WASHINGTON — States’ fiscal conditions are improving and, despite ongoing uncertainties, many of them can be expected to maintain good credit ratings and to try to lock in low interest rates with additional bond financings, officials of two groups said Tuesday.

“I wouldn’t be surprised if you see a steady growth in borrowing; interest rates are low and the needs are great,” Scott Pattison, executive director of the National Association of State Budget Officials, said when asked about bond financing during a conference call about the latest recent Fiscal Survey of States. NASBO conducts the survey twice a year along with the National Governors Association.

Dan Crippen, NGA executive director, noted that the federal government is trying to extend the maturities of its debt to take advantage of the low interest rates, and said he wouldn’t be surprised to see states following suit.

Crippen and Pattison both said that the lack of a multi-year transportation bill has caused states to be reluctant to spend money on transportation projects. “The uncertainty has slowed down transportation projects and that’s getting more severe over time,” Crippen said.

While states generally don’t use their general funds for transportation, Pattison said state officials have told him that “even if they have the money for a transportation project, they might be cautious” because of the uncertainty about federal funding.

House and Senate conferees have been struggling to negotiate a final transportation bill from legislation approved by both chambers. House Speaker John Boehner, R-Ohio, last week suggested a six-month extension, triggering an explosion of protest from Sen. Barbara Boxer, D-Calif., who was able to get the Senate to approve a two-year bill with bipartisan support.

In their survey, NASBO and NGA said, “State budgets reflect a national economy in which growth is slow and not as robust as in previous recoveries, yet overall state and fiscal improvement is occurring.”

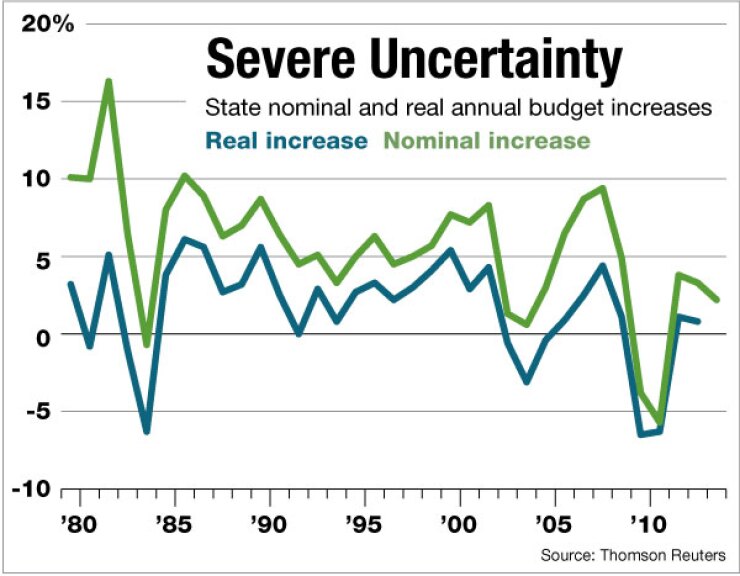

“Despite some improvement in state budgets since the depths of the recession, state budget growth is still significantly below average — growing at less than half the average growth of the past few decades,” Pattison said.

The nation’s governors are proposing $682.7 billion of general fund spending for fiscal 2013, which begins July 1 for 46 states, the survey shows. That level would represent a $14.6 billion or 2.2% gain over the estimated $668.1 billion level for fiscal 2012, which is expected to be up by an estimated 3.3% over the $646.8 billion level for fiscal 2011.

If the spending projections become reality, states will have three consecutive years of general fund spending growth, after major declines in fiscal 2010 and 2009. However, the general fund spending projection for fiscal 2013 would still be $4.6 billion, or 0.7%, below the pre-recession high of $687.3 billion in fiscal 2008, according to the survey.

The single largest component of total state spending is Medicaid, which was estimated to account for 24% of spending in fiscal 2011, the latest year for which data is available. Medicaid is also the second largest component of general fund spending, accounting for 17.4%, after K-12 education, in fiscal 2011.

“With the growth of Medicaid expenditures, spending priorities will again face competition for state budget dollars this fiscal year,” Crippen said. “States have undertaken numerous actions to contain Medicaid costs. … These efforts alone, however, cannot stop the growth of Medicaid.”

Meanwhile, general fund revenues are projected to be $690.3 billion in fiscal 2013, an increase of $27.4 billion, or 4.1%, from $662.9 billion estimated for fiscal 2012. The 2012 level would be $11.4 billion, or 1.7%, above $651.5 billion in fiscal 2011.

If those projections are met, fiscal 2013 revenue collections will surpass the pre-recession peak in fiscal 2008. However, 23 states are projecting fiscal 2013 general fund revenues below fiscal 2008 levels, NASBO and NGA said.

“Overall, general fund revenues remain tempered by the lingering high unemployment rate and slow growth in the national economy,” the report stated.

State revenue improvement has not been enough to meet the rise in demand for state services and spending. States had a combined $146.3 billion in budget gaps in fiscal 2012 and 2011. Nineteen states are forecasting a total of $30.6 billion in gaps for fiscal 2013 and four have $3.1 billion remaining gaps that must be closed for 2012, according to the report.