CHICAGO — The Metropolitan Pier and Exposition Authority of Illinois has selected a finance team as it gears up to enter the market this summer with a big refunding to take advantage of a favorable market in a deal that could also include some new money and debt restructuring.

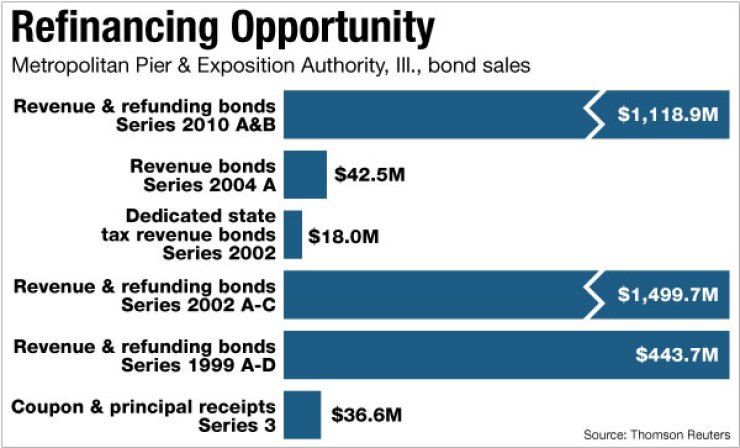

The issue, still unsized, would be the agency’s first since its $1.2 billion 2010 offering that launched a legislatively approved restructuring of its debt portfolio and operations aimed at providing near-term fiscal relief and long-term financial stability.

“We have some bonds that are callable in June and with rates where they are at there’s a significant amount of savings available,” said MetPier’s chief financial officer, Richard Oldshue. “The refunding opportunities on as much as $700 million of callable bonds are what is driving the timing of the sale, but we may elect to do some restructuring and new money.”

The MPEA, which owns the McCormick Place Convention Center and Navy Pier in Chicago, has $250 million remaining from a $450 million state-approved authorization for new-money debt. The net present-savings on some of the 2002 bonds are in the double-digits, Oldshue said.

Morgan Stanley and Jefferies & Co. Inc. will serve as co-book-runners with Loop Capital Markets LLC and Ramirez & Co. as co-senior managers and another six firms rounding out the syndicate as co-managers.

Acacia Financial Group and Public Financial Management Inc. are advising the authority. Katten Muchin Rosenman LLP is bond counsel and Neal & Leroy LLC is underwriters counsel with Mayer Brown LLP serving as special counsel.

All of the firms were pre-qualified during a competitive selection process in 2010. MetPier chose Morgan Stanley as a book-runner from its lead list of four because of its performance in that role on the 2010 sale and Jefferies because the firm “has been very active” in bringing the agency financing ideas, Oldshue said.

The MPEA board approved the team last week. The finance staff anticipates bringing a proposed sale to the board at a meeting in April or May and, once approved, heading to the market over the summer.

The agency’s 2010 deal came in the wake of state legislation that paved the way for a sweeping overhaul of MetPier’s work rules at McCormick Place while authorizing the debt restructuring and new money for the construction of a hotel tower.

The authority issued $204 million to finance construction of a new 450-room hotel tower over an existing parking garage to complement its existing 800-room Hyatt Regency McCormick Place Hotel. Oldshue said construction of the facility is on time and within budget.

The rest of the $1.2 billion issue restructured existing debt, extending the final maturity to end the near-term draw on state sales tax that backstops the debt, free up some existing authority tax revenue to help cover operations, and replenish exhausted reserves.

“The goal is to continue to protect the state sales tax from being drawn upon,” Oldshue said of the possibility of including some refunding bonds for restructuring purposes in the upcoming sale.

Primary security for the authority’s bonds is MetPier taxes on hotel rooms, restaurant meals, Chicago airport taxicab rides, and car rentals. They produced $98.4 million in fiscal 2010 and were tracking ahead of budgeted estimates in 2011 and 2012. Those revenues flow into a project fund to cover debt service that is subject to an annual legislative appropriation.

Rating agency analysts have said in previous reports that there is little incentive for Illinois not to grant the appropriation because the revenues otherwise remain in the project fund.

Collections of the taxes fell sharply after the Sept. 11, 2001, terrorist attacks. Their subsequent growth failed to keep pace with MetPier’s steadily rising debt-service schedule, prompting a draw on the state sales taxes that provide a backup pledge.

Under the MetPier reform legislation signed in 2010, the state pledged $139 million of sales taxes as a backup in fiscal 2010.

That figure rises to $350 million in 2031 — up from an existing maximum level of $275 million. It will remain in place at the $275 million level until 2060.

By restructuring existing debt, however, MetPier officials don’t anticipate tapping the backup. The authority was forced to tap about $18.8 million in Illinois sales tax revenue in fiscal 2009 to cover debt service. It estimated it would have needed about $37 million to $40 million in 2010 absent the 2010 restructuring.

The bonds carry a range of ratings. Fitch Ratings assigns them a AA-minus and stable outlook because of the strong debt-service coverage ratio provided by Illinois sales taxes. Moody’s Investors Service dropped $2.48 billion of authority bonds one notch to A3 earlier this year in tandem with its downgrade of the state’s general obligation rating. Standard & Poor’s rates the bonds AAA.

Fitch said in its 2010 report that while it did not view the extension of debt maturities as a credit positive, analysts acknowledged that pushing out the debt would give the MPEA the time needed to stabilize its operations.

Standard & Poor’s rating is tied to the state’s sales tax-backed bond credit, which also carries top marks.

“The rating reflects the state’s highly diversified and very strong sales-tax base and very strong coverage of maximum annual debt service from state sales tax revenues,” according to analyst John Kenward.

MetPier leaders had long sought state approval for the debt restructuring and hotel expansion. It achieved that goal in 2010 by including them in a sweeping reform package that overhauled MetPier’s governance and operating structure, including privatizing most convention center operations. Navy Pier is being operated now as a separate nonprofit unit.

The reforms lowered the costs for users of the convention center and eased union work rules. They were adopted to stave off the further flight of convention business to more affordable facilities in Las Vegas and Orlando.

Major trade show and convention business managers have praised the changes. Officials estimate that convention business produces 65,000 jobs and $8 billion in economic activity for the region.

In addition to allowing the authority to push out maturities, the legislation extended its taxes on auto rentals in Cook County, Chicago hotel rooms, downtown restaurants, and a departure tax on airport taxi rides by 18 years through 2060.

The legislation also allows the authority to tap about $20 million of its own taxes through 2014 to subsidize operating shortfalls anticipated because of the reduced costs to exhibitors. Oldshue said the funds should cover most of the agency’s operating loss and under a three-year plan, the authority is on track to break even as scheduled by 2015.

New board members took their seats last week. They include four appointments from Gov. Pat Quinn and four by Chicago Mayor Rahm Emanuel. It was also recently announced that Jack M. Greenberg, chairman of Western Union Co., would serve as the board chairman. Jim Reilly, who had taken over as trustee of MetPier as part of the 2010 legislation, became the chief executive officer. Former state Comptroller Dan Hynes was among Emanuel’s appointees.

“I am proud of the many milestones that we accomplished during my tenure as Trustee and I’m excited to work with the MPEA board to advance the mission of the Authority to attract more conventions and visitors to Chicago,” Reilly said in a statement.