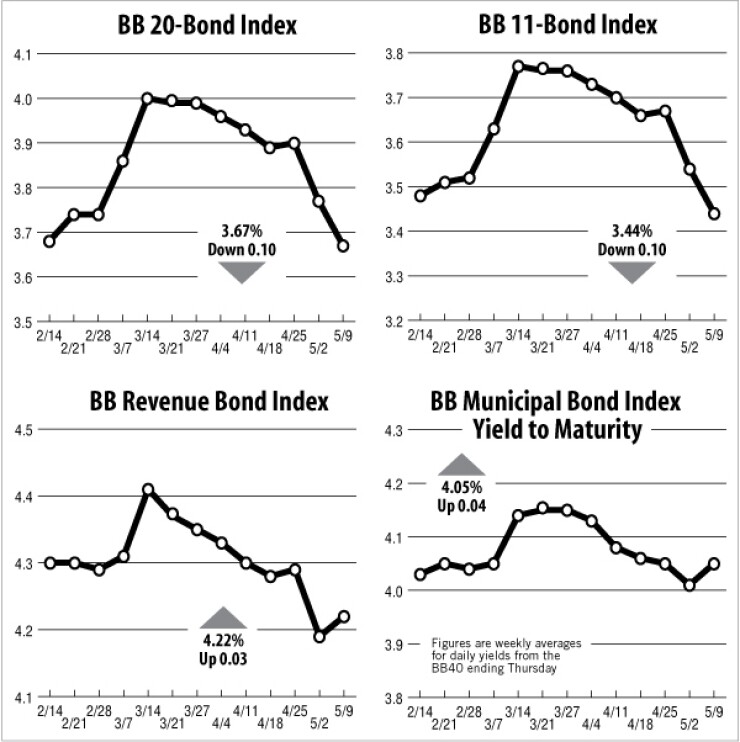

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, increased four basis points this week, to 4.05% for the week ending May 9, 2013. This is the same weekly average as two weeks ago (the week ended April 25, 2013).

The 20-Bond GO Index of 20-year general obligation yields declined 10 basis points this week, to 3.67%.This is its lowest level since Jan. 31, 2013 (14 weeks ago), when it was also 3.67%.

The 11-Bond GO Index of higher-grade 20-year GO yields also dropped 10 basis points this week, to 3.44%, which is its lowest level since Feb. 7, 2013 (13 weeks ago), when it was also 3.44%.

The Bond Buyer’s Revenue Bond Index, which measures 30-year revenue bond yields, gained three basis points this week, to 4.22%. But it remained below its 4.29% level from two weeks ago.

The yield on the U.S. Treasury’s 10-year note increased 19 basis points this week, to 1.82%, which is its highest level since March 27, 2013 (six weeks ago), when it was 1.93%.

The yield on the Treasury’s 30-year bond rose 17 basis points this week, to 2.99%. This is its highest level since April 11, 2013 (four weeks ago), when it was 3.00%.