Hartford, Conn., will come to market next week with one of its biggest bond sales ever.

Connecticut's capital city, looking to taking advantage of low interest rates, plans to sell nearly $240 million overall though $125 million refunding bonds, about $48 million in new money bonds — both general obligation — and $64.5 million in bond anticipation notes. The city will hold a retail order period in conjunction with Tuesday's sale, possibly a day earlier.

Wells Fargo Securities is lead manager. Municipal Resource Advisors is the financial advisor.

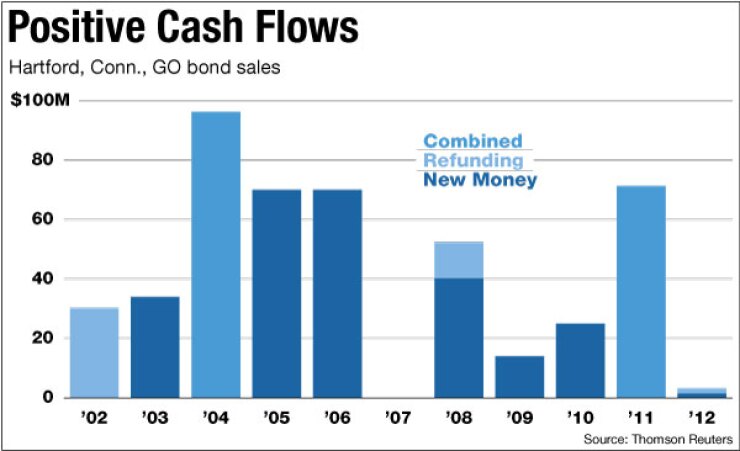

City Treasurer Adam Cloud told a City Council meeting last week that Hartford's refinancing plan would save money in the long-term. "This restructuring will provide significant positive cash flows to the city's budget and will assist in offsetting future deficits," he said.

According to Standard & Poor's, the city will restructure its debt service payments to provide general fund relief over the next three to five years.

"We acknowledge the city is not extending any maturities, but the estimated net present value savings is negative $5.4 million as a consequence of the restructure," the rating agency said.

Hartford intends to use the 2013 bonds and the 2013 BANs to finance public-improvement and school projects.

Traditionally, the city has generally sold its bonds in amounts ranging from $50 million to $70 million. Hartford has $322 million of outstanding parity debt, according to Moody's Investors Service.

Moody's and Standard & Poor's rated Hartford's Series 2013A refunding bonds and Series B new-money bonds A1 and A, respectively, both with stable outlooks. At the same time, the agencies affirmed the underlying rating on existing GO debt and provided a stable outlook on the city's long-term rating.

The rating agencies praised Hartford for maintaining a balanced budget and ending fiscal 2012 with a $4.5 million surplus, despite two straight years of potential operating deficits. According to Mayor Pedro Segarra, this represents Hartford's third consecutive year of undesignated general fund balance growth, giving the city the largest reserve — $30.1 million — among its Connecticut peers.

Moody's said rebuilding reserves to levels consistent with higher rating categories, among other factors, would drive up Hartford's bond rating. It warned that protracted structural budget imbalance, diminished general fund imbalance and deterioration of the city's tax base and demographic profile could push it downward.

Two weeks ago, city officials announced that Hartford's pension fund has a market value of $987 million and produced a 13.2% return last year, exceeding the benchmark return expectation of 8%. Cloud recommended that Segarra and the City Council reduce some costs that increase the pension fund's liability and encouraged them to fully fund the annually required contribution.