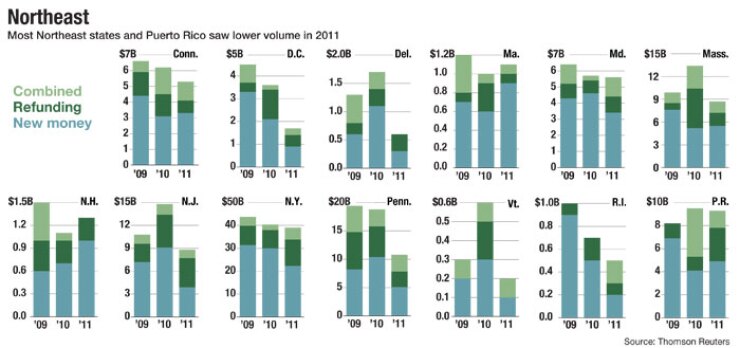

Issuers in the Northeast and Puerto Rico sold $96.6 billion of municipal bonds in 2011, down 18.1% from a year earlier, according to Thomson Reuters data.

The Northeast, however, outperformed the broader market. Nationwide, the drop was 32%, to $294.7 billion from $433.2 billion.

“Since ’08, it’s been a pretty cold atmosphere, but that has changed. People [in the Northeast] are realizing that the world hasn’t come to an end,” said James McKinney, the head of debt capital markets at William Blair & Co. in Chicago.

Nationally, the decline has hurt the bond counsel industry, according to Howard Zucker, member of the management committee at Hawkins, Delafield & Wood LLP, the most prolific bond counsel in the Northeast. The firm advised regionally on just under $10 billion through 214 issues. Bond issuers were less active than in previous years, he said. Several states had new governors advocating fiscal conservatism, which slowed issuance.

The drop in Northeast volume was more pronounced in the first two quarters — just under 40% from each comparable quarter. Many issuers closed deals at the end of the previous year as the Build America Bonds program concluded. Issuance dropped only 2.2% in the third quarter and actually had a slight uptick of nearly 5% in the fourth.

New York — city, state and conduit issuers — were the most busy, led by the New York City Transitional Finance Authority. The TFA, which issues bonds for general capital purposes for the city, sold $6.1 billion of debt last year, most recently $650 million of new-money building aid revenue bonds in December. The agency also held a $900 million new money sale in November.

The TFA has a $600 million sale of building aid revenue bonds scheduled for March, according to state Comptroller Thomas DiNapoli’s office.

“New York City had a successful year for bond sales thanks to a broad base of reliable investors in search of quality credits in the midst of global financial uncertainty,” city Comptroller John Liu said.

In the Northeast, local development deals spiked by volume to $7.9 billion from $1.8 billion, an increase of 352% over the year before. Development was the only sector to record an increase. Electric power (down 81.3%, to $709.8 million) and transportation (down 52.3%, to $10.6 billion) recorded the biggest declines.

The biggest individual bond sale in the Northeast was the New York Liberty Development Corp.’s $2.6 billion sale on Oct. 19 of multimodal Liberty revenue refunding bonds for the World Trade Center redevelopment project in lower Manhattan. Goldman, Sachs & Co. was lead manager. Overall, the LDC was the second most active issuer in the region at $5.8 billion.

Other top issuers were the Dormitory Authority of the State of New York ($4.3 billion), the Government Development Bank for Puerto Rico ($3.6 billion), the New York City Municipal Water Finance Authority ($3 billion), New York City ($2.5 billion), the New Jersey Economic Development Authority ($2.2 billion), Connecticut ($2.2 billion), the Massachusetts Development Finance Agency ($2 billion) and Massachusetts ($2 billion).

Puerto Rico came in with the second-biggest deal individually, a $1.8 billion sale on Dec. 21, managed by Santander Securities. According to Jose Otero, the bank’s vice president for financing, the money was raised within Puerto Rico. He said $1.3 billion was used to refinance local notes for “significant savings,” while the rest was used for new money.

On Dec. 1, the Puerto Rico Sales Tax Financing Corp. sold $1 billion to help finance the commonwealth’s deficit. Gov. Luis Fortuño, who inherited a budget deficit of 45%, has whittled it to 7%, Otero said. Most of the money from the issue was used to finance the deficit. Managed by Citi, it included a final 2046 maturity that carried a 5% coupon at par.

Moody’s Investors Service —which in August had lowered the commonwealth’s general obligation bond rating to Baa1 from A3 with a negative outlook — rated the sales tax bonds Aa2 and stable, while warning that the bonds are “still susceptible to general spending trends and the overall health of the economy.”

Otero said that Fortuño has moved the budget towards balance, implemented a housing stimulus plan and lowered electricity prices. Investors’ knowledge of these improvements will help the sale of Puerto Rico bonds, he said.

The Garden State’s most noteworthy deal was $1.3 billion issue for the New Jersey Transportation Trust Fund Authority on Nov. 16, an annual bond sale used to repair and create new transportation infrastructure statewide.

The authority spends on average about $1.6 billion each year. Some of the spending is pay-as-you-go, and the remainder comes from borrowing, according to Andy Pratt, a spokesman for state Treasurer Andrew Sidamon-Eristoff. New Jersey, he said, is moving more toward pay-go as debt growth has slowed since Gov. Chris Christie took office in 2010.

The state devises a plan for replenishing the trust fund every five years, Pratt said.

The $1 billion sale by Hudson Yards Infrastructure Corp. in October involved a high degree of difficulty. The deal primarily funded the extension of New York City’s No. 7 subway line.

“Hudson Yards was challenging and a complicated credit,” said James Haddon, a managing director at PFM Group Inc.

Under a unique structure, no principal payments are due until real-estate-related revenues within the Hudson Yards project area are enough to cover debt service. New York City has pledged to cover the interest costs for the life of the bonds when those revenues are insufficient.

“We were able to sell a number of unique deals in 2011,” said Liu, who cited Hudson Yards as well as the first-ever competitive sales for Municipal Water and the TFA’s building aid revenue bond credit. “This calendar year, we’re looking to do more of the same.”

PFM, the top financial advisor in the Northeast, worked on 288 issues valued at $16.1 billion.

Haddon envisions an increase in volume for 2012, especially infrastructure and refunding-related deals.

“The Northeast in general tends to have older infrastructure and has a greater need,” he said. “You’ll see a decent amount of refunding, because the interest rates are low. The refunding market will stay strong. I’m also more optimistic about volume in general, as the economy is improving, especially regarding infrastructure and capital needs, as the anti-debt sentiment is waning.”

“The Northeast in general tends to have older infrastructure and has a greater need. You’ll see lots of infrastructure and some real estate, which is infrastructure again,” Haddon said.

William Blair’s McKinney sees activity picking up at the local level, as it did in some pockets in 2011. Issuance was up last year in New Hampshire (29.1%, to $1.5 billion) and Maine (21.5%, to $1.2 billion). Only those two states and Puerto Rico (3.1%, to $9.8 billion) realized increases from 2010.

“In New England, unlike the Midwest, you have a lot of open-forum town hall meetings. By the time bonds go to a referendum, you’ve already heard a lot of back and forth,” McKinney said. School bonds are easier to sell because parent-teacher groups are active, he added.

The Massachusetts School Building Development Authority took advantage of low rates to issue $1 billion on Oct. 27. Proceeds were to be used as grants for cities, towns and school districts that overlap several towns for school construction projects. As part of the deal, $79 million was for the state’s debt service reserve. The authority gets a sliver of the state’s sales tax revenue to pay off the debt.

Authority spokesman Matt Donovan said districts file statements of need for buildings and the agency assesses the need. If the state approves making a grant, it reimburses a portion of the costs with the grants. The portion varies from 31 to 80%. Poorer communities get more money.

Variable-rate, short-put bonds — those with maturities of less than 15 years — should continue to regain popularity, said one banker speaking anonymously. Short-bond deals in the region rose 16.6% last year, to $7.5 billion, while long bonds were down 13.9%, to $762 million.

“As refundings remain a big component of the marketplace in general, there will continue to be a shift to a shorter issuance pattern,” the banker said.