DALLAS — Investors who like San Antonio’s top-rated credit can choose bonds, notes or certificates of obligation when the city goes to market with $192 million of debt Tuesday.

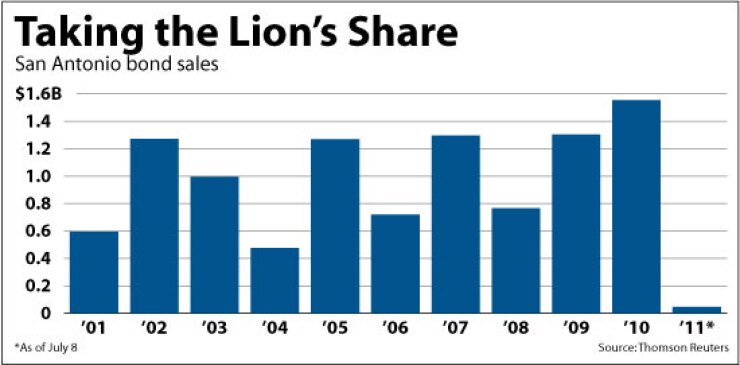

“We’re trying to have San Antonio take the lion’s share of the market presence,” said Jorge Rodriguez, managing director at financial adviser Coastal Securities. “We’ve seen excellent demand for this credit.”

The deal consists of $65 million of general obligation bonds, $89.5 million of tax and revenue certificates of obligation, $27.7 million of lease-revenue bonds, and $10.2 million of tax notes.

Siebert Brandford Shank & Co. is senior manager on the GO bonds and certificates. Piper Jaffray & Co., Stifel Nicolaus & Co., Frost National Bank, Loop Capital Markets, Rice Financial Products Co. and Wells Fargo Securities are co-managers. Fulbright & Jaworski is bond counsel.

Samco Capital Markets is senior manager on the $27.7 million of lease-revenue bonds, and Morgan Stanley is managing the notes.

The GO bonds and certificates reach final maturity in 20 years.

While the GO bonds and certificates have triple-A ratings, the lease-revenue bonds, issued through the San Antonio Municipal Facilities Corp. for a police and fire department communications system, are rated a notch lower.

The GO bonds, notes, and certificates are all backed by the city’s tax pledge, but the certificates also carry a pledge of a portion of the net revenue the city receives from its parks system.

Voters authorized the bonds in May 2007 as part of a $550 million program, the largest in San Antonio’s history. After this week’s issue, the city will have $98.6 million of authorized and unissued bonds, which officials plan to issue in various installments over the next few years.

The GO bonds and certificates will finance improvements to streets, bridges and sidewalks, as well asother purposes. The tax notes will finance projects related to technology infrastructure and business systems, as well as equipping various city facilities.

The lease-revenue bonds are secured by annual payments from the city to the nonprofit Municipal Facilities Corp. Proceeds of the bonds will fund a new fire and police emergency dispatch center, also known as the Public Safety Answering Point. The center is at Brooks City-Base, formerly Brooks Air Force Base, adjacent to the city’s Emergency Operations Center, and is scheduled to be completed in December 2011.

The bonds will also fund the replacement and enlargement of the existing fire and police Emergency Dispatch Center currently at the police headquarters.

With 1.4 million residents, San Antonio is Bexar County’s seat and the nation’s seventh largest city. As other cities have suffered declining economies, San Antonio continues to enjoy sustained growth in the manufacturing, tourism and services sectors. While the military continues to be a key sector of the local economy, increased production at a Toyota Corp. manufacturing plant, along with several businesses in the technology and health care sectors, have helped broaden the employment base.

Despite the addition of major employers in recent years, San Antonio’s tax base is expected to suffer its second consecutive year of declines. In fiscal 2011, the city’s total assessed valuation fell about 2.1%. For fiscal 2012, city officials anticipate a 1.25% decline, but project a gradual return to growth starting in fiscal 2014.

“In our view, the declines in San Antonio’s taxable assessed valuation have been modest when compared with those of other cities in Texas and throughout the country, and have not had a meaningful impact on the city’s credit quality,” Standard & Poor’s analyst Horacio Aldrete-Sanchez wrote.

“The city’s employment base has exhibited, in our opinion, significant stability throughout the current recession, as evidenced by its 7.3% unemployment rate in April 2011, which remained below the state and national averages,” he said.

The city’s unreserved general fund balance reached $199.1 million, or 24.2% of expenditures, at the end of fiscal 2010, but has fallen by $43.1 million during fiscal 2011, which runs through Sept. 30.

Texas Comptroller Susan Combs reported last week that while statewide sales tax distributions to local governments grew 7.2% in July compared to the same month last year, San Antonio’s fell 3.2% to $16.5 million. The July figures represented the 15th straight month of sales tax growth in the state.

“Strong business spending boosted sales tax revenue in sectors such as the oil and gas industry and manufacturing, and the retail sector continued to show growth,” Combs said in a statement.

City officials plan to seek voter approval for a bond program similar in size to the current $550 million plan in fiscal 2012. The city is also undertaking a major redevelopment of Hemisfair Park, which hosted the 1968 World’s Fair, with a view toward making the downtown acreage more accessible to city residents and visitors with more park-like amenities. The Hemisfair redevelopment follows the recent extension of the famed River Walk northward to the city’s museums and zoo. A southern extension toward the Museum District is in the works.

All future debt is expected to be sized and timed to maintain the city’s current debt-service tax rate, assuming modest tax-base growth. The city also plans to draw down its debt service fund balance to maintain level tax rates as part of its overall capital plan, with a target of between $25 million and $30 million for its debt-service fund balance. The balance at fiscal 2010 yearend was $80 million. The principal payout rate is modestly above average, with nearly 60% of principal retired in 10 years, according to Fitch Ratings analyst Gabriela Gutierrez.

“The impact of the proposed debt plans on the city’s direct debt profile should be manageable given its low current levels, above-average payout rate, and expansive tax base,” Gutierrez wrote in her report.

“The brisk payout rate is reflected in sizable annual debt payments, which in fiscal 2010 were above average at 19% of general government spending,” she said. “The city’s overall debt burden is high, even after adjusting for state support of local school district debt.”