CHICAGO — The St. Louis Metro will complete a refunding Wednesday of its $150 million floating-rate revenue bond issue from 2005, using a structure that provides a short-term salve for its fiscal challenges while the transit agency awaits a bump in sales tax dollars from a voter-approved increase.

Metro, formally known as the Bi-State Development Agency of the Missouri-Illinois Metropolitan District, restructured half of the original transaction with a three-year subordinate-lien note issue last week.

It will sell $75 million of variable-rate bonds Wednesday with a letter of credit from JPMorgan Chase Bank NA.

Columbia Capital Management LLC is advising the agency on its transactions.

Metro issued the $150 million of variable-rate bonds in 2005 to cover cost overruns on the 8.2-mile Cross County light-rail expansion project.

The mass transit agency used the structure because it expected to pay down the debt with an anticipated settlement from its lawsuit against the project’s developers.

Metro officials blamed some of the problems on design flaws, but the agency lost its lawsuit in 2008 and state auditors faulted Metro for failing to adequately control costs or ensure the viability of the design.

The finance team had hoped to undertake a permanent restructuring this fall with the looming expiration of the paper’s LOC on Nov. 1, but that became difficult due to floundering sales tax revenue and a public mandate to restore services that had been cut.

“Our priority was to restore transit service and much of the new sales taxes will go to restore service, but we won’t be getting a full year of those taxes until next year,” said Metro’s retiring chief financial officer, John Noce. “This structure allows us to restore service and maintain flexibility so that we can begin to look at bringing down our debt when we have the revenues.”

St. Louis County voters last April approved Prop A, a half-cent increase in Metro’s sales tax that is expected to raise at least $80 million annually. However, the increase did not take effect until July and the additional funds are just beginning to accrue.

The agency will use the extra money to cover operations, including the cost of restoring service cuts made in 2009, and to expand its services.

Officials also intend to use funds to retire debt early.

They had warned that due to growing budget costs, faltering sales tax collections, and dwindling federal funds, dramatic cuts would be needed on top of the ones made in March 2009 without the Prop A increase.

The new tax comes atop an existing quarter-cent sales tax in St. Louis and St. Louis County.

Those taxes, which come from the Proposition M tax, have fallen 11% the last two years, although collections improved in July and August.

Metro’s debt is secured by the Proposition M taxes subject to an annual appropriation, though the new sales tax revenues from Prop A are not pledged to debt service.

Under the restructuring plan, Metro sold $75 million of three-year notes last week with RBC Capital Markets serving as underwriter.

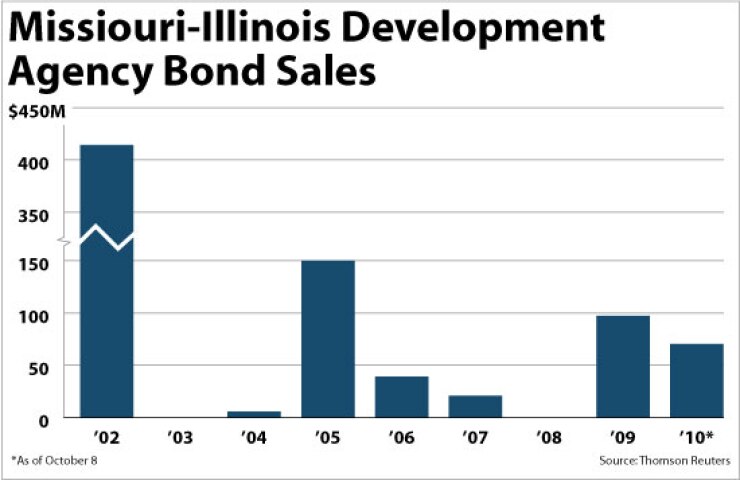

The agency will pay an interest rate of 1.7% and will make interest payments only until the debt’s maturity, at which time it will refund the principal along with $295 million from a 2002 issue that will then become callable.

Metro will use a variable-rate structure Wednesday with an initial weekly remarketing cycle to refund the remaining $75 million from the 2005 issue.

Jefferies & Co. is the remarketing agent.

The bonds carry a final maturity of 2035, but the mass-transit agency’s goal is to begin chipping away at repayment, redeeming them in chunks in the coming years, Noce said.

Moody’s Investors Service downgraded Metro’s $439 million of senior-lien mass transit sales-tax appropriation bonds to A2 from A1 and assigned a stable outlook to them, ahead of the three-year note issue.

Moody’s left the subordinate-lien bonds at A2.

Fitch Ratings upgraded the senior-lien bonds to A from A-minus and, revised its outlook to stable from negative. Fitch does not assign an underlying rating to the subordinate bonds.

Moody’s blamed the downgrade on weak sales-tax collections and other fiscal challenges associated with liquidity risks, including the potential need to use cash to fund a $28 million debt-service reserve fund should its surety provider be downgraded.

Other risks include obligations on two remaining leverage-lease transactions, interest rate risk on the $75 million of bonds being issued Wednesday, and refinancing risk on the $75 million bullet principal due in 2013.

The sales taxes pledged to bond repayment fell by 5.1% in fiscal 2009 and 6.4% in 2010, though they have returned to positive territory in recent months.

Moody’s called the recovery fragile. Pledged revenues have fallen to 1.4 times coverage of senior-lien bonds and 1.3 times of subordinate bonds.

Fitch attributed its upgrade to Metro’s “significantly enhanced financial flexibility” from passage of the new sales tax and to its reduced risks from leverage lease transactions and floating-rate debt.

Fitch analysts said even at the lower level, debt-service coverage remains acceptable, but Metro will still be challenged to maintain service while servicing the debt and successfully implementing its debt-reduction plan.

Standard & Poor’s did not rate the three-year notes.