other market activity, Block called this week’s $3.4 billion of new issuance “paltry,” but acknowledged that many issuers avoided pricing a significant amount of deals in the week where an FOMC meeting takes place.

Two of the larger negotiated deals this week include a $623 million Indiana Bond Bank offering and a Stanford University deal — both on Thursday.

Secondary market

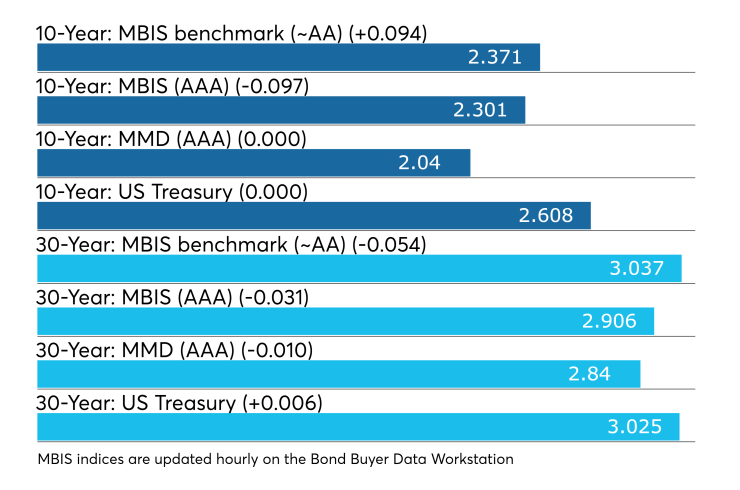

Municipal bonds were mixed on Tuesday, according to the MBIS benchmark scale, with muni yields rising nine basis points in the 10-year maturity while falling five basis points in the 30-year maturity. High-grade munis were also mostly stronger, with yields rising nine basis points in the 10-year maturity as yields fell three basis points in the 30-year maturity.

Investment-grade municipals were mixed on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year GO muni remaining unchanged as the yield on the 30-year muni fell one basis point.

The 10-year muni-to-Treasury ratio was calculated at 78.1% while the 30-year muni-to-Treasury ratio stood at 94.0%, according to MMD.

Treasuries were mixed as equities traded little changed.

In the week ended March 6, primary dealers reduced their total holdings of U.S. Treasury securities to the lowest level since November 2018, according to Subadra Rajappa, Head of U.S. Rates Strategy at Societe Generale. Holdings of bills and coupons due in the three- to six-year sector increased while holdings of FRNs and coupons maturing within two years and in the two- to three-year, six- to 11-year and over 11-year sectors decreased, she said in a market report released Monday.

Foreign holdings of Treasuries rose $42 billion in January. Official account holdings of Treasuries rose for a second month, by $24.7 billion, as world exchange reserves continued to increase during the period. Private accounts added $17.3 billion to their holdings

Previous session's activity

The MSRB reported 35,667 trades on Tuesday on $7.13 billion of volume. New York, California and Texas were most traded, with the Empire State taking 14.859% of the market, the Golden State taking 12.617% and the Lone Star State taking 12.07%. The most actively traded issue was the Chicago Series 2014B taxable GO 6.314s which traded 17 times on volume of $35.22 million.

Treasury to sell $60B 4-week bills

The Treasury Department said it will sell $60 billion of four-week discount bills Thursday. There are currently $35.006 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.