In 2011, municipal bonds went from being the girl no one wanted to dance with to being the one all the guys sought out.

In November and December 2010, some predicted a wave of major muni bond defaults for 2011. By the end of the year conditions had pushed muni yields to all-time lows and made munis the year’s best performing fixed-rate sector.

How did munis go from being rejected to being all the rage in 12 months?

Winter 2010-2011

In October 2007, financial analyst Meredith Whitney predicted big problems for Citigroup. She suggested to investors that they sell its stock. Over the following 17 months, Citigroup stock lost more than 90% of its value and Whitney became famous for her prescient “call.”

So when Whitney made a new prediction on a popular television news show in December 2010, she got lots of attention. This time, Whitney predicted “50 to 100” municipal bond defaults across the country in 2011, amounting to “hundreds of billions of dollars.”

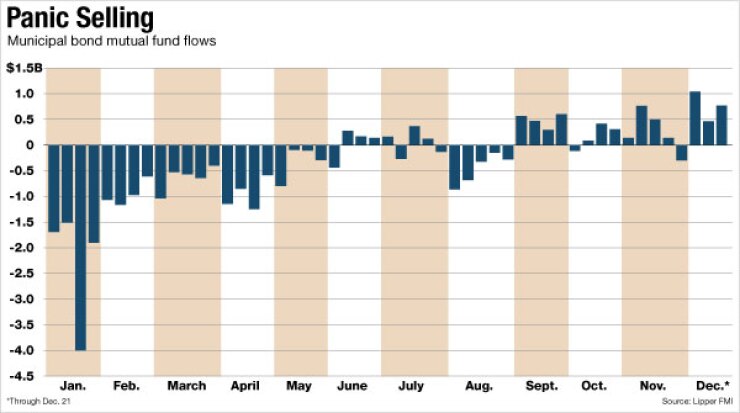

Retail investors, who already had been making withdrawals from muni mutual funds, flooded funds with sell orders. In December 2010, a Bloomberg LP index tracking bid-wanteds for municipal bonds hit a record $1.4 billion. Mutual funds sought most of those bids, market participants reported.

Money would be withdrawn from mutual funds for 29 straight weeks. From mid-November 2010 to early June 2011, about $50 billion was pulled from muni mutual funds, according to Chris Mauro, director of muni research at RBC Capital Markets.

Spring 2011

New-issue supply dropped dramatically at the start of the new year. Municipalities had pulled issuance forward to 2010 in order to take advantage of the taxable Build America Bond program before it expired at the end of that year.

The withdrawals from muni funds peaked in December and January and started to moderate.

The lack of muni supply intensified in the spring. There were 28 new governors, many proclaiming the importance of fiscal discipline. They curbed borrowing.

By late spring, investor concerns about European sovereign debt problems, particularly in Greece, pushed Treasury yields lower. U.S. sovereign debt was seen as a safe haven during such risky times. Muni yields followed.

Yields on Municipal Market Data’s 10-year triple-A scale went from about 3.5% in mid-January to about 2.6% in mid-June.

Summer 2011

The start of the new fiscal year and improved market sentiment brought some new supply to the market. Concerns about Greek, Italian, and Spanish sovereign debt continued to push foreign as well as domestic investors into Treasuries. Treasury yields plummeted. Some research reports said that actual muni defaults had fallen from 2010 levels.

Fall 2011

With tax-exempt bonds yielding more than taxable Treasuries, investors were finding value in munis despite absolute low yields. Crossover buyers weren’t fazed by the efforts of the Obama administration to curtail tax exemption for munis. They saw value in munis yielding more than 100% of Treasuries.

Indeed, the 10-year triple-A MMD spot yield reached record lows as both Treasuries and munis attracted money from investors concerned about European debt problems. A weak economic recovery made the typical alternate investment, U.S. stocks, less attractive.

Over the course of the year, yields would fall more in percentage and even in absolute terms for triple-A, double-A, and single-A rated bonds than for triple-B bonds. The triple-A MMD five-year yield declined 41.7% from Dec. 31, 2010 to Dec. 12, 2011, going from 1.63% to 0.95%. By comparison, the triple-B MMD five-year yield declined only 16.9% during the same period, going from 3.44% to 2.86%.

A similar pattern took place with 20-year bonds. The triple-A yield declined 24.6% during the period. The triple-B yield declined just 13.6%.

The spread between triple-A and triple-B five-year yields increased from 1.81 percentage points on Dec. 31, 2010, to 1.91 percentage points on Dec. 12, 2011. The spread between triple-A and triple-B 20-year yields increased from 1.49 percentage points on Dec. 31, 2010, to 1.77 percentage points on Dec. 12, 2011. This prompted analysts to recommend that investors look to longer, lower-rated bonds for better returns.

In the fall, muni supply would finally start to return to something like normal levels. However, over the course of the year, total new issuance of long-term bonds would be the lowest since 2001 at about $288 billion, down about 30% from 2010.

Despite high profile municipal bankruptcies in 2011 — Harrisburg, Pa.; Jefferson County, Ala.; and Central Falls, R.I. — the market did not cooperate with Meredith Whitney. There were defaults, but nothing on the scale she predicted.

Bank of America Merrill Lynch said as of Dec. 23 muni bonds had outperformed all but one other class of fixed-income assets, with an after-tax 8.74% return for 2011. The only asset to exceed this return was taxable BABs, which had an after-tax 13.65% return. (So much for the speculation that BABs would become an orphan child of the market when the program expired.)

As the year drew to a close, almost every day saw a headline to the effect that Whitney had been wrong. Whitney did not respond to a request for comment. Also in the news: Cash was returning to muni bond funds.

2012

Some firms have provided predictions for the coming year:

•MorganStanley SmithBarney: MorganStanley SmithBarney projects that muni supply will increase 15% to 20%. It also predicts that credit spreads for A-rated bonds will tighten. The firm is recommending purchases of bonds with six- to 14-year maturities.

•Bank of America Merrill Lynch: Bank of America Merrill Lynch predicts a 21.8% increase in supply in 2012. However, this will not be enough to keep up with the amount of munis maturing. It projects a negative net muni supply of $15 billion for the year. Most of the relative shortfall will take place in January and February, and then July and August. This will lead to a shortage of munis compared to demand. This shortage will lead to muni yields not rising as fast as those for Treasuries. Over the course of the year, the muni-Treasury ratio should go back below one. By the end of the year, the firm is projecting the muni 10-year to be 2.40% and the 30-year to be 3.60%, said municipal research strategist Elliot Mutch. The company is recommending five- to seven-year munis and longer “kicker” bonds.

•Citigroup: Citigroup is projecting a 22.8% increase in muni supply in 2012. It notes that this will largely just continue the monthly level from the latter months of 2011. “Factors such as global/U.S. economic growth and the trend in Treasury yields will be affected greatly by the ability or inability of the European Union to find solutions to its crisis,” the Citigroup municipal research section states. The firm expects the slope of the yield curve to remain steep. It predicts that the yield premium on revenue bonds relative to like-rated general obligation bonds to decline. While downgrades will continue to outnumber upgrades, actual defaults will remain at a fairly low level.

•Wells Fargo: Municipal defaults and bankruptcy levels should remain at a historically moderate level, Wells Fargo says, though government fiscal problems will persist. Wells Fargo believes that the most likely issuance level of new munis will be $300 billion to $350 billion. If there is world economic stability and calm markets, new issues could be nearer to $350 billion. On the other hand, negative foreign economic news or a downgrade of U.S. debt could curb issuance in the second half of the year. “Unanticipated events have become the norm in the new operating environment,” the Municipal Securities Research group states. “To navigate as safely as possible, we recommend a toolbox filled with contingency plans, worst-case scenarios, alternate approaches, and flexibility to turn quickly.”