The Bond Buyer’s weekly yield indexes rose this week in light to moderate secondary trading as activity slowly began to creep back into the market after a holiday lull.

“The muni market still has a decent tone to it,” said Evan Rourke, portfolio manager at Eaton Vance. “It seems like there’s cash in the market, but investors are cautious with Treasuries being off. It does seem like there’s money out there that can be put to work that isn’t.”

Also this week, Build America Bonds have traded stronger in the aftermath of the program’s Dec. 31 expiration.

“The scarcity factor may be driving that bid at this point,” Rourke said. “But over the long run, I’d be concerned with liquidity issues.”

The primary market was quiet once again this week as 2011 began with a bit of a supply lull. The calendar is expected to pick up somewhat next week, with a $1.2 billion New Jersey Educational Development Authority deal leading the way.

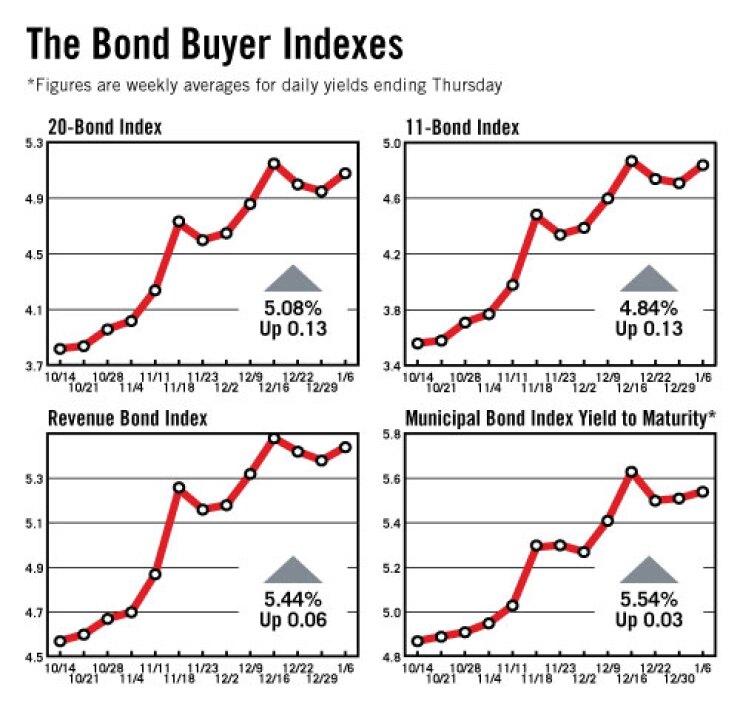

The Bond Buyer 20-bond index of 20-year general obligation bond yields rose 13 basis points this week to 5.08%. That’s the highest level for the index since Dec. 16, 2010, when it was 5.15%.

The 11-bond GO index of higher-grade 20-year GO yields increased 13 basis points this week to 4.84%. That’s the highest level since Dec. 16, 2010, when it was 4.87%.

The revenue bond index, which measures 30-year revenue bond yields, gained six basis points this week to 5.44%. That’s the highest level since Dec. 16, 2010, when it was 5.48%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose four basis points this week to 0.57%. That’s the highest level since Dec. 8, 2010, when it was also 0.57%.

The yield on the 10-year Treasury note increased eight basis points this week to 3.42% — the highest level since May 13, 2010, when it was 3.55%.

The yield on the 30-year Treasury bond gained 13 basis points this week to 4.54%. That’s the highest level since Dec. 16, 2010, when it was 4.56%.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 5.54%, up three basis points from last week’s 5.51%.