The Massachusetts Water Resources Authority will issue $150 million of senior revenue bonds this week to help finance water and sewer projects in the Boston area.

Officials will use $100 million of the bond proceeds to help support the authority’s ongoing combined sewer-overflow program, electrical equipment upgrades at its Deer Island Wastewater Treatment plant, and other drinking water and sewer infrastructure improvements to the system. Another $50 million will help roll over commercial paper that is set to expire.

The MWRA provides clean water and sewer collections to 43 cities, towns and other localities across 61 communities in eastern Massachusetts. It serves approximately 2.8 million residents, or about 43% of the state’s population.

JPMorgan plans to price the Series 2011B revenue bonds on Wednesday following a one-day retail order period on Tuesday. McCarter & English LLP is bond counsel. Public Financial Management Inc. is financial adviser.

The Series 2011B bonds offer serial maturities from 2012 through 2031, according to the preliminary official statement. The transaction also includes two term bonds, with $33 million maturing in 2036 and $42.1 million maturing in 2041.

The authority will sell the bonds under its senior-lien credit. It has $3.43 billion of outstanding senior-lien debt and $1.25 billion of subordinate-lien bonds, according to Moody’s Investors Service.

Fitch Ratings and Standard & Poor’s rate the Series 2011B senior bonds AA-plus, both with a stable outlook. Moody’s assigns its equivalent Aa1 rating to the senior-lien transaction and revised the authority’s outlook to stable from negative in late April due to “sound financial performance.”

The MWRA’s subordinate credit carries AA ratings from Standard & Poor’s and Fitch. Moody’s rates the subordinate bonds Aa2.

Officials expect to issue the bonds over two days, but are ready to sell the entire deal on Tuesday if demand is strong enough to shorten the time frame. The authority’s last three bond deals ended up pricing within one day rather than two days due to high demand, according to Rachel Madden, the MWRA’s director of administration and finance.

“That’s going to be our hope, that we can wrap it all up on Tuesday,” Madden said. “But you never want to be too cavalier and you want to plan accordingly.”

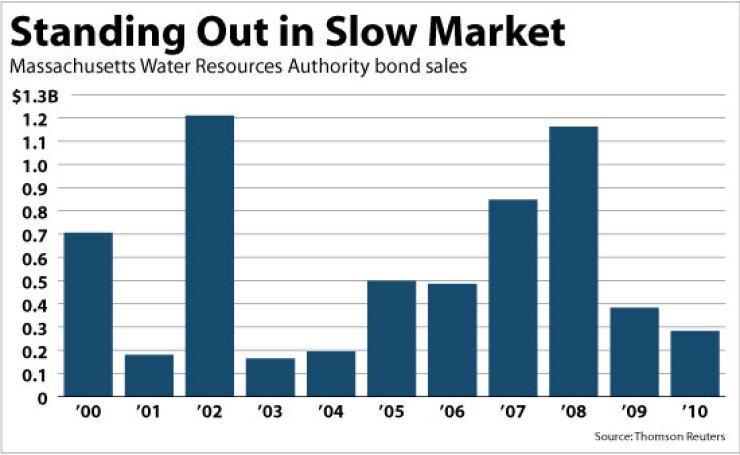

While tax-exempt money market funds have posted outflows during the past few months, municipal bond issuance has been light this year.

Volume of bond sales in the primary market from January through April is 53% lower than the same period in 2010. With its double-A-plus level ratings, the authority hopes to stand out against a slow primary market.

“We are aware of [the outflows] and concerned of course, but our sense is that the diminished supply is going to counteract that,” said MWRA treasurer Tom Durkin. “So we’re pretty optimistic about the transaction.”

Last week, the New Jersey Transportation Trust Fund Authority switched gears and sold an entire $600 million transportation revenue deal on May 3. State Treasury Department officials expected to issue the appropriation bonds over two days, but once the TTFA deal received $300 million of retail orders Tuesday, officials cut yields by 5 to 16 basis points on certain maturities and completed institutional pricing on that same day.

The TTFA carries A-plus and AA-minus ratings from Standard & Poor’s and Fitch, respectively. Moody’s last month downgraded the credit to A1 from Aa3 following a downgrade of New Jersey’s general obligation credit.

The MWRA last sold $100 million of Series 2010A new-money revenue bonds under its senior-lien credit in April 2010. The bonds priced with yields on serial maturities ranging from 1.88% on a 3% coupon for debt maturing in 2015 to a 4.07% on a 4% coupon for debt maturing in 2030, according to the official statement. A 2030 maturity also priced with a 4.07% yield on a 5% coupon with a first call date on Aug. 1, 2020.

Term bonds for $25.5 million and $32.8 million yielded 4.27% and 4.33% for debt maturing in 2035 and 2040, respectively.

Holders of the two term bonds included Vanguard, Guardian Life Insurance Co., and American Family Mutual Insurance as of Dec. 31, according to Bloomberg LP. MFC Global Investment Management and BlockRock Fund Advisors also invested in the Series 2010A term bonds as of Nov. 30 and May 4, 2011.

The authority is working on altering its bond resolution in order to tap into $140 million from reserve funds — including $95 million from the debt-service reserve fund — to defease outstanding bonds.

The MWRA initially set up a community obligation revenue enhancement, or CORE, fund, as a precaution in case localities failed to pay their water and sewer fees.

“We put that in place in the event that one of our member communities didn’t pay their assessments,” Durkin said. “Well, we have a nearly perfect track record with having collected those assessments, and Massachusetts law also gives us the ability to intercept the state aid that goes to these communities. So it doesn’t seem necessary to have the CORE fund anymore, so we’re going to eliminate that.”

Even with the fund withdrawals, the revised bond resolution would stipulate that combined senior and subordinate debt-service coverage cannot fall below 1.1 times and senior debt-service coverage must be at least 1.2 times.

Officials expect to use the reserve funds by fiscal 2016, when two-thirds of the authority’s debt will fall within the new bond resolution.

That time frame could change depending on how often the MWRA accesses the market during the next few years, Madden said.

According to Moody’s, closing the CORE fund and reducing the debt-service reserve fund and rate stabilization fund “could result in diminished flexibility and capacity to absorb future financial pressures and may have a negative impact on [the MWRA’s] long-term credit strength.”

The authority’s rates and charges have increased by an average rate of 3.56% each year between fiscal 2007 and fiscal 2011, according to the POS. During that time, all of the agency’s collections have come in within 30 days of their due dates, except for one instance when the authority extended a deadline for a town.

Combined water and sewer rate revenue has increased annually from $495.4 million in fiscal 2007 to $569.8 million in fiscal 2011.

Officials project such revenue to total $592.2 million in fiscal 2012, which begins July 1, and increase to $764.1 million in 2016, the POS said.

While Fitch views the authority’s rates as high, the MWRA expects to spend up to $240.9 million annually during the next two fiscal years.

The proposed fiscal 2012 capital improvement plan includes $1.58 billion of capital spending for fiscal 2014 and beyond, according to the POS.

“MWRA’s rates are among the highest in the urban U.S. and an ongoing credit concern, somewhat mitigated by the above-average area income levels,” according to a Fitch report. “However, as annual capital spending has declined over time, so has the size of needed rate hikes.”

Moody’s considers the authority’s outstanding debt “sizable” and it is just below its debt limit of $6.45 billion. Variable-rate debt, including commercial paper, accounts for 24% of the debt portfolio.

On Monday officials will replace standby purchase agreements that are set to expire on $388 million of Series 2008A revenue bonds. Durkin said the MWRA has worked to stagger expiration dates of its liquidity facilities to minimize rollover risk.

It will need to renew credit enhancement on nearly $200 million of floating-rate debt toward the end of 2012, with renewals then coming up about every six months.

“We won’t have a lot of expirations happening at the same time,” according to Durkin.