No sooner did Build America Bonds become orphaned than they caught fire.

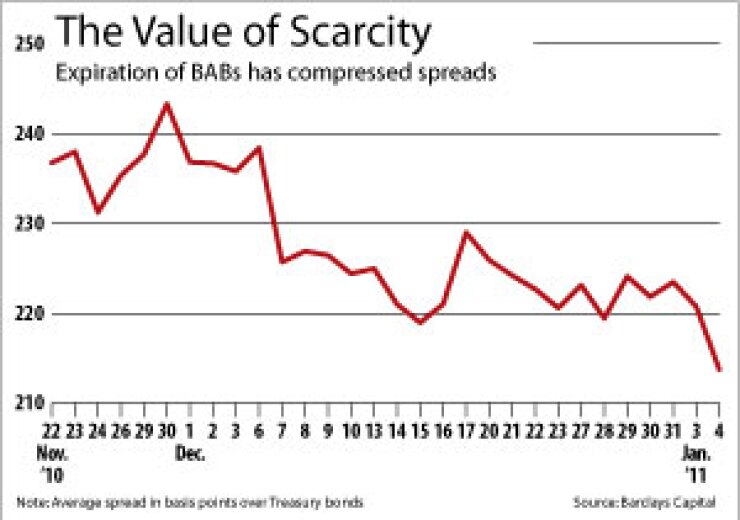

Spreads on many of the biggest BAB deals have tightened significantly early in 2011, validating the thesis that the scarcity created by the program’s expiration would bolster their value.

Yields on some of the biggest BAB issues have come down as much as 20 or 30 basis points the past few days, according to trades reported through the Municipal Securities Rulemaking Board.

Market sources say the most robust tightening is hitting the bigger issues that are eligible for inclusion in long-duration taxable bond indexes.

The average spread in the Barclays Capital Build America Bonds Index compressed by 10 basis points in the first two days of the new year, after finishing 2010 at 223 basis points.

The real spread-tightening began in mid-December, when the onslaught of new BABs finally subsided and any lingering hopes for a program extension vanished. The average BAB yield shriveled from a near-term high of 6.54% on Dec. 15 to 6.34% on Tuesday, according to the Barclays index.

“BABs are trading stronger this week — much stronger, in fact,” a trader in New York said. “There’s been an exceptional amount of demand for the product in the secondary in the immediate aftermath of the program’s expiration. How long that will continue is anyone’s guess, but for now, they are a hot commodity.”

The 2034 maturity of California’s $6.86 billion BAB changed hands on Tuesday at a yield of 7.08%, in a customer purchase from a dealer. The same bond in the same type of transaction traded at 7.3% on New Year’s Eve.

The 2041 maturity of a $1.85 billion New Jersey Turnpike Authority deal that priced last month enjoyed a 41 basis point decline in yield from Dec. 29 to Wednesday. The yield on a $1.3 billion Bay Area Toll Authority issue has come down 33 basis points since mid-December.

“It is definitely tighter,” said Rob Novembre, managing director at Arbor Research and Trading. “The tone of the market was definitely stronger, firm.”

Many market participants saw this coming, though not necessarily with such immediacy. While some figured the BAB market would become illiquid without new supply, many foresaw tighter spreads. Their thesis was simple: with the expiration of the BAB program, demand remains stable and supply evaporates.

The supply side of the equation is being determined by the sunset of the BAB program at the end of 2010, which halted new issuance. Municipalities sold an average of $2.87 billion of taxable bonds a week in 2010, and stuffed more than $13 billion of combined new issuance into the market during the first two weeks of December as the deadline loomed.

With the supply of new BABs at zero, investors are left to bid on outstanding bonds trading in the secondary market.

Municipalities sell a limited amount of taxable bonds other than BABs, but they seldom comprised more than 10% of municipal issuance before the BABs era. Last year, taxable bonds represented 35% of muni bond issuance.

The demand for taxable municipals, meanwhile, theoretically doesn’t change.

BlackRock still has a $1.25 billion BAB closed-end fund and Nuveen Investments has two BAB closed-end funds with more than $700 million of combined assets. Eaton Vance runs a $53 million BABs mutual fund, and Dupree Funds just launched a $15.6 million taxable municipal bond mutual fund.

Plus, anyone running a long-duration taxable credit portfolio faces pressure to acquire taxable municipal bonds. Nearly 10% of the Barclays Capital U.S. Long Credit Index — a widely used benchmark for long-term taxable bond managers — is comprised of BABs. A manager whose performance is gauged against that benchmark would implicitly be taking a position against taxable munis by not matching his portfolio with the same weights.

Taxable municipal bonds represent some of the highest-yielding bonds in that index as a consequence of BABs tending to yield more than comparably rated corporate bonds and the preference among municipalities for selling long-maturity debt.

A taxable fund manager might have trouble beating his benchmark index without collecting the coupons on the highest-yielding bonds in that index.

For this reason, “index-eligible” has become a crucial buzzword splitting the BAB market into two tiers — those big enough to be included in the Barclays long credit index, and those that are not.

The threshold for index eligibility is $250 million par value. Bonds above this threshold are being fought over because managers benchmarked to the Barclays index will still need them in the absence of new supply, market participants say.

Novembre said he has seen some people selling their non-index-eligible BABs to switch into index-eligible bonds.

“Unless somebody resurrects the BABs program there aren’t any more coming, and I still think there’s demand,” said Vincent Harrison, who manages the Dupree BAB fund. “That’s going to tighten the yields.”

He said traders stockpiled BABs last month in the expectation investors would follow them to the secondary. “Some people need those bonds, so the traders are marking them up,” Harrison said.

Novembre said the customary end-of-year inventory liquidations skipped over the BAB market in 2010 as dealers dug their heels in.

Craig Brandon, who co-manages the Eaton Vance BAB mutual fund, said: “Ever since it was decided that they weren’t going to extend the program, institutional buyers have really tried to find as much of it as they can.”

While BABs are for sale at the moment, Brandon expects availability in the secondary market to wane over the next six months. The BAB program helped create some new demand for taxable municipal bonds, some of which will continue past the expiration of the program, he said.

“If you see some bonds pop out, I think people will scramble to try and buy them,” Brandon said.