SAN FRANCISCO — Moody’s Investors Service’s recent downgrade to junk of California redevelopment bonds has triggered complaints from state officials, but little evident stir in the market.

“We believe Moody’s action was wholly unjustified,” said Tom Dresslar, a spokesman for Treasurer Bill Lockyer. “The law makes it very clear that bondholders have the same priority that they did before the dissolution.”

Moody’s Thursday downgraded $11.6 billion of California tax-allocation bonds rated Baa3 or higher to Ba1.

The move followed Moody’s one-notch downgrade in January.

The agency also kept all of the debt on review for possible rating withdrawal.

Moody’s cited the uncertainty over the flow of cash from the former redevelopment agencies to bondholders amid the complicated process of unwinding RDAs following their dissolution earlier this year.

“We have been evaluating the sector for a while, we put out a piece in January, we had all of the ratings on review for downgrade,” said Eric Hoffmann, Moody’s lead analyst on California TABs. “The San Jose and Santa Clara dispute crystallized and made clear that some of the risks that we had highlighted as potential risks in the legislation were coming to pass.”

San Jose and Santa Clara County are battling over an interpretation of how the property tax revenues from San Jose’s former redevelopment agency are doled out.

San Jose says if the county’s claim stands, it will default Aug. 1 on some bonds backed by the tax-increment revenue.

“The way the cash flows now is not clear — that is, whether it gives priority to bondholders” or not, according to Hoffmann.

One dealer said Tuesday that Moody’s move didn’t provide too much of a shock because the sector has faced several downgrades and warnings.

“It was little bit of a surprise, but there is quite a bit of history,” said Kelly Wine, executive vice president of R-H Investment Corp., a broker-dealer in Los Angeles. “I think there is still interest in those bonds. I think people are thinking perhaps there may be an opportunity to pick up select names.”

Late last year, the state Supreme Court upheld a law dissolving California’s 400 or so RDAs. Since then, there has been a scramble by the “successor agencies” — in most cases the municipalities that created the redevelopment agencies — to tally their debts, assets and revenues.

The review process involves oversight and review of RDA finances by a local oversight board, county auditor-controllers, the state controller’s office and the Department of Finance.

“We can’t see any factual basis for why [Moody’s] would take that action,” said H.D. Palmer, spokesman for the Department of Finance. “We at Finance haven’t disapproved any requirements to use tax increment to make a bond payment at all.”

National Public Finance Guarantee Corp., which insures many California TABs, is not so sanguine.

“While the legislative intent was not to disadvantage bondholders, some confusion regarding the application of revenues is testing the state’s commitment to make sure that bondholders are paid,” chief risk officer Adam Bergonzi said in a statement, adding that NPFG will stand behind its policies.

According to Hoffmann’s report, the current law is clear that legal security for the tax-allocation bonds is meant to be preserved.

If any TAB defaults occur, investors would likely recover “at or close to 100%,” the report said.

Local governments and analysts have warned about the messy transition of the redevelopment agencies’ debt.

So far, none of the bills introduced by state lawmakers to “clean up” the uncertainty has come to fruition.

A trailer bill attached to the budget that possibly addresses the concerns could be adopted this week. Hoffman said he would wait until the passage of the measure before saying whether it might address his concerns.

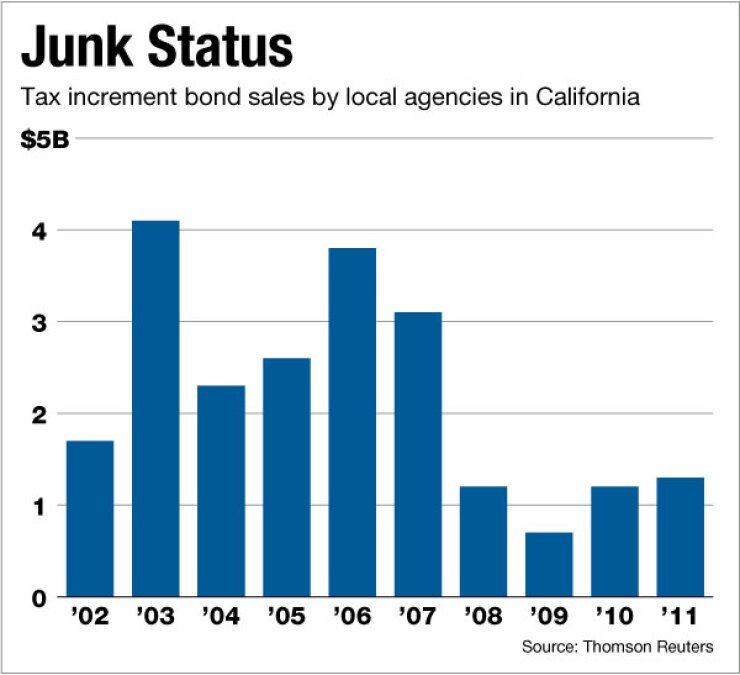

There are $23 billion of outstanding tax-allocation bonds in California, according to the National Federation of Municipal Analysts.