Even without the tailwinds of a strong rally, the municipal market coasted through a solid week, held aloft by falling yields and supply that was well-received.

Before Thursday, muni yields hovered throughout the week on all but the long end of the curve, where they firmed. On Thursday, though, investors bought in the short end, where the two-year triple-A dropped three basis points to a record low 0.26%.

Investors gobbled up the new supply. The institutional order periods for the week’s two biggest deals arrived a day earlier than scheduled, thanks to robust retail demand. Two large deals were also upsized, while other deals generally priced well, industry pros said.

Treasury yields rose modestly on the week. But they provided little direction for munis, said Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

“The market’s just meandering around, overall, in a very tight range,” he said. “And there’s apathy, in terms of reaching for bonds that perhaps you can wait for. On the other hand, there’s very little impetus to sell.”

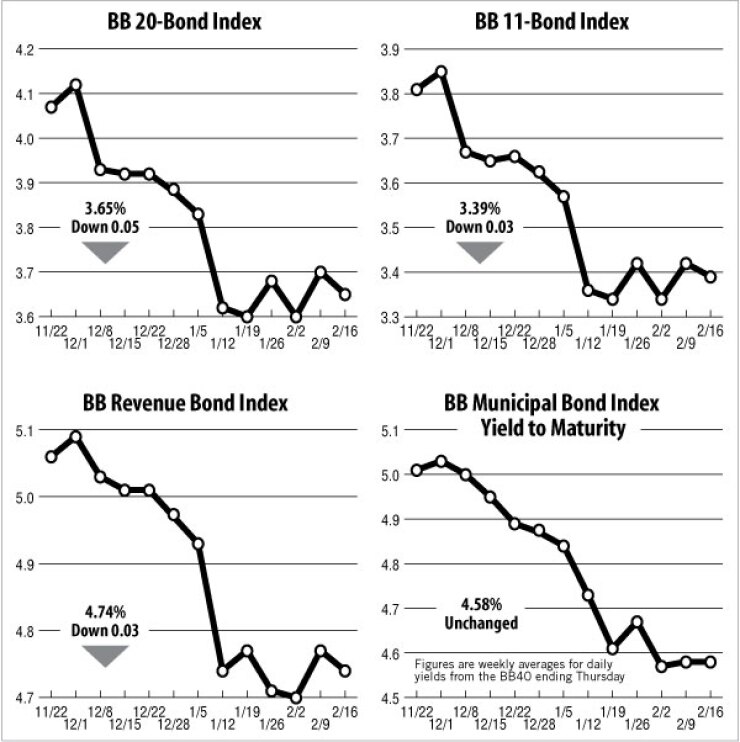

Muni bond indexes fell across the board. The Bond Buyer’s 20-bond index of 20-year general obligation yields declined five basis points this week to 3.65%, but remained above its 3.60% level from two weeks ago.

The 11-bond index of higher-grade 20-year GO yields dropped three basis points this week to 3.39%. But it remained above its 3.34% level from two weeks ago.

The yield on the U.S. Treasury’s 10-year note declined five basis points this week to 1.99%, but remained above its 1.83% level from two weeks ago. The yield on the Treasury’s 30-year bond fell five basis points this week to 3.14%, but is still higher than its 3.01% level from two weeks ago.

Muni got richer to Treasuries. Accordingly, muni ratios to Treasuries fell across the curve. They were two percentage points lower on the intermediate and long ends of the curve.

And they continued their freefall at the two-year mark, where the ratio dropped 20 percentage points on the week to 86.67%, according to Municipal Market Data numbers. On Sept. 20, the two-year ratio stood at 200%.

Against a backdrop of rising issuance, demand among investors this week remained solid. The $834.7 million sale of Dormitory Authority of the State of New York bonds stood out for Pietronico and set a nice tone for the market.

“The pricing was very well received, and as of right now, the bonds are trading up in the secondary market,” he said. “It proves that for the right credit, there’s some sizable amount of cash out there.”

The revenue bond index, which measures 30-year revenue bond yields, decreased three basis points this week to 4.74%. But it is still above its 4.70% level from two weeks ago.

The Bond Buyer’s one-year note index, which is based on one-year GO note yields, declined one basis point this week to 0.24%. This is its lowest level since Jan. 25, when it was also 0.24%.

The weekly average yield to maturity of the Bond Buyer municipal bond index, which is based on 40 long-term bond prices, held this past week at 4.58%. It remained below its 4.67% average from the week ended Jan. 26.