Bonds rallied as market observers gauged whether Friday’s weak employment report will spur the Federal Reserve to cut rates.

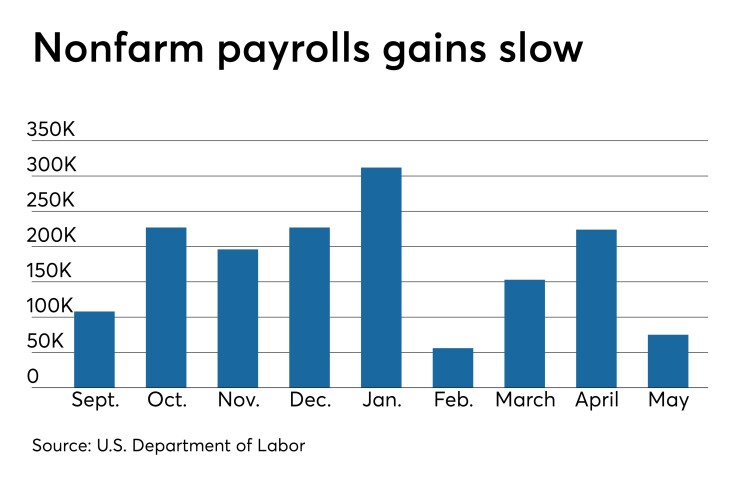

Nonfarm payrolls grew by 75,000 in May, well below the 183,000 expected by economists polled by IFR Markets, while the unemployment rate held at 3.6%, according to the U.S. Bureau of Labor Statistics. The numbers for April and March were lowered to 224,000 and 153,000, respectively, from the previously reported 263,000 and 189,000.

“After a disappointing ADP jobs number of only 27,000 on Wednesday, we got only 75,000 jobs this morning,” said Bryce Doty, senior vice president/senior portfolio manager at Sit Fixed Income. “The bottom line is a very weak number. Bond yields are dropping sharply with the yield curve inversion intensifying.”

The Federal Open Market Committee meets June 18 and 19. While the Fed is unlikely to make a move at this meeting, analysts said they might signal a future cut. “I still don’t think they cut because of the unemployment rate,” Doty said. “The unemployment rate stayed at a 49-year low of 3.6%. The Fed is achieving its goal of full employment and stable prices. The key on the 19th will be how much they guide investors toward the timing of any future cuts.”

Ball State University economist Michael Hicks, agreed, the weak report won’t mean a June move. “The May jobs report will add to worries that the domestic economy is slowing,” said Hicks, but it “is not sufficient to lead to rate cuts.”

Average hourly earnings rose 0.2% in May, similar to April’s growth and 3.1% year-over-year. “The 3.1% year-over-year increase in wages is a decent number,” said Doug Duncan, chief economist at Fannie Mae. “With gains in productivity, the Fed will remain patient.”

Trade tension factored into the “lackluster” report. “Uncertainty regarding future trade policy, in addition to the actual costs imposed by tariffs [imposed on China], may be making businesses, especially those with exposure to international markets, hesitant to expand employment,” said Beth Akers, Manhattan Institute senior fellow and former Council of Economic Advisors economist.

While “one month does not a trend make,” Jeffrey Cleveland chief economist at Payden & Rygel said payrolls gains have slowed relative to last year, averaging 164,000 new jobs a month this year compared with 223,000 in 2018. “Slower, indeed, but coming off a stellar year last year.

“Also: we are officially in the 120th month of the economic expansion (tying the record long expansion of the 1990s). A decade into a cycle, we should expect payroll growth closer to, say, 100,000, not 200,000,” he said.

Also, “a big chunk of the slowdown in May” came from the services sector, “which is completely at odds with the May reading of the [Institute for Supply Management] services gauge.”

As such, Cleveland said, “I'm still not convinced we are on the cusp of, or in, a recession, nor am I convinced that the May jobs report will be enough to force the Fed's hand at the June meeting.”

A rate cut “to offset perceived or anticipated weakness,” would make sense, Cleveland said. “A rate cut (or two) would be welcomed by the markets,” much like in “the mid-to-late 1990s, where the Fed fine-tuned policy but a recession did not follow.”

The Fed might have been better served cutting its balance sheet before it began raising rates, Sit's Doty said. "Doing both at the same time could have been too much too soon.” Still the labor market, he said, is reacting to “the uncertainty of the trade wars,”he said.

“Starting this week, bad news is good news. The worse the economic news, the more likely investors believe they will be saved by the Powell put. The worse the outlook, the higher the chance the Fed cuts,” he said. “A warning from our Spidey Sense tells us the Fed may not bail out a president that hasn’t had any love for the Fed. And rate cuts don’t remove tariffs.”

Brian Coulton, chief economist at Fitch Ratings, said while the dip in wage growth “will support the Fed’s patient stance on rates, the average pace of job growth over the last three months (at 151,000) is hardly alarming. It speaks to a slowdown in the domestic economy but there’s no suggestion of demand falling off a cliff.”