WASHINGTON — Market participants are stepping up their efforts in support of muni-friendly provisions in the Senate highway bill, as that body prepares to head to conference with the House to resolve differences in legislation each chamber has passed providing funding for the nation’s surface transportation programs.

The two-year, $109 billion Senate bill sponsored by Sens. Barbara Boxer, D-Calif., and James Inhofe, R-Okla., that passed last month would temporarily exempt private-activity bonds from the alternative minimum tax and increase the limit for bank-qualified bonds to $30 million from $10 million.

Those provisions didn’t find their ways into a bill that won House approval last week, extending current transportation policy until September but including the funding provisions from a failed, five-year $260 billion plan offered by House Transportation Committee chairman John Mica, R-Fla.

Greg Principato, president of Airports Council International-North America, sent a letter late last week to Sens. Max Baucus, D-Mont, and Orrin Hatch, R-Utah, the leaders of the Senate Finance Committee.

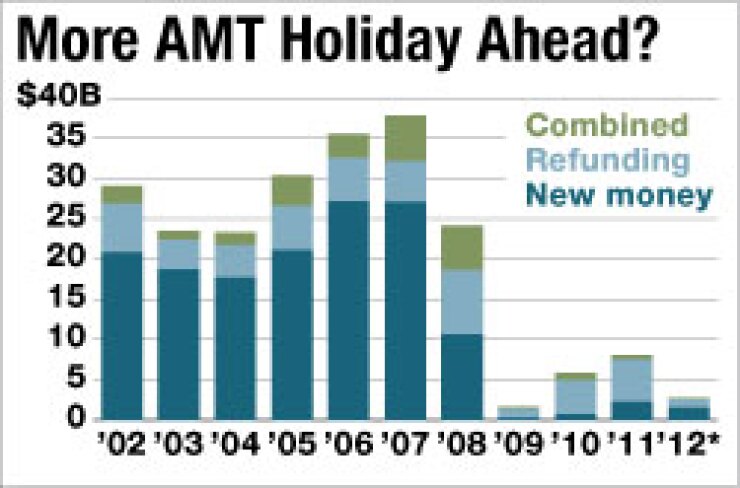

Principato urged the senators to “push for inclusion” of the Senate-passed language in any bill produced by the House-Senate conference. PABs were exempted from the AMT in 2009 and 2010, and getting that exemption back has been a high priority for airport advocates ever since.

Lobbyists expect that Baucus, whose committee bore the responsibility of finding money to pay for the Boxer-Inhofe bill, will be among the Senate conferees when Senate Majority Leader Harry Reid, D-Nev., appoints them sometime this week.

“The Airport Improvement Program (AIP), which has provided critical funds for airports based on ticket taxes paid by passengers, is under heavy pressure,” Principato wrote.

“This, coupled with the fact that the local passenger facility charge (PFC) has lost nearly 50% of its value due to Congressional refusal to increase the $4.50 cap (established in 2000) to offset the impacts of construction-cost inflation, and the need for the AMT exemption could not be clearer, if we are to move forward with needed safety and security projects at airports across the country.”

Toby Rittner, president and chief executive officer of the Council of Development Finance Agencies, also expressed support of that language.

“CDFA fully supports the elimination or repeal of AMT for private-activity bonds,” Rittner said. “AMT is a concept that is outdated and unfairly penalizes too many individuals. Particularly investors of tax-exempt bonds. With so many investors subjected to AMT, the motivation to invest in PABs is diminished. By repealing or eliminating AMT altogether, investors would be able to invest in tax-exempts without penalty.”

However, the provision only applies to private-activity bonds issued from a law’s enactment through the remainder of 2012.

Chuck Samuels, a member at Mintz, Levin, Cohn, Ferris, Glovsky and Popeo PC, said he wondered about the value of such an exemption.

The bank-qualified bond provision, which would allow banks for one year to deduct 80% of the cost of buying and carrying tax-exempt bonds sold by issuers whose annual issuance is $30 million or less, lasts from June 30 of this year until July 1, 2013.

“What’s the value of a short-term extension of a provision?” Samuels asked. “A full year, it could be useful.”

Both chambers are expected to assign conferees this week after negotiations over the ratio of Democrats and Republicans in the committee conclude.