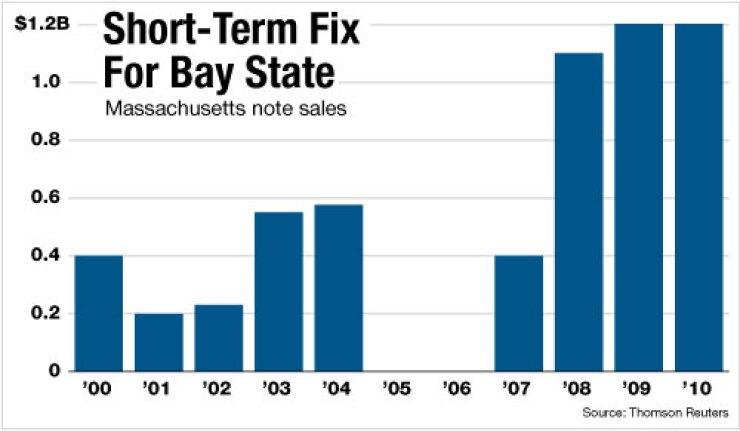

Massachusetts is scheduled to sell $1.2 billion of general obligation revenue anticipation notes in two $600 million series by competitive sale on Tuesday.

The Series A and B notes are rated MIG-1 by Moody’s Investors Service, SP-1-plus by Standard & Poor’s, and F1-plus by Fitch Ratings. Standard & Poor’s cited “strong note debt service coverage at maturity” in assigning its short-term rating.

“All three ratings are the highest possible, which reflects the improved perception among investors about how our economy is performing,” Treasurer Steven Grossman said in an interview.

The state will use the notes to bridge the mismatch in timing between revenue collections and expenditures, notably personal income tax receipts and school aid payments to municipalities.

According to Fitch, the notes represent a moderate 2.4% of projected fiscal 2012 cash receipts. Coverage is strong at 3.2 times for the Series A maturity on April 26 and 2.2 times for the Series B maturity on May 31.

A supplemental budget bill Gov. Deval Patrick signed three weeks ago added $350 million to the state’s rainy-day fund, raising the balance to $1.4 billion. Massachusetts, which deposited $712 million to the fund this year, has the third-largest such fund in the nation, Patrick said. It is one of only four states with contingency funds exceeding $1 billion.

That fund had peaked at $2.4 billion before the 2008 recession. “Then in one fell swoop, it diminished,” Grossman said. “We’ve worked hard to replenish the fund.”

In contrast to the previous two years, Massachusetts was able to hold off on its only Ran sale for fiscal 2012 until November. It had to sell $1.2 billion in August each of the last two years. “Frankly, we didn’t need the money,” Grossman said. He added that the state may hold another bond sale by the end of the year.

Massachusetts in September received an upgrade from Standard & Poor’s of its GO bonds to AA-plus from AA, when it held a $500 million GO sale. Moody’s rated the GO bonds Aa1, while Fitch assigned a AA-plus.

“Formalized policies relating to debt affordability, capital investment planning, financial planning, and enhanced funding of the stabilization fund are key improvements from a credit standpoint,” wrote Standard & Poor’s analyst Robin Prunty.

“More important than our being pleased is that the market is pleased,” Grossman said. “The investment community is pleased that we did health care reform, we did pension reform, and we replenished our rainy-day fund.”

Moody’s praised state officials for “prudent use of reserves,” and for closing budget gaps. “Budget reserves … provide an adequate cushion to another downturn,” a report said.

Moody’s, however, also warned about expenditure pressure from health care and social services, and cited a low pension funding level.

According to the Pew Center on the States, Massachusetts has a 68% pension funding level, below the 80% level that Pew considers acceptable.

Massachusetts received its upgrade in September two weeks after it pitched its attributes to the rating agencies. In addition to its budget management, officials cited a highly educated workforce that enables the state to adjust more quickly to an innovation-oriented economy.

In a January report, the Milken Institute rated Massachusetts first overall among the 50 states in its science and technology index.

“Massachusetts is a breeding ground of research with world-renowned universities and cutting-edge firms fueling its economy,” the institute wrote.

Edwards Wildman Palmer LLP is bond counsel for the Ran sale. Mintz, Levin, Cohn, Ferris, Glovsky, and Popeo PC is disclosure counsel.