Municipal bond yields fell this week amid relatively heavy issuance and dithering Treasuries.

The market found a firm stride by Wednesday and quickened its pace Thursday. Its fundamentals mostly radiated a healthy hue, investors said.

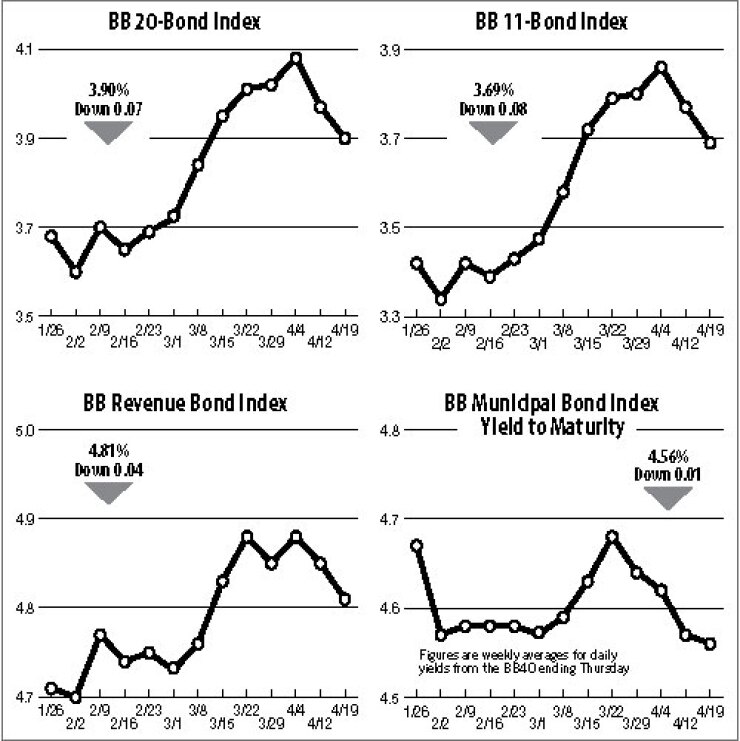

Municipal bond indexes all reflected lower interest rates after a strong week. The Bond Buyer’s 20-bond index of 20-year general obligation yields declined seven basis points this week to 3.90%. It sits at its lowest level since March 8, when it was 3.84%.

The 11-bond index of higher-grade 20-year yields dropped eight basis points this week to 3.69%. This represents its lowest level since March 1, when it was 3.47%.

The yield on the U.S. Treasury’s 10-year note fell 10 basis points this week to 1.96%, its lowest level since Feb. 2, when it was 1.83%. The yield on the Treasury’s 30-year bond also dropped 10 basis points this week, to 3.12%, which is its lowest level since Feb. 2, when it was 3.01%.

Primary deals met a balanced demand. No single deal dominated the calendar or set the tone, yet almost 20 issues for at least $100 million were mostly absorbed without price cuts.

Investor interest in tax-exempts remained strong, said Phil Condon, chief investment strategist for fixed income and lead muni portfolio manager at DWS Investments.

“The Treasury market has been having a good week and supply is a little heavier than usual — but that’s no problem,” he said. “So, things have worked out and demand is still there.”

A closer look at yields showed how investors have expressed the most interest in the belly of the triple-A curve. Muni yields outperformed those of Treasuries on the week.

Since last Friday, the benchmark 10-year triple-A fell nine basis points. By comparison, the 10-year Treasury, after rising early in the week, skipped down two basis points over the same period.

Tax-exempts on the week got slightly richer compared with Treasuries, but mostly remained cheap, according to Municipal Market Data numbers. This was particularly true for muni ratios to Treasuries at the two- and 30-year sections of the yield curve — at 115% and 105%, respectively.

But the numbers alone don’t express values properly, some say. Even though they appear somewhat cheap at the short and long ends of the curve, munis overall are valued fairly, said Chris Ryon, a portfolio manager of muni bond funds at Thornburg Investment Management.

“We’re not really cheap to Treasuries,” he said. “Treasuries are overvalued.”

The revenue bond index, which measures 30-year revenue bond yields, fell four basis points this week to 4.81%. It is at its lowest level since March 8, when it was 4.76%.

The Bond Buyer’s one-year note index, which is based on one-year GO yields, declined two basis points this week to 0.23%. This is its lowest level since March 14, when it was 0.22%.

The weekly average yield to maturity of The Bond Buyer municipal bond index, which is based on 40 long-term bond prices, declined one basis point this week to 4.56%. It is the lowest weekly average for the yield to maturity since the week ended March 22, 2007, when it was 4.54%.