The municipal market scored solid gains this week, energized by the simple economics of supply and demand, as well as by investors flush with cash.

The resurgence of new issuance was greeted by a voracious appetite this week as Treasuries rallied and stocks slumped. Secondary activity has been clearing the overhang of supply from previous weeks.

Retail investors have gotten involved, traders noted. And municipal bond yields have fallen — moderately at the intermediate end of the curve and strongly at the long end.

Muni bond indexes plunged on the week, beholden to the lower rates.

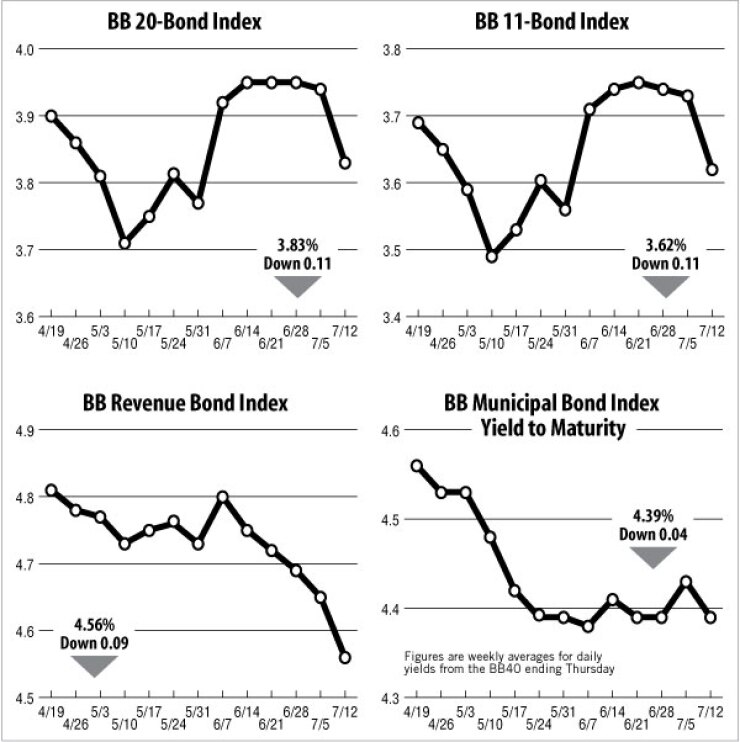

The 11-bond general obligation index of higher-grade 20-year GO yields dropped 11 basis points this week to 3.62%, which is its lowest level since May 31, when it was 3.56%.

The Bond Buyer’s 20-bond GO index of 20-year general obligation yields declined 11 basis points this week to 3.83%. That is its lowest level since May 31 when it was 3.77%.

The yield on the U.S. Treasury’s 10-year note dropped 12 basis points this week to 1.48% — its lowest level since the 1950s.

The yield on the Treasury’s 30-year bond fell 16 basis points this week to 2.56%.

That is its lowest level since Dec. 18, 2008, when it reached its all-time low of 2.53%.

Once again, it’s been all about supply and demand this week, according to David Manges, a managing director of municipal trading at BNY Mellon Capital Markets.

“There’s a lot of available cash from July redemptions, in large part perhaps unspent from other months,” he said.

“What we’ve seen periodically, for the last year or two, the customers that dislike these low absolute rates get dragged in by the pressure of available cash they have,” Manges added.

Since last Friday, muni yields beyond the short end have fallen precipitously, particularly on the long end, Municipal Market Data numbers show.

The 10-year triple-A fell eight basis points over the period to 1.74%, a mere seven basis points from its record low.

The 30-year muni yield, which set an all-time low Wednesday, kept descending to new depths; it ended Thursday’s session at a new low of 2.96%. The two-year remained at 0.32% for a 29th straight session.

“Customers have realized that they’re under-invested, and realized that the higher rates they had hoped for are not materializing,” Manges said. “And so they are forced to capitulate and buy at prevailing rates.”

Despite the low yields, retail has also gotten in on the act, a trader in Texas said. “Looking at the [Municipal Securities Rulemaking Board] trade count, we’re seeing a lot of retail-type pieces going away,” he said. “There’s a lot of activity in zeroes, par bonds … except it was stacked up there two weeks ago, that stuff’s been cleaning up in the 10- to 15-year range.”

The revenue bond index, which measures 30-year revenue bond yields, dropped nine basis points this week to 4.56%. It is now at its lowest level since May 24, 2007, when it was 4.55%.

The Bond Buyer’s one-year note index, which is based on one-year GO note yields, declined two basis points this week to 0.22%, which matches its all-time low first set on March 14.

The weekly average yield to maturity of The Bond Buyer municipal bond index, which is based on 40 long-term bond prices, declined four basis points this week to 4.39%. That is the same level as two weeks ago.