The Illinois Housing Development Authority came to market last month with $100 million of housing revenue bonds, helping about 1,000 borrowers obtain affordable mortgage loans.

The deal was made possible by a new mortgage-backed security pass-through structure that has been growing in popularity among housing finance agencies in the past year, after falling conventional mortgage rates following the 2008 financial crisis made it difficult for them to keep their rates on home loans competitive.

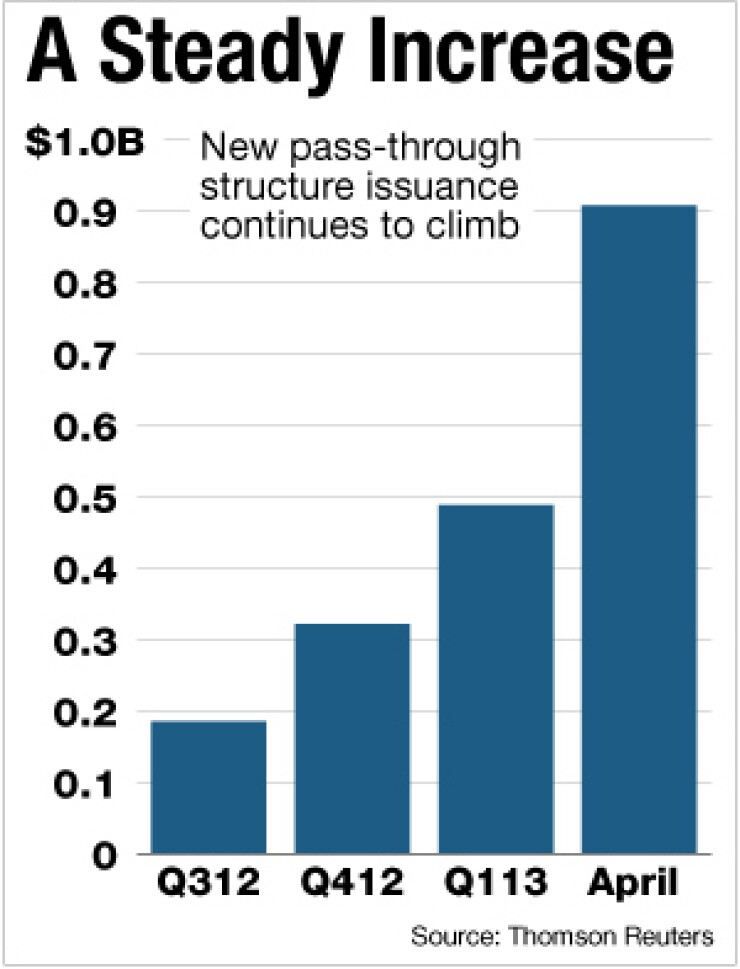

An analysis of Bond Buyer data found more than 30 deals using the new structure, since July. Issuance in the second half of 2012 was approximately $500 million and in just the first quarter of 2013, it totaled around $488 million. In April alone, issuance reached $900 million.

"The more the HFAs have used it, the more popular it has become," said Janney Capital Markets municipal credit analyst Tom Kozlik, who estimates total issuance of pass through or pass-through like bonds since last July at $2 billion. "And cross-over buyers have found it to be a viable and valuable investment option."

The new pass through structure closely mirrors that of mortgage-backed securities, allowing HFAs to tap into that market to get rates that are more in line with those on MBS. As a result, HFAs are can afford to finance competitive mortgage loans.

Hazim Taib, the Illinois housing authority's chief financial officer and assistant treasurer, said that if the agency hadn't used the new structure, it would have found a different way of financing, but would not have been able to use the traditional bond structure that HFAs have utilized in the past.

"With treasury or taxable rates and the tax-exempt rates on top of each other, issuing bonds using the traditional structure became more difficult," Taib said. "Investors continue to demand yields at levels that translate to a higher mortgage rate."

In the IHDA's deal, priced on April 24 by RBC Capital Markets, the agency sold $78.5 million of tax-exempt bonds that priced at 2.45%, and $21.5 million of taxable bonds, which priced at 2.75%.

Cory Hoeppner, a managing director in the housing finance group at RBC, said the weighted average cost of funds was 2.51%, versus the comparable market at the time, which was close to 3.30% to 3.40%.

"So we really see an 80 to 90 basis point pick up in the overall bond yield by doing this pass-through structure, as opposed to a traditional structure with serials and term bonds," he said.

The April deal was the IHDA's second time using the new structure. Taib said if the authority issues bonds in the future, it will structure the bonds based on the new product as long as it continues to provide value.

"We aren't committing to doing it, but until something else comes about, or a new product comes around, this is the bond execution that we envision of using," he said.

The Indiana Housing Community Development Authority also returned to the market recently with its second pass-through deal on April 26, priced by JPMorgan.

The authority had previously issued tax-exempt bonds using the structure, but sold bonds last month in its first taxable pass-through issue.

"We would not have issued bonds under a traditional structure as the economics of a traditional structure did not work," said Blake Blanch, chief financial officer for the IHCDA. "This deal allowed us to capture some savings as well as refund $63.7 million of New Issuance Bond Program Bonds [out of a total of $209.8 million that were outstanding as of Jan. 1] that were purchased by the Treasury and Fannie Mae and Freddie Mac."

The Florida Housing Finance Corporation came to market on April 24 for its first public offering utilizing the structure in a $108.1 million sale of homeowner mortgage revenue bonds, priced by Morgan Stanley. The bond issue refunded NIBP bonds from 2010.

The agency was able to save $6.3 million in net present value savings, based on the current lifetime prepayment speed, according to the FHFC's CFO, Barbara Goltz.

"These NIBP bonds had a yield of 4.06%, and this pass-through structure allowed Florida Housing to drop the yield to 2.80%," Goltz said. "The traditional bond sale method would not have been as attractive."

Since then, the agency has returned to the market with another pass-through deal that also refunded NIBP bonds.

The FHFC sold $90 million of mortgage revenue bonds on May 15, priced again with a 2.80% coupon by RBC.

A Growing Market

"This is a market that has depth and liquidity and there's demand for this product," said Michael Baumrin, managing director and head of the housing finance group at RBC. "And as each transaction gets done, more and more issuers get comfortable that their transactions will be completed efficiently."

The Minnesota Housing Finance Agency, with four pass-through deals under its belt, was the first to use to the new structure, when it sold $50 million of bonds in July 2012 in a deal crafted by RBC.

"What we've done is we've developed an investor base for this product that is a slightly different base of buyers than the traditional housing bond buyer," said Hoeppner, who helped craft the bank's program. "These investors understand the MBS product, so we came in with an HFA MBS product that we believe closely mirrors what they were already buying."

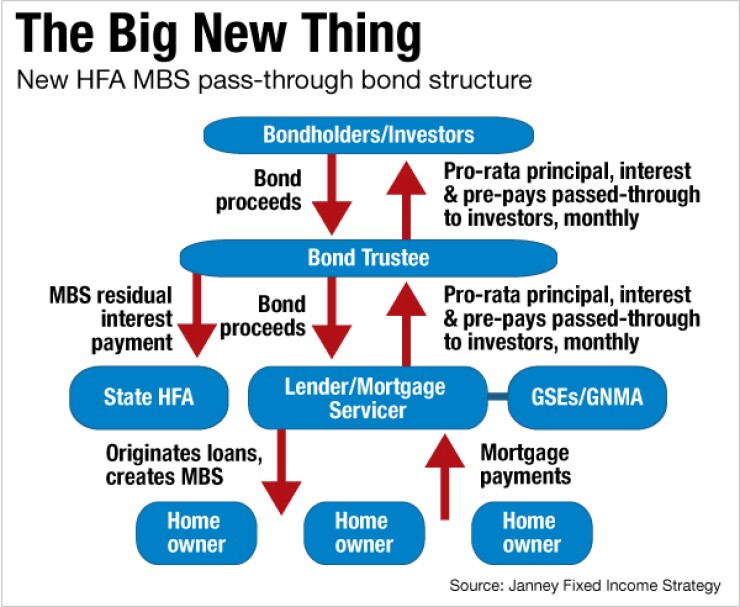

Under the new pass-through structure, the borrowers, or homeowners, pay a mortgage servicer or lender monthly payments on their mortgages, and the pro-rata principal, interest, and any pre-payments are then passed through to the bondholders.

The mortgage-backed security payments are guaranteed by Ginnie Mae and other government-sponsored enterprises and, as a result, the pass-through bonds generally have triple-A or AA-plus ratings.

The new structure is different from the traditional structure, under which the pre-payments go to the HFAs, which can decide to recycle the payments into new loans. The new pass-through structure forces the prepayments to pass through to the investors.

"From the investors' perspective, it's more transparent and certain than the traditional structure," said Ping Hsieh, vice president and senior analyst at Moody's Investors Service. "I don't know whether they like it more or less, but they know what they're buying, and they enjoy knowing with more certainty when these bonds will be redeemed."

Hsieh released a report in early April, calling the new pass-through structure a credit positive for HFAs since they provide them with additional financing flexibility.

Another way the new structure is different is that it usually consists of one bond with a 30-year bullet maturity, unlike the traditional MRBs, which are structured as serial and term maturities. They also do not have a sinking fund, unlike traditional MRBs.

The Old Way

Traditional single-family MRBs use semiannual serial and term bond structures or planned amortization-class bonds. Their interest rates traditionally tracked lower in yield than conventional mortgage rates, which allowed HFAs to finance their programs at competitive rates.

"But that really stopped working for them in 2008 when the financial crisis started, because the housing name was tainted, and the whole relationship between taxable rates and tax-exempt rates got thrown out the window," Hsieh said. "Going to the tax-exempt market really didn't work like it used to."

As Treasury rates fell and tax-exempt bond rates stabilized at a level higher than conventional mortgage rates, HFAs found it difficult to generate enough income to offer low loan program rates.

Under the New Issue Bond Program, created in late 2009, the federal government agreed to buy $15.3 billion of securities from Fannie Mae and Freddie Mac that were backed by new mortgage revenue bonds or multifamily housing bonds.

The program expired at the end of 2012. Since then, single-family bond issuance had generally been limited to refundings.

Starting early last year, however, Hoeppner began exploring how to create a pass-through structure with RBC's sales force and underwriting desks.

Since the MHFA deal in July, the firm has structured at least 10 transactions for HFAs using the new structure, and has a few more in the pipeline that are expected to price in the next couple months.

"The market continues to evolve and we're looking at ways to shorten the average life in order to bring in more buyers, and we're looking at ways to potentially do this on a whole loan basis, as opposed to an MBS basis," Hoeppner said. "Every time a deal gets done we're learning something new and executing these deals efficiently."

While the HFA pass-through structure is a viable option for HFAs, some issuers are still continuing to use the traditional structure, though less frequently.

Baumrin said we will continue to see issuance with these traditional structures as many state HFAs have subsidies available to them from NIBP and other refundings. In many situations, the traditional structure fits more readily into their current bond and mortgage program requirements, he said.

Increasing Demand

For investors, HFA pass-through bonds offer significantly higher coupons in most cases than comparable agency MBS.

"This is for several reasons, but largely has to do with the overall relative immature nature of the market, structure variations, and the HFA pass-through bond's current lack of liquidity," Janney's Kozlik said. "It is also important to note that most HFA pass-throughs possess an optional redemption provision."

As an example, he explained that HFA pass-through bonds offer coupons at par between 2.35% and 3.00%, while the traditional GNMA pass-throughs offer coupons between 2.00% and 2.25%.

MBS investors have been willing to consider alternative mortgage investments such as these HFA pass-through bonds because the supply of agency MBS has been limited, Hsieh wrote in her April report.

While demand for MBS has increased as investors reinvest prepayments and seek higher yields, supply has remained low because of the Federal Reserve's Agency MBS Purchase Program, which began in 2008.

HFA loans packaged into MBS offer a federal guaranty, along with lower prepayment risk, which makes them more attractive to mortgage investors than agency MBS with similar coupons, she said.

"In the second half of 2012 a number of mortgage investors that don't typically entertain HFA bonds purchased pass-through MRBs at levels substantially lower than traditional MRBs," Hsieh wrote.

Kozlik said that as interest has steadily increased, he's also started to see secondary trading in this new type of bond materialize.

"Under current market conditions we expect investor interest to continue to expand in this product and secondary market trading to increase as buyers learn more about the existence of the new structure," he said.

Looking Ahead

"HFAs are going to increase their production because of multiple finance options, and this new structure will be one of them," RBC's Baumrin said.

Hoeppner noted that the taxable MBS market dwarfs the municipal market.

"You develop a market by broadening and diversifying your secondary market liquidity, so we are hopeful over time that more HFAs continue to see the benefits and see the success of the states that are executing in this manner and subsequently choose to participate in this market as well," he said.

To be sure, the new structure may lose its appeal if market conditions change. "We think the old structure could start working again under two circumstances: when interest rates reverse their direction and start going up and when the Federal Reserve stops purchasing mortgage-backed securities," Hsieh said.

The Fed has indicated that won't happen until the unemployment rate is below 6.5%, which Moody's projects won't happen until the end of 2014.

Kozlik also said he thinks the structure will remain an attractive option for HFAs as long as interest rates remain low.

In the near- to medium-term, he said, issuance will continue to increase.