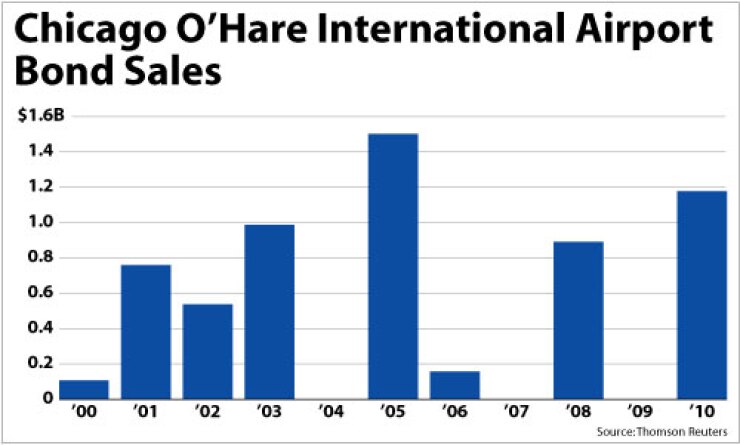

CHICAGO — Using a structure that bypasses airline approval, Chicago will enter the market early next month with a long-planned sale of $1.1 billion of debt for O’Hare International Airport.

The bonds mark the first new-money borrowing to fund the final phase of an $8 billion expansion program. The city will take retail orders on Feb. 1 and hold an institutional pricing the next day, according to finance officials.

Citi is senior manager and Siebert Brandford Shank & Co. is co-senior manager. Another 10 firms are co-managers. Scott Balice Strategies is the financial adviser. The transaction includes four series. The Series A passenger facility charge revenue bonds for $468 million and Series C PFC bonds for $152 million will provide initial financing for the completion phase of the O’Hare Modernization Program. The $81 million of Series B PFC bonds will refund outstanding debt.

A fourth series of bonds for $413 million, backed first by federal grants and secondly by a subordinate PFC pledge, will also raise new money for both the completion phase and the final projects in the $3.3 billion first phase of the OMP.

The airport’s major airlines have resisted city pressure to fund some of the projects in the completion phase and want Chicago to push back its 2014 deadline to complete the program. They support runway expansion but want a $2.2 billion terminal project delayed.

With ongoing negotiations failing to produce a funding agreement, the city is securing the bonds with a PFC pledge and federal letter of intent pledge.

The financing plan relies on $2.5 billion of future general airport revenue bonds, but without airline approval the city would structure the deal to delay debt-service repayment until after the current airline-use agreement expires in 2018.

Chicago then could include debt-service costs in its rates and charges in the new agreement. The existing agreement between the city and carriers requires the airlines to sign off on the use of some revenues pledged to the GARB credit, such as landing fees and terminal rents.

Ahead of the sale, Moody’s Investors Service affirmed its ratings on the various O’Hare credits but revised to negative its outlook on the A1 rating on $4.2 billion of third-lien GARBs. The third lien is the city’s primary mode through which it issues new debt for O’Hare projects.

The airport’s $700 million of passenger facility charge-backed bonds — and the upcoming sale — are rated A2 by Moody’s. The agency last year downgraded the PFC rating by one notch.

Moody’s attributed the outlook change to the risks associated with the completion phase and concerns over the impact of the current financing plan on the airport’s balance sheet.

Debt-service coverage is projected to drop to or just above the airport’s rate covenant beginning in 2015, while increasing costs per enplanement rise to $19.76 in 2016 and peak in 2019 at $26.90.

“The complexity of this very large program and the current uncertainty in how the project may be funded are substantial risks in completing this phase as expected,” Moody’s analysts wrote.

Moody’s rates the $500 million of second-lien GARB bonds A1 and the $73 million of first-lien bonds Aa3. The rating outlook on all non-third-lien bonds is stable based upon Moody’s expectation that forecast passenger levels will remain on target.

The city responded to the outlook change, saying O’Hare’s ratings stand to benefit over the long term should an airline funding agreement be reached and if Congress approves an increase in the current $4.50 cap on passenger facility charges.

“Given the length of time between now and when we sell the rest of the bonds for the completion phase, as well as the continuing bond structure refinements, ongoing airline negotiations, and potential legislative changes to the PFC program, it is premature to speculate about possible rating changes in the years ahead,” said city finance department spokesman Peter Scales.

The U.S. Department of Transportation in April announced a $410 million federal letter-of-intent grant, its second for the OMP. Moody’s said the city faces some risk that LOI payments could be delayed, reduced, or revoked by the Federal Aviation Administration if the airport does not meet all of the criteria set forth in the grant agreement.

Other challenges include weaker-than-expected passenger levels, rising material costs, and a high dependence on airline revenue for 65% of operating revenue. Strengths include its strong originations and destinations base, high demand for service, and its unique dual-hub status.

Both United Airlines and American Airlines operate hubs at O’Hare, with United accounting for 48% of travelers and American for 35%. The airport’s airlines carried 32 million passengers in 2009, down 5.8% from 2008. Another positive credit factor is that the first phase of the OMP is on schedule and within budget.

Under the $8 billion expansion program first unveiled by Mayor Richard Daley in 2001, Chicago is shifting the airport’s runways to a parallel configuration from an intersecting design that leads to runway closures during poor weather conditions and negatively affects the national air-traffic grid.

Construction of a runway set to open in 2013 has been hampered by litigation that delayed the city’s acquisition of land, including a cemetery in an adjacent suburb. The program also includes a new automated people-mover system and construction of two more additional runways and the extension of a third.

Chicago has won a spate of recent court rulings, allowing it to take ownership of the cemetery, but the relocation of burial sites to make way for a new runway is pending an Illinois Supreme Court ruling on the issue expected next month.