CHICAGO — Louisville, Ky.-based Hilliard Lyons has hired Chicago-based banker Alexander Rorke to lead an expansion of its public finance banking business across the firm’s 13-state footprint.

Rorke, who previously managed the public finance banking group at Loop Capital Markets LLC and managed UBS’ former Midwestern group, joined Hilliard Lyons as a senior vice president and director of public finance. He will lead the firm’s efforts to bolster its public finance originations business within its broker-dealer division, J.J.B. Hilliard, W.L. Lyons LLC.

The firm hopes to snare business in Illinois, Indiana, Michigan, Ohio, Tennessee and other states where Hilliard Lyons currently operates. While competition for deals is fierce among broker-dealers given the shrinkage in volume last year, the firm believes now is the time to launch its expansion. Public finance growth is one of four key goals set by senior management.

With some firms laying off municipal professionals or cutting back on compensation “we think there will be real opportunity,” chief operating officer Jim Rogers said in an interview this week. “Now is the much better time to attract individuals.”

Rogers said he tapped Rorke because of his experience in building teams and their relationship working on deals in the same syndicate over the last 15 years. “I know his credentials, I know his capabilities. We are very excited,” said Rogers, who has been with Hilliard Lyons for 26 years.

Rorke managed public finance banking at Chicago-based Loop from late 2009 until last summer. He left UBS in 2008 after his position as a senior advisor in the corporate finance, mergers and acquisitions, and asset management groups was eliminated. UBS moved him into that post in spring 2008 after the Swiss banking giant shuttered its muni group.

Rorke worked for Salomon Brothers in New York City, moving to Dean Witter after Salomon’s exit from the public finance business in 1987, and relocated to Chicago. He joined PaineWebber Inc. in 1993 to build the firm’s group here. UBS AG purchased PaineWebber in 2000 and eventually eliminated the brand name.

Rorke takes over a group of five bankers in Indiana and Kentucky. The group is supported by some 17 trading and underwriting professionals. The firm operates trading and underwriting desks in Indiana, Kentucky, Ohio and Tennessee.

Rorke will take over for Samuel Connor, who previously was both a working banker with a book of business and a manager of the banking group but will now focus solely on deals. After building its banking group, the firm intends to grow its sales, trading and underwriting staff.

Officials hope to capitalize on the broker-dealer’s strong retail distribution network, as issuers in recent years have sought increased retail participation in an attempt to broaden investor bases and lower interest rates.

The firm also sees strong demand for primary market municipal paper among its high-net-worth clients. Rorke said he was impressed with the bounty of retail orders submitted by Hilliard Lyons on past deals. “I saw the way the Hilliard sales force could come through,” he said.

The firm has no immediate volume, revenue or hiring goals as Rorke takes over. “We will be following the footprint and we will be growing, in a thoughtful, but quick pace,” he said.

He anticipates pursuing senior manager positions on deals in the range of $50 million or less where the firm has relationships. The firm will seek work on larger deals in new territory as a co-manager. It hopes to eventually move up to senior manager on larger deals, which it has the capital to support.

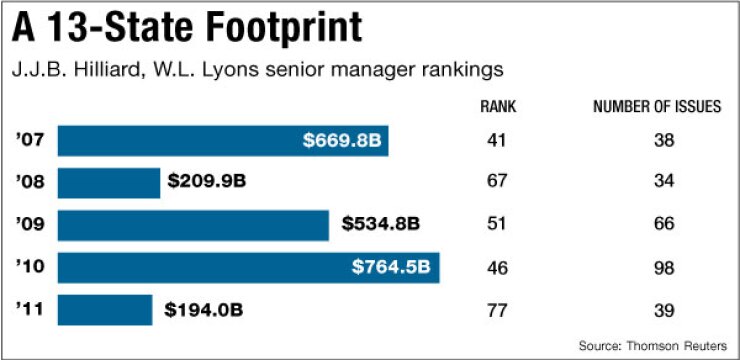

It ranked 77th among senior managers nationally last year, 11th in Kentucky, 38th in the Southeast and 45th in the Midwest, according to Thomson Reuters.

Rogers said the firm will be patient in pursuing growth, which many say is necessary because some larger issuers in its footprint draw underwriters from pools set through a request for proposals process.

Public finance growth “is key to our strategic plan,” he said.

The financial services firm was founded in 1854 and is jointly owned by its employees and Houchens Industries Inc. It operates more than 70 offices in the South and Midwest.