Many banks were aggressive buyers of municipal bonds in 2011, seeing value in high relative tax-exempt yields and stepping in to make direct purchases of debt.

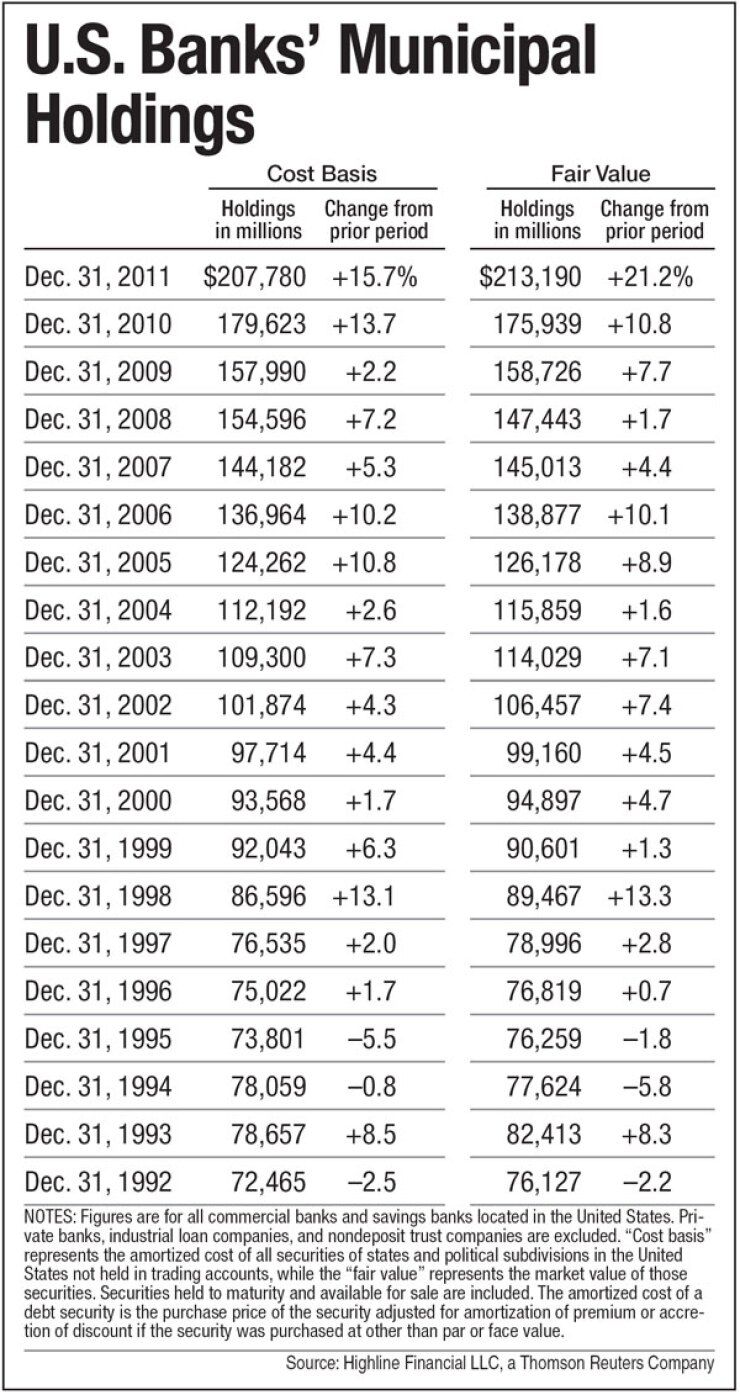

Bank holdings of municipal bonds rose 15.7% on a cost basis to $207.78 billion and 21.2% on a fair-value basis to $213.19 billion, according to new data from Highline Financial LLC.

It was the highest percentage increase in municipal portfolios since 1991, when banks owned just $74.31 billion on a cost basis and $77.80 billion on a fair-value basis.

It was also the second consecutive year of strong growth for bank portfolios, following a 13.7% increase on a cost basis and 10.8% increase on a fair-value basis in 2010. That came on the heels of three previous years of more modest growth, including the 2009 rise of just 2.2% on a cost basis and 7.7% on a fair-value basis.

“It was an unusual year for the bond market and some of its abnormal characteristics drove commercial banks to add municipal bonds to their investment portfolios,” said Rick Calhoun, first vice president of municipal sales and trading at Crews & Associates Inc. in Little Rock, Ark.

The opportunity to buy tax-exempt bonds at yields that were well beyond the traditional 80% to 90% of the taxable U.S. Treasury yield convinced many banks to buy munis, he noted.

“For most of 2011, yields on many high-grade municipals were well over 100% of U.S. Treasuries,” Calhoun said.

Despite lower volume overall, “lower interest rates brought a wave of refunding issues that led to a healthy supply of municipal bonds for most of 2011,” he said.

“In spite of Meredith Whitney’s now-infamous forecast, many portfolio managers felt more secure with state and local municipal issues that were closer to home than debt issued by Fannie Mae and Freddie Mac — especially after Standard & Poor’s downgrade of U.S. government debt last August,” Calhoun said.

Wells Fargo Bank’s portfolio ranked number one after it ballooned 133.6%, or $12.77 billion, to $22.34 billion last year, up from just $9.56 billion in 2010.

In December, the bank completed its merger with Wachovia Bank, a transaction that was originally announced in 2008 and became one of the largest bank mergers in U.S. history. Wells Fargo held just $1.66 billion and $1.65 billion of munis back in 2009 and 2008, respectively.

The bank declined to comment.

Citibank NA ranked second, increasing its portfolio by 8.9% to $16.28 billion, up from $14.95 billion in both the previous year and the same amount in 2009.

JPMorgan Chase & Co. captured the third spot with a municipal portfolio of $11.97 billion, a 42% jump from $8.43 billion in 2010 and a 138.6% increase from $3.53 billion in 2009.

State Street Bank’s 2.8% increase to $7.03 billion from $6.84 billion the previous year gave it the fourth-largest portfolio.

U.S. Bank’s portfolio decreased by 6% to $6.34 billion, but it still managed to take the fifth-ranked spot. It held $6.74 billion in 2010.

Alliance Bank of Arizona saw the highest percentage growth, as its portfolio soared a whopping 24,470% to $76.7 million from just $312,000 in 2010 — on the heels of zero muni exposure in both 2009 and 2008.

Bank of New York Mellon was ranked eighth among the banks with the largest municipal gains as its portfolio increased by 356.9% to $2.76 billion, up from just $605 million the year before.

However, not all banks added to their portfolios, and some significantly curtailed muni ownership.

Bank of America dramatically reduced its muni holdings. Its portfolio fell by nearly half to $2.89 billion last year from $5.40 billion in 2010. And that was down substantially from previous years.

Key Bank had the largest percentage decline in its municipal portfolio, which dropped by 65.1% to $59.8 million from $171.4 million held in 2010.

TD Bank’s portfolio decreased by 61.1%, or $260.6 million, to a four-year low of $165.7 million, down from $426.3 million in 2010. It owned as much as $615.5 million in 2008.

“While most banks increased their municipal holdings, some banks were forced to reduce municipal positions because of increased liquidity requirements — especially those banks that experienced real estate-related loan losses,” Calhoun said.

Calhoun added that one of the biggest challenges for bank portfolio managers was the increased due-diligence requirements on new municipal purchases.

“In a break from tradition, federal regulators instructed banks to not rely completely on the rating agencies and instructed them to prepare a file with a 'pre-approval’ check list and other financial data on the issue before purchasing municipals,” Calhoun said.

Overall, however, municipal experts said the banks that added to their muni exposure had good reason to do so in 2011.

Tom Kozlik, a municipal credit analyst at Janney Capital Markets, said many institutions took advantage of last year’s poor investor sentiment, key tax advantages, and the strong credit quality of local governments — particularly those with a median rating between Aa2 and Aa3 — despite headline risk and negative forecasts.

On the tax front, Kozlik pointed out in his February 2012 “Municipal Bond Market Note” that due to a temporary change in the Internal Revenue Service Code, banks also found more favorable tax treatment when it came to owning municipal bonds if those institutions were eligible for the IRS’ 2% de minimis interest expense deduction rule.

The rule allowed banks that purchased new-money, tax-exempt bonds sold in 2009 and 2010 to deduct 80% of the carrying, or interest, costs of the bonds — up to 2% of the bank’s total assets. That, as well as temporary incentives from the American Recovery and Reinvestment Act that expanded bank-qualified eligibility for bonds sold in 2009 and 2010, grabbed banks’ attention for much of the year, Kozlik said.

Meanwhile, Nat Singer, managing director at Swap Financial LLP in West Orange, N.J., said the trend of replacing letters of credit and standby bond purchase agreements with direct bank purchases of municipal debt was also a driving factor for increased bank ownership of municipal bonds last year, especially among such large players as Wells Fargo.

“The direct-purchase loan has a number of advantages over a variable-rate demand note for both the borrower and the lender,” Singer said. “The borrower ends up with cost-effective, variable-rate debt, in most cases, without weekly remarketing risk or bank risk. The lender is able to put capital to use without some of the onerous Basel III capital requirements and earns a tax-exempt spread rather than a taxable letter-of-credit fee.”