CHICAGO — The Illinois State Toll Highway Authority unveiled a proposed $1.5 billion budget for 2013 that banks on $1 billion in borrowing to finance projects planned under the system’s $12 billion capital program announced last year.

The ISTHA budget allocates $922 million for capital projects aimed at reducing congestion and pollution, expanding the 286-mile system and improving roads. A total of $771 million of the capital spending will pay for projects in the $12 billion Move Illinois program.

Some of the projects include interchange construction, resurfacing, and the start of the Elgin O’Hare Western Access Project. The budget also funds tollway operations and annual maintenance.

“This $1.5 billion spending plan provides for $922 million in capital investments that will create thousands of jobs and help stimulate the local and regional economies,” said the agency’s executive director, Kristi Lafleur. “The 2013 budget also shows that we remain dedicated to strong fiscal management as we implement the largest capital program of any toll agency in the nation.”

The agency presented the tentative budget to its board’s Finance Administration Operations Committee on Wednesday and the full board will review it at its meeting next week on Thursday. Approval is expected at the board’s December meeting.

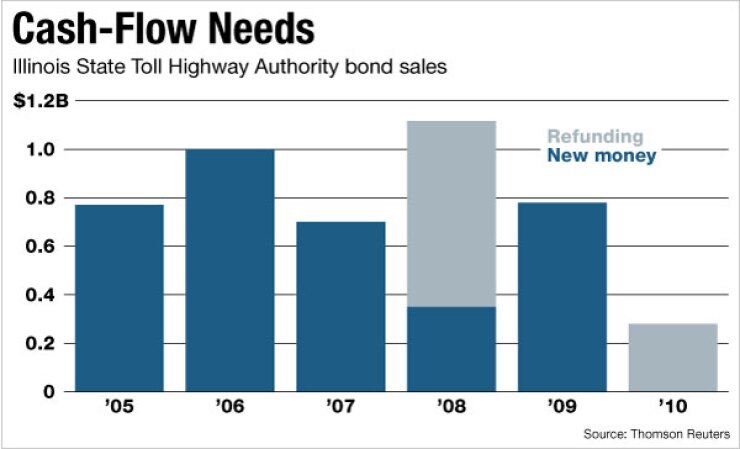

The highway authority anticipates issuing $1 billion in toll-backed borrowing to support capital projects planned in 2013 and beyond.

It originally planned to borrow $200 million this year for the new capital program but now expects its first issuance to be completed in the first quarter of 2013.

“The size of that issuance, and the size and timing of any additional issuances in 2013, will be determined nearer to issuance based on cash-flow need and market conditions, though we expect to issue as much as $1 billion next year,” said spokeswoman Wendy Abrams. “A financing team for the first issuance has not been established and once a recommendation is made, it will be considered by the full board of directors.”

The ISHTA over the summer established new senior manager, co-manager, financial advisory, and bond counsel pools after a competitive selection process. The agency has not yet publicly named a finance team for its next bond sale.

The tollway anticipates an increase of $13 million in revenues to $986 million next year, with about $977 million coming from toll collections, $1 million from investment income, and $8 million from concessions and other sources.

The authority’s operating costs are up about 4% due in part to increased pension and health care contributions for retired workers and fees associated with an independent review of the tollway’s construction practices.

The agency said it is attempting to keep operations costs in check by negotiating new contracts, improving toll recovery from motorists, and through energy-efficiency upgrades.

Efforts have resulted in $5 million in savings expected next year. The agency will fund 1,595 positions next year, down three from this year.

The senior and co-senior manager pool is made up of 14 firms and the pool of co-managers is made up of 17 firms. The firms were approved to provide underwriting and remarketing services for an initial term of three years, with options to renew for up to two years.

The ISHTA qualified for four advisory firms. The high scorer, Public Financial Management Inc., which employs former tollway board member Tom Morsch, will advise the authority on an ongoing basis. Three others were chosen to advise on individual transactions. The bond counsel pool includes 10 firms.

The authority board in August 2011 approved Move Illinois, promoting it both as needed to keep the 52-year-old system in a state of good repair through 2026 — required under its bond indenture — and as a job creator. The program provides $8 billion for improvements to existing roads and $4 billion for new and expanded roadways.

A steep toll increase of 87.5% will go toward repaying $4.8 billion of borrowing for the program. Debt service has a priority claim on the system’s revenues after operations are funded. The tollway had exhausted its borrowing capacity under the current toll structure based on its policy of maintaining a two-times debt service coverage ratio considered critical to its double-A ratings.

Moody’s Investors Service rates the authority Aa3. Fitch Ratings and Standard & Poor’s rate its $4 billion of debt AA-minus. Fitch assigns a negative outlook. It affirmed its rating on $4 billion of outstanding debt earlier this year.

The credit is supported strong traffic demands, the essential nature of the system, flexibility to raise rates, strong liquidity, proactive financial management, and the on-time delivery of the system’s former $5.8 billion capital program, which is nearly complete, Fitch said.

The rating also reflects challenges including a dependence on traffic growth to maintain debt-service coverage ratios and the need to refinance variable-rate debt in the coming years. Nearly 33% of the authority’s outstanding debt is variable rate, with plans to push that number down to 21% by 2015.

Maximum annual debt service is currently at $303 million in 2018, but is projected to rise to $636.9 million in 2030 as a result of new-money bond issuance, Fitch said.