On Togus Road near Augusta, Maine, you'll notice cows in the fields and boats in yards and the generous amount of space between houses. Heading north from Chelsea toward Togus along a lightly populated stretch of forested road there comes a clearing where a new $14.5 million K-8 school is rising alongside an old school where generations learned their ABCs.

"It's going to be awesome, it's going to be great," said Belinda Waterhouse, finance manager of Sheepscot Valley Regional School Unit No. 12. "The school that it's replacing is really dated and dark and dingy, and it's going to be just a whole new lifeline for them, just a shot in the arm."

It's also going to be financed with triple-A rated tax-exempt bonds.

The old Chelsea elementary school will be demolished when the new one is finished, and that is just one of the projects being financed with $77.4 million of bonds that the Maine Municipal Bond Bank plans to market this week. A one-day retail order period begins on Monday followed by institutional sales on Tuesday.

Wells Fargo Securities is book-running senior manager. Hawkins Delafield & Wood LLP is bond counsel.

The school district, which was created in 2009 under a statewide reorganization process, operates eight schools that serve about 22,000 students in eight towns. Located nine miles south of Augusta, the town of Chelsea has a population of 2,645, according to 2009 U.S. Census estimates.

The Chelsea elementary school's website documents the construction progress and contains a section created with the help of an eighth-grader showing floor plans and an artist's rendering of the building that is expected to welcome students to its sunny classrooms and new gym in the fall.

Borrowing through the bond bank gives a small district like RSU 12 a lower cost of funds than they could get by going out on their own.

"The bond bank has been running this program for local governments in Maine for just about 40 years now," said Robert Lenna, executive director of the MMBB. "We provide them with access to a triple-A interest rate, which I don't think any other governmental issuer in the state has."

The pooled issuance adds economy of scale by spreading issuance costs, such as bond counsel fees, across multiple borrowers.

"It's prorated among four borrowers instead of having one borrower carry the whole load," he said of this week's offering. "People have gotten more used to us because we've been here a long time and because we do all of the work in terms of packaging the deal and working with the underwriters."

Another benefit is that the bond bank name is recognizable. Since 1973, it has issued $4.04 billion of bonds on behalf of municipal issuers that may be less familiar to investors.

"It's much more liquid for the investors," Lenna said. "For the vast majority of governmental units, it's just more efficient and cost-effective to borrow through the bond bank than to go out on their own."

In addition to the Chelsea school, this week's offering will finance projects for the towns of Jay and Jefferson and the Maine School Administrative District No. 22.

RSU 12 sold $9 million of bond anticipation notes on its own to begin construction on the Chelsea school, which the MMBB bonds will take out, but for long-term debt "we've always gone through the bond bank," Waterhouse said. The state is providing 98% of the construction costs for the school, which will be used to repay most of the debt, she said.

This week's offering is structured with serial maturities from 2011 to 2031, according to the preliminary official statement. A term bond could be offered to institutional investors on Tuesday, Lenna said.

"Normally what will happen is, depending on the retail order period, we may create term bonds out toward the end for the institutional market," he said. "They may be more interested in the longer-dated term bonds but we will finalize the structure on Tuesday based on what happens on Monday."

Lenna said they have historically had a lot of retail interest.

"I don't believe the bank has done a deal in eight or 10 years where we haven't sold at least 25% to Maine retail, and then national retail comes in on top of that, and often we are selling 60% to 70% of our deals retail," he said. "For the national retail funds, it's triple-A rated paper from a fairly scarce issuer, and I think that provides some further interest for the national retail market."

The MMBB was last in the market Oct. 6 when it sold $23.5 million of tax-exempt bonds as part of a larger deal that included $41.2 million of taxable Build America Bonds and $15.5 million of taxable recovery zone economic development bonds. On the short end, those tax-exempts priced at 0.38% on a one-year bond with a 2% coupon, one basis point lower than Municipal Market Data's triple-A benchmark, according to Thomson Reuters. On the longest maturity, bonds maturing in 2040 yielded 4.13% on a 4% coupon, 40 basis point higher than MMD.

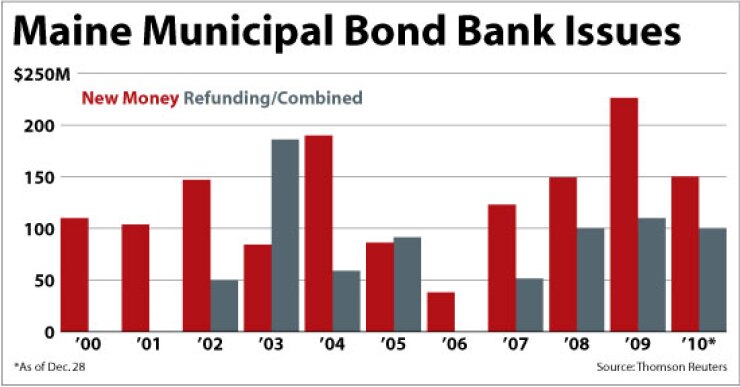

The bond bank has issued $2.04 billion of bonds since 2001, of which $1.3 billion was new money, according to Thomson Reuters. The issuer sells bonds on four active resolutions — one for municipal issuers, two for transportation, and one for water and sewer projects. This week's issue is being offered on its general resolution, which is for municipal issuers and on which $1.07 billion of bonds were outstanding on June 30, according to the preliminary official statement. The bond bank uses the proceeds of its bonds to make loans to municipal government units like RSU 12, which in turn place bonds with the MMBB. It then uses the payments from the municipal issuers to repay bondholders.

Standard & Poor's and Fitch Ratings both assign MMBB's general resolution bonds their AAA ratings with stable outlooks.

Standard & Poor's cited strong structural features that include two pledged reserve funds and a third fund that total more than $150 million, as well as a state aid intercept program if the borrower fails to make payments.

"Its loans outstanding are from a large and diverse pool of borrowers," Standard & Poor's said. "There have been no loan defaults in the pool's 35-year-plus history, and management maintains strong oversight of borrowers."

With this issue, the bond bank will have a "diverse pool" of more than 300 borrowers that largely secure their debts with a general obligation pledge. A large portion of the borrowers have used the bond proceeds to finance school construction that typically receives state subsidies of 15% to 85% of project costs. Additional support comes from double-A rated Maine's moral obligation pledge to replenish any draws on the debt service reserve, the report said.

Moody's Investors Service no longer rates new MMBB deals and rates its outstanding general resolution debt Aa1. In October, Moody's put the general resolution debt on watch list for possible downgrade, based solely on the agency's changes to its methodology to rating pooled municipal debt.