Refunding momentum drove strong municipal bond issuance in April, as long-term volume weighed in at more than twice what was issued the year before.

Bonds floated in April totaled $33.64 billion on 1,158 issues, a 113.5% increase from the same period in 2011. In April 2011, borrowers issued just $15.76 billion on 743 issues.

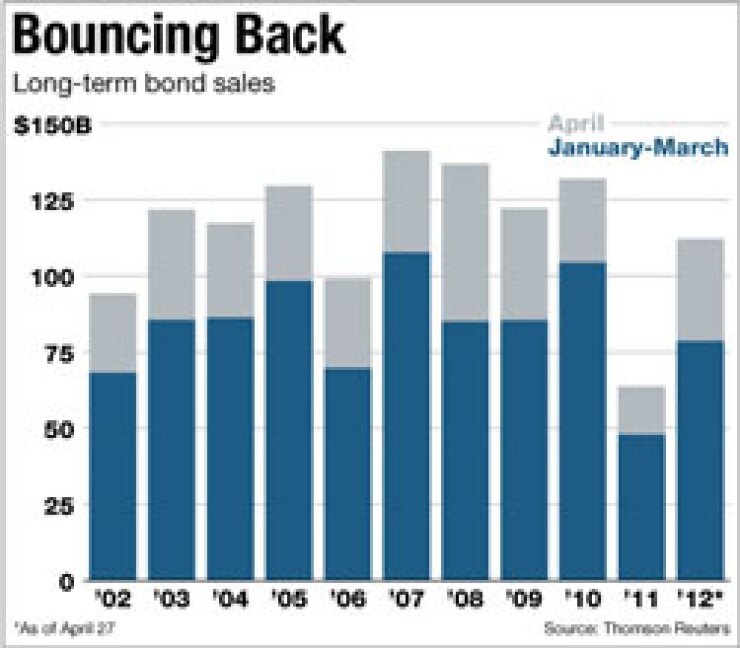

For the year to date, long-term muni issuance is up 76.3% from the same period a year earlier, to $112.2 billion on 4,151 issues. That compares with $63.65 billion on 2,680 issues through the first four months of 2011, according to Thomson Reuters numbers.

Industry analysts calculate that volume for 2012, now projected at about $360 billion, is on pace to top most earlier estimates for the year. Of the largest municipal sectors, general purpose, education, and health care saw the biggest gains in April.

But refundings continue to dominate the story of new issuance for the year, and April was no exception. Refunding deals ran almost neck and neck with new-money issuance for the month, and well ahead of their typical pace, said Chris Mauro, director of municipal bond research at RBC Capital Markets.

“If the refunding trend continues the way it has for the first four months, we’ll most likely blow through most people’s estimates for what volume will be this year,” he said. “It’s the big driver.”

Refundings were up 158% for the month, at $13.09 billion on 593 deals. By comparison, there was $5.08 billion in refundings on 214 issues over the same period in 2011.

New-money deals totaled $13.37 billion on 471 issues last month, against $8.20 billion on 466 issues in April 2011, a 63% gain.

For the year to date, refundings are up 159%, at almost $50 billion on 2,305 issues. That stands against $19.29 billion on 847 deals through the first four months of 2011.

To be sure, April’s volume was significant. But the difference from last year was more attributable to a down period in 2011 than to an anomalous flood of issuance last month.

By comparison, volume this April was 22% more than it was in April 2010, when borrowers issued $27.50 billion. The total for April 2011, on the other hand, was the lowest for the month since 2000, when only $15.70 billion was sold.

That was due primarily to the fact that April 2011 fell into a period where the market was still wrestling with the hangover it suffered when the Build America Bond program ended and municipal governments shifted into full austerity mode.

At this point in 2011, investors were also still pulling money out of muni bond mutual funds. In April 2012, by contrast, the market took on an entirely positive tone, while April 2011 was decidedly negative.

The year-to-date numbers for 2012 fit more closely to those of around six years ago, before the extreme volatility that started in 2008 and the BAB program launched in 2009 warped them, said John Dillon, chief municipal bond strategist at Morgan Stanley Smith Barney.

Looking at the first four months of 2012 — although the growth year-over-year, year-to-date is striking — the market obviously handled the uptick very well, he said.

“It’s interesting that the numbers can be so strong, as far as growth goes, and the buyers in the market are still clamoring for paper,” Dillon said.

The reason why concerns the nature of the issuance itself, he continued. Issuance added to supply, but because a lot of it has been refunding and combined refunding and new money, as opposed to pure new money, it also sapped supply, Dillon said.

“If you look at that year-over-year new-money growth, it’s pretty minimal,” he said. “Whereas, if you look at the refundings and combined numbers, they’re a much bigger part of the pie.”

Among the heavy-issuing municipal sectors, general purpose bonds increased 272% last month, compared with the same period one year earlier. There were $9.62 billion of them on 370 issues in April, against $2.59 billion on 198 deals a year earlier.

Health care deals were up 127% year over year. Education deals were up 60% over the same period.

Of the lighter-issuing municipalities, environmental facilities issued 1,178% more in bonds last month than they did in April 2011, and development deals weighed in at 519% more in volume over the same period.

Tax-exempt debt issuance jumped 146% last month, to $30.57 billion on 1,062 deals. That compares with $12.41 billion on 644 issues in April 2011.

Taxable deals were lighter and less numerous last month than they were in April 2011. There were nine deals, worth $1.65 billion in April, compared with 92 issues at $2.85 billion.

Negotiated deals far outweighed their competitive brethren last month, compared with April 2011. They measured $25.85 billion on 756 deals in April, against $13.06 billion on 457 issues, a 98% jump.

Competitive issues still saw a 222% increase last month from the same period in 2011. There were $7.76 billion via 395 competitive deals in April, against $2.41 billion on 258 issues one year earlier.

Revenue and general obligation bond deals last month also saw large increases. Revenue deals leapt 90.4%, to $20.92 billion on 369 issues. GO deals rocketed 167%, to $12.72 billion on 789 issues.

Among state issuers, California floated the most in long-term debt in April, compared with a year earlier. The Golden State issued 171% more than it did a year earlier, when it occupied third place.

Last month, it issued $15.14 billion on 220 deals. That compared with $5.59 billion on 219 issues in April 2011.

New York followed last month with $12.92 billion on 304 issues. It dropped from first place one year earlier, when it issued $8.05 billion on 160 deals.

Filling out the top five were Texas, up 91% April-over-April; Puerto Rico, 633% higher, and Florida, up 78%.

Illinois, ranked second in April 2011, dropped to ninth place last month. Its issuance fell 45%.

California also floated two of the five largest deals in April, including the month’s biggest. On April 13, the state issued $1.34 billion in new-money and refunding GOs.

The New Jersey Economic Development Authority trailed with $1.04 billion in refunding bonds on April 2. Pennsylvania issued $950 million of GOs.

The New York City Transitional Finance Authority floated $900 million in taxable and tax-exempt various purpose qualified school construction bonds. Meanwhile, the California Statewide Communities Development Authority issued about $870 million in debt for hospitals.