WASHINGTON — The District of Columbia plans to sell $900 million of income tax-secured bonds in November, the biggest amongst a rash of deals closing the calendar year.

The negotiated deal will feature both new money bonds to fund the district’s fiscal year 2013 capital improvements program, an initiative which is slated to cost $1.1 billion over five years, and bonds to refund the 2010 debt supporting infrastructure at the Capper Carrollsburg Housing Redevelopment project in the city’s southeast quadrant. The development, slated for completion in 2017, received a $34.9 million Hope VI federal grant in 2001. It will be a mix of affordable and market-rate apartments in an area the city government is pressing hard to redevelop.

The sale will feature a retail only order period on the week of Nov. 12, and institutional bidders will get a shot the following day, said interim deputy chief financial officer and interim treasurer Jeffrey Barnette. The transaction is tentatively scheduled to close Nov. 28, he said.

Goldman, Sachs & Co. will lead the underwriting syndicate, which will also include J.P. Morgan and Loop Capital Markets. Bryant Miller Olive will serve as bond counsel.

The district expects the bonds will receive the same ratings as its outstanding income tax-supported debt. Chief Financial Officer Natwar Gandhi has said the income tax bonds, first issued in March 2009, are among the greatest achievements of his 12-year tenure. They represent a strategy that makes use of the district’s concentration of high-income residents and helps skirt disadvantages imposed on the city by federal law, such as the inability to tax the pay of non-residents or commercial real property owned by the federal government.

The outstanding income tax bonds are rated triple-A by Standard & Poors, Aa1 by Moody’s Investors Service, and AA-plus by Fitch Ratings. The district’s general obligation bonds carry lower ratings of A-plus from Standard and Poor’s, Aa2 from Moody’s, and AA-minus from Fitch.

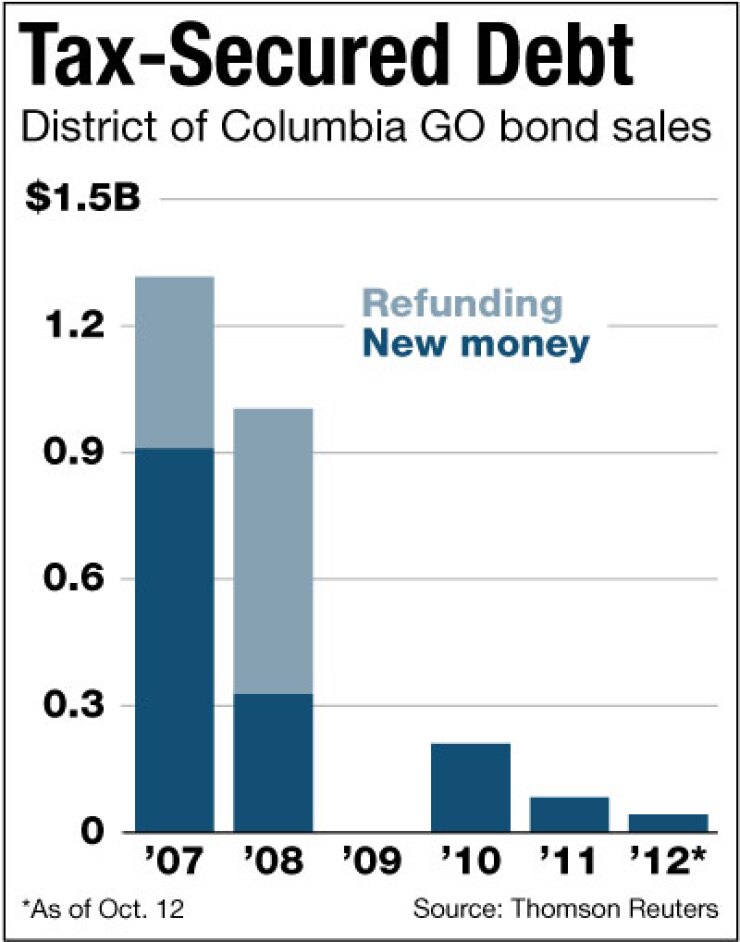

The district last issued income tax-secured bonds in May, when it sold $314 million. Those bonds have become the largest chunk of the city’s bond debt, and fundamentally changed its debt-issuance behavior so that it issues less GOs. The city reached or surpassed the $1 billion mark in GO debt in 2007 and 2008, the last two years before the income tax bonds came into being, according to data from Thomson Reuters. It has not reached that mark since.

“This bond sale is another demonstration of the city’s financial strength,” Gandhi said. “These high ratings will help the district achieve the lowest possible rates, which will save millions that can be used to pay for vital programs or and/or to increase the district’s savings account.”

The district plans to competitively sell $675 million of GO notes this week, after selling $42.9 million of grant anticipation revenue (Garvee) bonds last month. Barnette also said the city plans to price $45 million of additional debt in a negotiated sale of deed-tax revenue bonds between Thanksgiving and Christmas.