DALLAS — Analysts say that debt ratings for international toll bridges in Texas are bearing up under the stress of continuing drug violence in Mexico and recent traffic declines due to additional crossing points.

Twenty-six of the 42 border-crossing points along the nearly 2,000-mile U.S.-Mexico border are in Texas. Financially challenged cities on both sides of the Rio Grande are racing to exploit the commercial traffic through those crossing points, which is expected to grow dramatically if Mexico builds the new seaport envisioned for its west coast.

Traffic on the McAllen-Hidalgo Bridge in the Lower Rio Grande Valley fell nearly 21% in the fiscal year that ended Sept. 30, 2010, according to Fitch Ratings. That followed a decline of 10.2% in fiscal 2009 due to the recession, slower growth of manufacturing in Reynosa, Mexico, cross-border violence, and the opening of the nearby Anzalduas Bridge, analysts noted.

“System-wide traffic, excluding pedestrian traffic, is down 5.3% for fiscal 2010,” analysts wrote in a report Friday affirming the authority’s revenue bond rating at A. “Fiscal year-to-date (two months) traffic is down over 30%, excluding pedestrian traffic.”

The International Toll Bridge System, which operates the two bridges in the McAllen-Pharr area of the Lower Rio Grande Valley, issued $38 million of toll revenue bonds in 2007 and $500,000 parity bonds in 2002.

The system’s McAllen-Hidalgo and the new Anzalduas bridges are among 14 in the three counties of the Lower Rio Grande Valley that link Texas with Mexico. Tolls are collected on traffic that includes pedestrians, motorcycles, cars, buses, and trucks.

However, commercial traffic is prohibited on the Anzalduas Bridge until 2015, or until the nearby Pharr-Reynosa International Bridge starts receiving 15,000 northbound commercial vehicles per week, in keeping with a permit signed in 1999. At 3.2 miles, the Pharr-Reynosa Bridge is the world’s longest between two countries.

Crossings of the Pharr-Reynosa were down nearly 19% in December from the same month in 2009. Car crossings fell nearly 25%, though truck crossings rose 4.4% during the same period. Revenue fell more than 12%. Tolls range from $2.50 for cars to $30 for wide-load trucks.

The four-lane, 3.2-mile-long Anzalduas Bridge opened to traffic on Dec. 15, 2009. The $100 million to build the bridge came from the cities of McAllen, Mission, Hidalgo, and Granjeno, the Texas Department of Transportation, and the U.S. and Mexican governments.

The new bridge is touted as the most direct and efficient route between the Rio Grande Valley and Mexican cities such as Monterrey and Mexico City. It reduces travel time as much as 45 minutes.

The new seaport being planned for Mexico’s west coast is a catalyst for many improvement projects. It is expected to generate a significant increase in commercial border traffic.

Seaport traffic would connect with Texas via a series of new highways on both sides of the river. Plans for the seaport got waylaid by the economy in 2008 and the 18-month recession that started in December 2007.

U.S.-Mexico surface transportation trade rose nearly 20% to $28.6 billion in November from a year ago, according to the U.S. Department of Transportation. The value of imports carried by truck rose 22.4% and the value of exports was up nearly 22%. Texas led all states in surface trade with Mexico in November, with $10.3 billion.

In the southernmost Texas city, the U.S. DOT and the Texas Department of Transportation are providing most of the funding for a $28.5 million rail bridge that will bypass downtown Brownsville, Texas, and Matamoros, Mexico. Cameron County, which includes Brownsville, is funding 10% of the so-called West Rail Project’s cost.

The new bridge will be used by Union Pacific Railroad. It is among seven projects nationwide funded through the Federal Railroad Administration’s rail line relocation and improvement program.

As local officials in border cities seek to increase commerce between the two countries, U.S. political opinion about illegal immigration has prompted efforts to increase security with measures that cause further delays.

In December, the town of Donna, Texas, and Rio Bravo, Mexico, opened a new $24 million bridge that is expected to carry 3,000 vehicles per day. To finance the project, Donna worked with TxDOT and developer Grubb & Ellis to create a public-private partnership. The deal allows Grubb & Ellis to recover costs of public improvements from tax reimbursements in the zone around the bridge. The reimbursements can be used as a credit enhancement or as debt service on bonds.

Unlike the Anzalduas Bridge, the Donna-Rio Bravo is not restricted on commercial traffic, according to local officials.

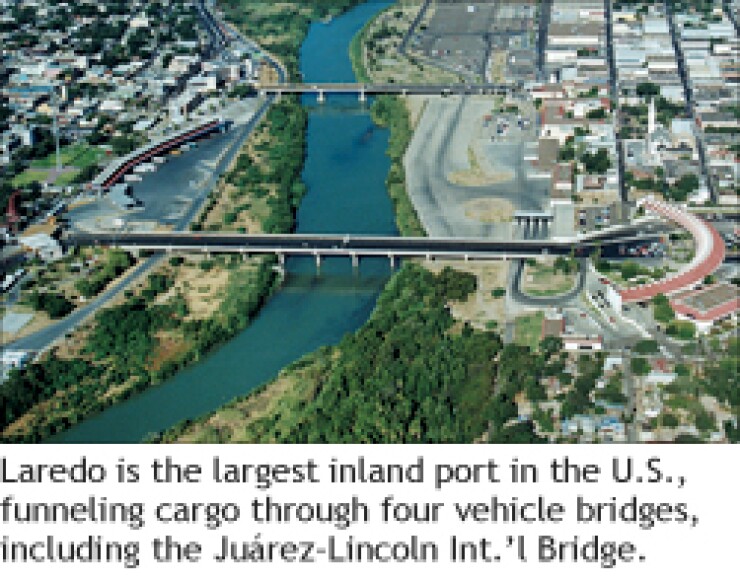

About 120 miles upstream, Laredo serves as the largest inland port in the U.S., funneling cargo to the U.S. through four vehicle bridges and one train bridge. Laredo has $59 million of outstanding bonds for its bridges. They include the newest, a 10-year-old span solely for commercial traffic that is called the World Trade International Bridge.

Citing the same issues that affect the bridges downstream, Fitch affirmed its A-plus rating on Laredo’s toll bridges. The rating agency noted that prospects for so-called maquiladora factories — plants on the Mexican side of the border operated by U.S. companies — play a large role in generating revenue.

“Reflecting the cyclical nature of cross-border trade and consumption, overall traffic levels declined at a compound annual growth rate of 4.6% between fiscal 2005 and 2010, with the most significant year-over-year decline of 8.2% in fiscal 2009,” wrote Fitch analyst Tanya Langman. “As a result of the global economic downturn combined with stabilization of maquiladoras in Nuevo Laredo in fiscal 2010, noncommercial and pedestrian transactions declined 7.5% and 9.2%, respectively, while commercial traffic rebounded with a 12.5% increase.”

Of the nine cities operating bridges in the region, Laredo’s toll bridges accounted for nearly 46% of the total revenue in the fiscal year ending June 30, 2010, according to city officials. Brownsville was second at 15%. After falling more than 10% in 2008, Laredo’s bridge revenue rebounded 5.2% in 2009 and is projected to grow 2% in the current fiscal year.

Laredo’s Colombia-Solidarity International bridge is one of the more controversial border spans due to faulty revenue projections and tighter border security. It crosses the Rio Grande river to Colombia, Nuevo Leon, Mexico.

The bridge was designed to feed commercial traffic onto a private highway known as State Highway 255 that provided a bypass to Interstate 35. The 22.5-mile-long highway cost $90 million to build, but faced foreclosure in 2003 and was auctioned for $12 million to the John Hancock Life Insurance Co. The tollway was later sold for $20 million to TxDOT, which lowered the toll from $16 per vehicle to $2 for cars and $2 per additional axle.

For several years, Laredo and Nuevo Laredo have been planning to build a fifth bridge, but the two cities have not been able to agree on a location.

El Paso, which is more than 500 miles north of Laredo, operates five crossing points. They include the toll-free Bridge of the Americas and a rail corridor. Built between 1996 and 1998, the Bridge of the Americas is actually four bridges with two lanes each for commercial trucks. About half the traffic that crosses the border at El Paso uses the four spans.

Bridge tolls and fees provided El Paso with $16.9 million in fiscal 2009.

While the city operates the existing bridges, El Paso County is developing plans for its first bridge. The county span will be known as the Tornillo-Guadalupe, will feed the largest port of entry on the U.S.-Mexico border, and is expected to be funded with $91.6 million in federal funds.

The county plans to invest an additional $27 million for roads connecting the proposed bridge to Texas Highway 20 and Interstate 10.

Complications in the planning for the bridge during the past 13 years include land-acquisition difficulties and uncertainty about a proposed connecting highway on the Mexican side of the river.

Union Pacific is also moving ahead with plans for a $400 million inland port in the El Paso suburb of Santa Teresa, N.M., which is considered one of the metro area’s other border-crossing points.

“This inland port will give New Mexico a stake in one of the most important rail corridors in the country,” Sen. Jeff Bingaman, R-N.M., said last month. “In the near term, it will create as many as 3,000 construction jobs. And in the long term it will enhance New Mexico’s standing as a great place for commerce.”

The multi-modal port was a pet project of former New Mexico Gov. Bill Richardson, but was delayed by the economic downturn. Union Pacific will move some of its fueling and maintenance operations from El Paso to Santa Teresa if lawmakers pass a locomotive fuel-tax exemption. The Omaha-based company will keep its rail yards and cross-border rail service in El Paso.

Without the tax incentives, “these jobs otherwise would have gone to Texas,” said New Mexico Gov. Susana Martinez.

Aware that it may be losing out to both Texas and New Mexico, some trade organizations in Arizona also have pushed for an inland port on the state’s border with Mexico, which does not include a river.

Among the organizations pushing for the border port are the Tucson Metropolitan Chamber of Commerce, the Tucson Regional Economic Opportunities, the city of Tucson, the Pima Association of Governments, and Union Pacific.

The Arizona inland port would include a number of scattered facilities connecting Interstates 10 and 19 with rail access on Union Pacific from Los Angeles to Dallas-Fort Worth and Houston via the route that includes Santa Teresa.

Tucson also is on the rail line running south to Nogales, Mexico, where it connects to the Mexican railroad Ferromex’s line along the west coast of Mexico.

To the north of Tucson, the Maricopa Association of Governments in Phoenix last year launched a $500,000, 18-month study to find out if the freight port would succeed. To make it work, Arizona is considering the possibility of building a new Interstate 11 to compete with the slowly developing Interstate 69 in Texas, designed to handle trans-border cargo traffic.

Researchers at Arizona State University say nearly two-thirds of all the freight on Arizona’s roads and rails currently passes through the state rather than being loaded or unloaded there. One-third of the entire nation’s goods come across the state.

To develop businesses related to that commerce, Arizona needs to develop the kind of logistics hubs offered in other states, according to planners. Standing in the way are Arizona’s deep economic problems and the recent chill between the state and Mexico over Arizona’s crackdown on illegal immigration.

One long-term factor driving the interstate competition is Mexico’s plan to build a port on its west coast at the town of Punta Colonet at a cost of up to $5 billion.

The Mexican port would compete with Los Angeles and funnel cargo to the inland ports and the new interstates. However, economic conditions have sidelined the plan to build the port. Its future remains murky.

The plan would also require major highway construction in Mexico, a dicey proposition that has left at least one border bridge in limbo in the past.