The municipal market has had a mixed week of rising yields and noticeable demand for new supply.

Muni yields underperformed those of Treasuries on the intermediate and long ends of the curve. Their ratios to Treasuries at those ranges rose, but remain richer than their averages over the past 12 months.

Treasuries have been leading to a small degree, said Howard Mackey, president of the broker-dealer unit of Rice Financial Products. Investors’ fears about the debt crisis have idled, as tremors from Greece have mostly subsided with a second resolution.

“The flight-to-quality fear has abated, to some extent,” Mackey said. “We see that in Treasuries, and that’s followed though in our market.”

Muni bond indexes mirrored yields. They moved higher for those covering long-term bonds and down slightly for one covering one-year notes.

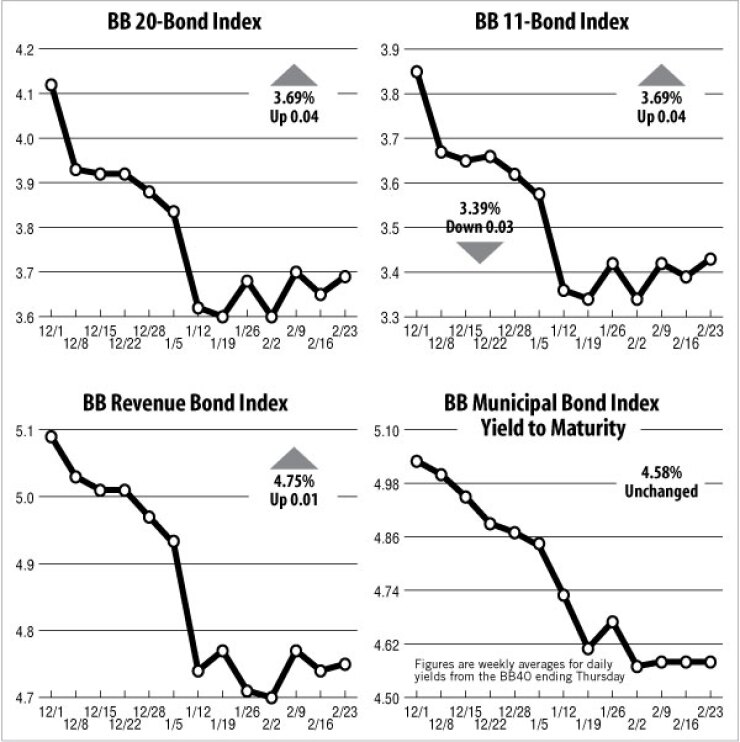

The Bond Buyer’s 20-bond index of 20-year general obligation yields increased four basis points this week to 3.69%. But it remained below its 3.70% level from two weeks ago.

The 11-bond index of higher-grade 20-year GO yields also rose four basis points this week to 3.43%. That is its highest level since Jan. 5, when it was 3.57%.

The yield on the U.S. Treasury’s 10-year note was unchanged this week at 1.99%.

The yield on the Treasury’s 30-year bond fell one basis point this week to 3.13%. This is its lowest level since Feb. 2, when it was 3.01%.

In the week since last Friday, the 10-year muni yield rose five basis points to 1.88%, according to the triple-A Municipal Market Data scale. Over the same period, the 30-year yield climbed four basis points to 3.27% and the two-year held flat on the week at a record low of 0.26%.

Still, traders report that the holiday-shortened week’s new issuance has been well-received, indicating strong demand. Large new issues from New York City and the University of California Regents were both upsized and saw strong buying.

“This week’s moderate new-issue slate is meeting strong demand with many issues oversubscribed, but secondary bids were reportedly weaker, reversing the strong tone of the prior three sessions,” Alan Schankel, managing director at Janney Capital Markets, wrote in a market post.

After reaching the lowest levels of the past several months, muni ratios to Treasuries rose on Wednesday and Thursday. Since last Friday, ratios have fallen at the short end to 83.87%. They have averaged 126.14% over the past 12 months, and hit 200% on Sept. 19.

Since Friday, the 10-year ratio to Treasuries rose to 94.0%, compared with 96.88% over the past 12 months. The 30-year ratio rose on the week as well, to 104.47%, versus 109.60% over the past 12 months.

The revenue bond index, which measures 30-year revenue bond yields, gained one basis point this week, to 4.75%. But it is still below its 4.77% level from two weeks ago.

The Bond Buyer’s one-year note index, which is based on one-year GO note yields, declined one basis point this week to an all-time low of 0.23%. The previous record low was 0.24%, first set on Jan. 18. The index began in July 1989.

The weekly average yield to maturity of the Bond Buyer municipal bond index, which is based on 40 long-term bond prices, was unchanged for the second straight week at 4.58%.