Municipals were stronger at mid-session as new supply started to trickle into the market.

Primary market

In the competitive arena on Tuesday, Clark County, Nev., sold $450 million of general obligation bonds in two sales.

Morgan Stanley won the $300 million of Series 2018B limited tax transportation improvement bonds with a true interest cost of 3.6149%.

Bank of America Merrill Lynch won the $150 million of Series 2018 limited tax park improvement bonds, additionally secured by pledged revenues, with a TIC of 3.5405%.

The financial advisors are Hobbs, Ong & Associates and PFM Financial Advisors; the bond counsel is Sherman & Howard.

Proceeds of the 2018B bonds will be used to finance a portion of the costs of certain improvements to transportation facilities within the Strip Resort Corridor; proceeds of the 2018 bonds will be used to finance certain park projects.

The deals are rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

Since 2008, the county has sold about $10.8 billion of bonds with the most issuance occurring in 2010 when it offered $2.2 billion. It sold the least amount of bonds in 2012 when it issued $207.8 million.

Ohio sold $162 million of Series 2018A GO infrastructure improvement bonds on Tuesday.

JPMorgan won the bonds with a TIC of 3.4541%.

Proceeds will be used to finance the cost of public infrastructure capital improvement projects of local subdivisions in the state. The financial advisor is PFM Financial Advisors; the bond counsel are Roetzel & Andress and Squire Sanders.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Loop Capital Markets priced Atlanta’s $291 million of Series 2018C water and wastewater revenue refunding bonds.

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

JPMorgan is set to price the Tarrant County Cultural Educational Facilities Finance Corp., Texas’ $447.32 million of Series 2018AB revenue and refunding bonds for Christus Health on Tuesday.

Also on Tuesday, JPMorgan is set to price for Christus Health a $339.02 million taxable corporate CUSIP deal. The deals are rated A1 by Moody’s and A-plus by S&P.

Citigroup is expected to price the Hillsborough County Aviation Authority, Fla.’s $402 million of revenue bonds for the Tampa International Airport.

The deal consists of Series 2018E bonds subject to the alternative minimum tax and Series 2018F non-AMT bonds, rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll Bond Rating Agency; and Series 2018 subordinate bonds, rated A1 by Moody’s, A-plus by S&P and Fitch and AA-minus by Kroll.

Tuesday’s bond sales

Georgia

Nevada

Bond Buyer 30-day visible supply at $8.01B

The Bond Buyer's 30-day visible supply calendar increased $309.1 million to $8.01 billion for Tuesday. The total is comprised of $2.86 billion of competitive sales and $5.15 billion of negotiated deals.

Secondary market

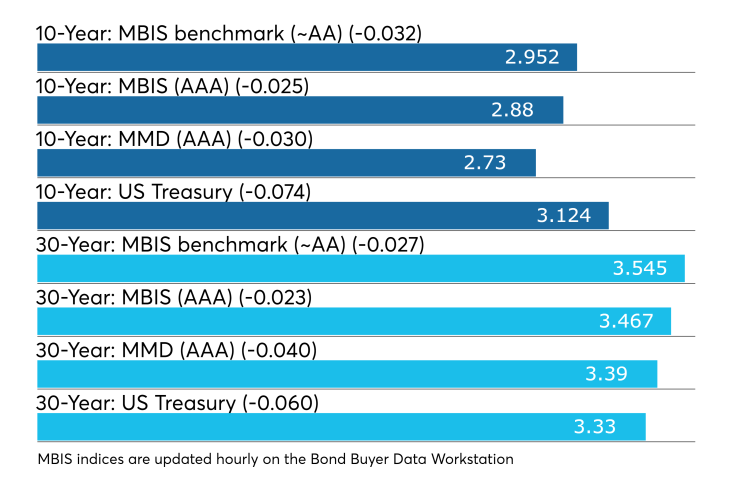

Municipal bonds were stronger on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as three basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling one to three basis points while the yield on 30-year muni maturity fell two to four basis points.

Treasury bonds were stronger as stocks traded sharply lower.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 85.4% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,461 trades on Monday on volume of $7.82 billion.

New York, California and Puerto Rico were the municipalities with the most trades, with the Empire State taking 13.904% of the market, the Golden State taking 12.554%, and the commonwealth taking 10.45%.

Block: Some deals may be attractive

While year-to-date volume is down compared to last year, this week’s calendar includes some large deals that could attract investors’ attention, according to municipal sources.

The $262 billion total gross supply year-to-date is down 11% year-over-year, noted Peter Block, managing director of credit strategy at Ramirez & Co.

Block said Ramirez is maintaining its full-year 2018 supply projection of $317 billion — which is a decrease of 27% year-over-year. “Year-over-year, we think new-money will likely decelerate in 4Q18,” Block said in his Oct. 22 weekly municipal market strategy report.

Over the next 30 days, net municipal market supply — the difference between new money and redemptions — is negative $12.45 billion, according to Block. That number is comprised of $8.88 billion of new issues against a total of $22.3 billion in maturing bonds, he noted.

Treasury sells bills

The Treasury Department Tuesday auctioned $40 billion of four-week bills at a 2.180% high yield, a price of 99.824389. The coupon equivalent was 2.214%. The bid-to-cover ratio was 2.86.

Tenders at the high rate were allotted 12.25%. The median rate was 2.140%. The low rate was 2.110%.

Treasury also auctioned $25 billion of eight-week bills at a 2.180% high yield, a price of 99.673000.

The coupon equivalent was 2.218%. The bid-to-cover ratio was 3.43.

Tenders at the high rate were allotted 21.38%. The median rate was 2.160%. The low rate was 2.130%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.