The Puerto Rico Public Corporations Debt Enforcement and Recovery Act, approved by the Puerto Rico legislature in late June, has had a notable impact on market activity and perceived credit quality for bonds of the Commonwealth and its agencies. In this article we will examine trade volumes and Interactive Data evaluated price history for a variety of Puerto Rico municipal bonds, seeking to illuminate different dimensions of market response to these developments.

BACKGROUND

Faced with a worsening squeeze between revenue and costs of operating its large public infrastructure and utility entities, on June 25 the Puerto Rico government proposed legislation establishing a process for some of the island's public corporations to restructure their debts.

Approved by the legislature and signed into law on June 28, the restructuring law is applicable to Puerto Rico Electric Power Authority (PREPA), Puerto Rico Aqueduct and Sewer Authority (PRASA) and Puerto Rico Highway and Transportation Authority (PRHTA), among other entities.

However, it explicitly excludes direct obligations of the commonwealth, the Government Development Bank (GDB) and Puerto Rico Sales-Tax Financing Corp. (COFINA).

Before the measure even became law, the three major rating agencies downgraded several Puerto Rico public issuers. A second wave of downgrades on July 1 hit Puerto Rico's general obligation debt rating, plus COFINA and GDB.

Although this latter contingent is not eligible to restructure under the new law, Moody's Investors Service reasoned that the legislation signaled Puerto Rico authorities' "new preference for shifting fiscal pressures to creditors," with implications for all of the island's public debt, including that of the central government.

MARKET RESPONSE

Trading activity for Puerto Rico securities spiked following the restructuring law, as reflected by both retail and institutional trades.

The number of trades of $1 million or larger jumped from an average of 19 per week during the first four weeks of June to 95 per week from June 30 through July 11.

What's more, the daily proportion of trades of fixed-coupon bonds at prices 50 and below has jumped tenfold since the measure's introduction, from 0-2% through June 24 to 10%-20% for June 26 and thereafter, according to Municipal Market Advisors. (Data reviewed by Interactive Data shows a similar pattern.)

A low point occurred on June 27 when several PRHTA bonds traded at 35. Bonds trading at 50 and below are viewed as an indicator of distress and a likelihood of default.

While the fiscal challenges facing Puerto Rico have commanded investors' attention throughout the past year, until recently the potential for default had been evident primarily in trade prices for longer maturity bonds. Puerto Rico bonds maturing in the next few years had not traded at distressed levels.

During the latter half of June, however, many shorter-dated bonds began trading at levels more in line with their longer- dated counterparts, as the reality set in that bonds coming due in just a few years might not get paid at maturity.

For example, a PREPA bond with a July 1, 2016, maturity (CUSIP 74526QXA) traded in a $2.9 million block at $50.50 on June 27, according to Municipal Securities Rulemaking Board data; the previous block trade was on May 22 when $1 million traded at $86.

A PREPA bond maturing July 1, 2017, (CUSIP 74526QKK) traded $4.2 million at $60 on June 26; the previous block trade was on March 11 when $1 million traded $86.75. And a PRASA bond maturing July 1, 2015, (CUSIP 745160RK) traded $5.3 million on June 25 at $71; the previous block trade took place March 10 at $94.

Initial market reaction to the restructuring law in late June focused on issuers eligible under that law.

Interactive Data evaluated prices — which incorporate trade data along with market color including bids, offerings etc. — began declining on June 25 for PREPA and on June 26 for PRHTA.

Meanwhile, COFINA bonds were unchanged on those dates, while the new Commonwealth of Puerto Rico general obligation bond issued in March 2014 (maturing in 2035) edged higher.

The latter issues responded to the downside only after July 1 when Moody's downgraded the Commonwealth GO rating (along with COFINA and GDB) — although by July 18 the GO bond had recouped its entire decline.

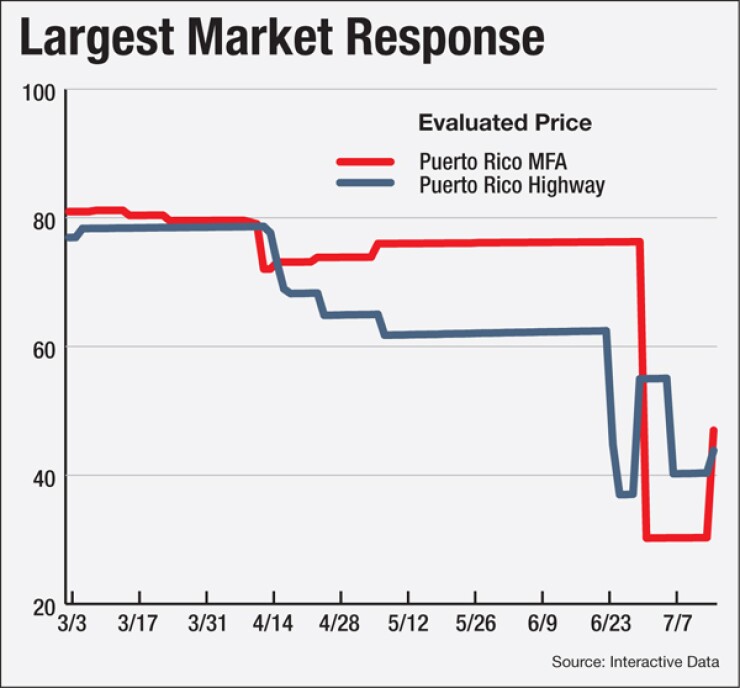

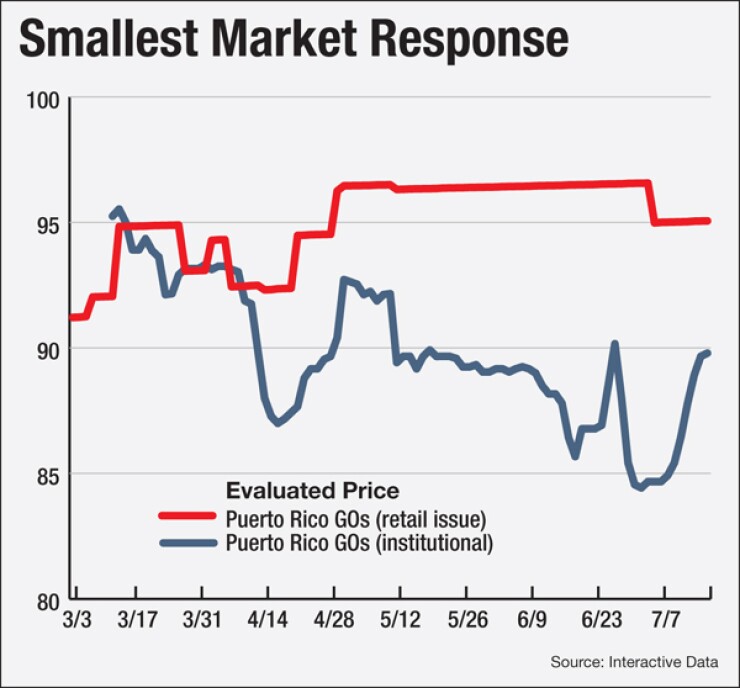

Aside from differences in timing, Interactive Data evaluated price histories show differing magnitudes of market response to the restructuring law and rating downgrades. Among the seven bonds examined, we can discern three tiers.

LARGEST:

A Puerto Rico Municipal Finance Agency (MFA) bond and a Puerto Rico Commonwealth Highway and Transportation Authority revenue bond experienced initial evaluated price declines of 25-50 points, or 40-60% from their respective mid-June levels. Yields for these bonds initially rose by approximately 15 percentage points.

MIDDLE:

For bonds of COFINA, PREPA and a taxable pension obligation bond issued by the Employees Retirement System, Interactive Data evaluated prices initially fell 15-20 points, or 15-30%, after enactment of the restructuring law. Yields on these bonds rose by 2-4 percentage points.

LEAST:

Commonwealth GO bonds showed the smallest market response.

The evaluated price for the 8% coupon GO maturing July 1, 2035, declined as much as 6 points (7%) after the legislation and Moody's downgrade, but subsequently recouped the entire decline.

A different GO issue, marketed to retail investors and maturing in 2016, dipped 1.5 points or 2% on July 8.

These evaluated price movements correspond with yield increases of 50 to 100 basis points.

Jon Barasch is Director, Municipal Evaluations, and Jon Jacobs is Senior Fixed-Income Analyst for Interactive Data.