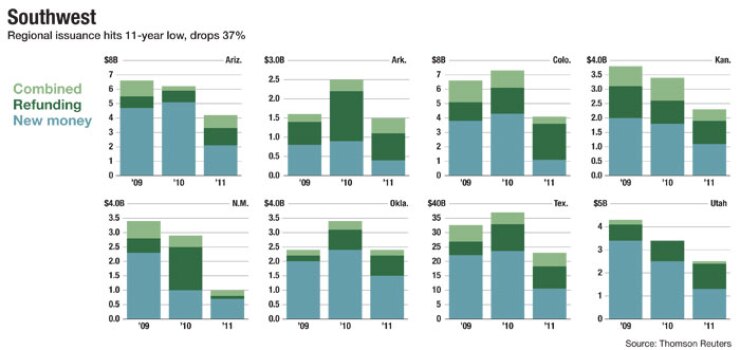

DALLAS — After riding the updraft of Build America Bonds in 2010, the Southwest municipal bond market hit bottom in 2011, with issuance falling 36.7% to an 11-year low of $42.1 billion.

The crash was loudest in the first quarter, when volume in the entire eight-state region was less than $6 billion, off more than 50% from first-quarter 2010. The decline in the Southwest for the full year was slightly sharper than the 32% national drop-off to $295 billion.

It was the thinnest year for municipal bond issuance in the Southwest since 2000, when $29 billion was sold. Last year’s volume was down nearly 42% from the peak of $72 billion in 2008.

Market participants say 2012 is bringing a rebound that may not be dramatic, but it is expected to be steady as issuers take advantage of record-low rates.

“We’re not going to see anything like the Roaring Twenties, but it’s going to come back,” said Boyd London, managing director of First Southwest Co. “I think 2011 is going to be seen pretty much as the bottom. Even if we’d still had BABs, it would have been down.”

Nationally, long-term issuance in January was already 17.6% higher than it was in the first month of 2011.

Rising revenues across the Southwest are also beginning to replenish empty state and local coffers.

“We won’t have a good handle on that until the Legislature concludes in May,” said Oklahoma state bond advisor James Joseph. “But like everyone else, we’re looking to take advantage of refund opportunities on any of the issues at or near their redemption dates.”

As the largest state in the region, accounting for nearly twice the volume of the other seven states combined, Texas saw its issuance fall 37% to $23.3 billion.

“I think we need to remind ourselves how severe this recession really was,” John Heleman, Texas’ chief revenue estimator and comptroller of public accounts, told The Bond Buyer’s Texas Public Finance Conference in Austin Sunday. “We’re still recovering.”

Across the region, new-money issues were down nearly 55% to $19 billion, and refundings fell 9.2% to $15.6 billion.

In the first month and a half of 2012, several large refunding issues have already been priced, as the limited supply and improving economy in 2011 helped make rates hard to resist.

Uncertainty played a major role in the market after the United States lost its triple-A credit rating from Standard & Poor’s in the midst of a partisan showdown over the federal debt limit in the fall.

American Airlines parent AMR Corp. threw in the towel Nov. 29 after years of fighting off bankruptcy, filing Chapter 11 and defaulting on many municipal bonds issued to finance facilities for the airline.

The Fort Worth-based carrier is working on a reorganization plan that requires thousands of layoffs and may put it in play for a merger with another large airline.

Among senior managers, JPMorgan edged out RBC Capital Markets, followed by Citi, Bank of America Merrill Lynch and Morgan Keegan & Co. JPMorgan’s $4.9 billion volume gave it a 12% market share compared to 11.2% for RBC.

First Southwest Co. remained the top financial advisor with $9.76 billion of volume and a 27% share, more than double RBC’s $4.6 billion and 12.8% share. The top five included Public Financial Management Inc., Estrada Hinojosa & Co. and Southwest Securities.

For FAs whose clients needed to get to market in 2011, the year was not all bad news.

“The first quarter looked deathly,” said Charlotte Knight-Marshall, principal at TKG Associates. “But later in the year, we were pretty busy.”

TKG was involved in deals from the year’s two largest issuers, the North Texas Tollway Authority and the city of Houston.

“It depended on your issuer base,” Knight-Marshall said. “We’re a small boutique firm and we did well with transportation issues.”

McCall Parkhurst & Horton stood atop the bond counsel rankings with $6.9 billion in volume and a 17% share. Fulbright & Jaworski’s $4.7 billion gave it an 11.6% share.

Vinson & Elkins ranked third with $3.6 billion and an 8.9% share in its swan song on the municipal league tables; the firm’s public finance team departed at year’s end for Bracewell & Giuliani. The top five was rounded out by Kutak Rock and Andrews Kurth.

State governments, dealing with their third year of austerity amid declining tax revenues, issued 70% less debt in dollar volume.

The Texas Legislature, which saw revenues fall nearly 25% below full funding levels for existing budget requests, made its first cuts in education outlays while trying to preserve its rainy-day fund.

Gov. Rick Perry took center stage in the budget battle, calling a special session to complete the biennial spending plan.

Arizona, which mortgaged its capitol complex and other state buildings in 2010 to fund education and other general fund expenses, won voter approval for a 1-cent increase in the sales tax rate to provide badly needed revenue.

The top two issuers for 2011 were the North Texas Tollway Authority with $2.1 billion in a single deal, followed by Houston with $2.1 billion in two offerings.

The Arizona Transportation Board’s three deals worth $874 million ranked third, followed by Denver City and County School District No. 1 with $792 million and the Oklahoma Turnpike Authority with $683.7 million.

The $1.12 billion of municipal bonds sold out of New Mexico in 2011 represented the steepest fall of any Southwest state, down 61%, followed by Colorado, down nearly 42%.

New Mexico’s dollar volume was also the least of the eight states, followed by Arkansas at $1.5 billion. Oklahoma had the lowest volume drop among the Southwest states: 25.4%.

While Kansas registered a slight 5.6% increase in sales during the third quarter of 2011, total debt sales by issuers in the state fell almost 30% from 2010. The number of issues also dropped, to 268 in 2011 from 326 in 2010.

The total of $2.4 billion of Kansas issuance consists of $1.2 billion of revenue bonds and $1.2 billion of general obligation debt.

Arkansas total issuance was down 38.4% year-over-year.

University of Arkansas Board of Trustees was the largest issuer in the state, with sales of $160.2 million in four issues. Arkansas debt sales were lean in the first and third quarters of 2011, with declines of 71% and 60%, respectively, but came closer to year-earlier totals in the second and third quarters. The state plans to sell the first tranche from a new authorization of road bonds in late 2012.

Arkansas voters in November 2011 approved an extension of the state’s grant anticipation revenue vehicle, or Garvee, bond program, which that will allow the state to issue $575 million of general obligation bonds to finance repair projects on Interstate highways.

Triple-A-rated Utah registered one of the less dramatic declines in volume with $2.55 billion of issuance, down 29.6% from the previous year.

The Utah State Board of Regents was the region’s seventh-largest issuer with 632.1 million of bonds sold, followed by the state of Utah in eighth position with $610 million.