CHICAGO — Minnesota picked RBC Capital Markets to run the books on its planned Minnesota Vikings stadium bond issue with JPMorgan and Wells Fargo Securities serving as co-senior managers, according to the Minnesota Management and Budget office.

Another five firms — Piper Jaffray & Co., Morgan Stanley, Citi, Cronin & Co. Inc., and Loop Capital Markets LLC — round out the underwriting syndicate as co-managers.

The team will underwrite at least the first sale under an up-to-$600 million authorization to sell appropriation-backed bonds to raise sufficient proceeds to finance the public's $500 million tab for a new professional football stadium for the National Football League team. The project carries a $975 million price tag with the team picking up the remainder.

The state received a total of 22 responses to a request for proposals. "We were very pleased with the strength of the proposals we received," said Kristin Hanson, assistant commissioner for Treasury in MMB. The firms' proposals were scored by a selection team based on how best they met the state's criteria.

In addition to experience, the RFP sought information from firms on their past support on competitive state transactions, retail capabilities, service provided to the state on market updates, and whether the firm has worked with an NFL team within the last year.

Public Financial Management Inc. is financial advisor and Kutak Rock is bond counsel on the Vikings issues.

The underwriting pools remain in place through June 2017. The state is on the hook to repay $350 million and Minneapolis the other $150 million.

The RFP provides some insights into the state's preliminary thinking so far about the borrowing and structure. The state contemplates tapping the authorization in more than one market outing over the next two years. Each transaction may include tax-exempt and/or taxable bonds and may be sold on a competitive or negotiated basis. A portion of the authorization is expected to be issued as soon as this year, once the team finalizes its financial contribution.

Proceeds will help finance construction, improvements, and equipping of the stadium.

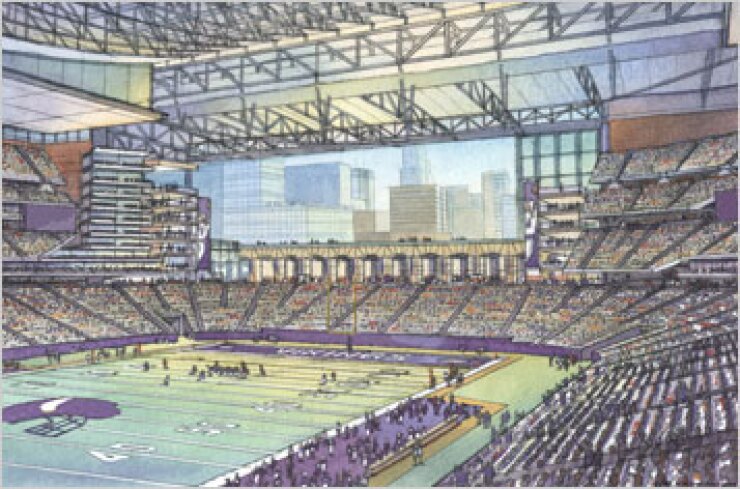

The state carries appropriation-backed ratings of AA from Fitch Ratings and Standard & Poor's. The 65,000-seat stadium is expected to be completed in time for the start of the 2016 season. It's being built adjacent to the team's current home, the 31-year-old Hubert H. Humphrey Metrodome.

The state originally intended to repay its share of the bonding with increased revenues from an expansion of charitable gambling. Revenues have fallen short, so the state will set aside funds from a cigarette tax increase and corporate tax changes approved earlier this year. Minneapolis will repay its $150 million share beginning in 2021 by redirecting a portion of its existing 0.5% convention sales taxes and hospitality taxes.