DALLAS — Arizona’s Salt River Project Agricultural Improvement and Power District achieved savings of about $58 million or 12.3% on a $441.5 million refunding that is the first and largest issue of the year from the electric utility provider, officials said.

The negotiated deal with Citi as senior manager and book-runner priced on Tuesday, an official said. Retail pricing was Monday.

True interest cost came to 3.35%, according to SRP district treasurer Dean Duncan.

Co-managers were Bank of America Merrill Lynch, Goldman, Sachs & Co., JPMorgan, Morgan Stanley and Ramirez & Co.

Public Financial Management is financial advisor and Drinker Biddle & Reath is bond counsel.

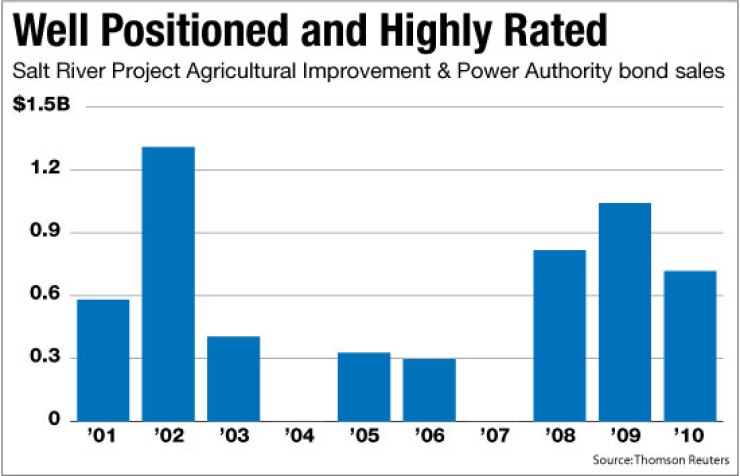

The revenue bonds, which will refund 2002 Series A and B bonds with a final maturity in 2031, carry ratings of AA from Standard & Poor’s and Aa1 from Moody’s Investors Service with stable outlooks.

The district currently has $3.9 billion of outstanding revenue bonds.

“SRP is well-positioned in its current rating category and is one of the highest rated U.S. public power electric utilities,” Moody’s analyst Dan Aschenbach observed.

“The rating could be revised downward should SRP lose its competitive advantage or if its strong financial ratios weaken below the level expected at its current rating category.”

Based in the Phoenix suburb of Tempe, the Salt River Project is a vertically integrated electric utility providing retail electric service in parts of Maricopa, Gila, and Pinal counties.

The district also provides raw water to municipalities and for agricultural irrigation in areas surrounding Phoenix. However, water operations represent less than 1% of operating revenues.

SRP’s financial statements consolidate results for the electric and water systems, but only electric revenues are pledged to electric system bonds. The electric system provides a small subsidy to the water system.

“Therefore, we believe consolidated debt service coverage accurately portrays the electric system’s capacity to support its debt obligations,” noted Standard & Poor’s analyst David Bodek.

The power district serves 950,000 electric customers and was growing rapidly before the recession and housing collapse in 2008.

“Although the greater Phoenix area exhibited strong growth before the recession, growth has slowed considerably in recent years,” Bodek said. “The utility added about 86,000 customers during 2006-2008, but only 20,000 customers during 2009-2011.”

The district’s capital improvement program is $3.3 billion from 2012-2016, with generation emissions controls and plant rehabilitation accounting for about one-third of that. The company expects to add $559 million of debt to fund the $3.3 billion of projects.

The recession, coupled with low natural gas prices, trimmed SRP’s wholesale business.

Wholesale energy sales volumes fell by about 43% from 2005 through 2011 and wholesale revenues declined 46% during those years, according to Standard & Poor’s.

Declines in market prices and sales volumes, coupled with rate increases for native load customers — the wholesale and retail customers that the Salt River Project is obligated to serve — reduced the utility’s wholesale revenues’ contributions to operating revenue by 56% during that period.

A year ago, SRP issued $729 million of revenue bonds, including $500 million of Build America Bonds.

After repricing on Tuesday, the bonds sold this week offered 2.00% and 3.00% coupons in 2013 with a yield of .40%. Bonds maturing in 2030 featured a 5.00% coupon with a 3.68% yield.