Nearly all of The Bond Buyer’s weekly yield indexes fell during the seven-day period ending Thursday as firmness persisted in the municipal market.

“The market continues to grind higher in price,” said Michael Pietronico, chief executive officer at Miller Tabak Asset Management. “There seems to be more inclination by some investors to look further out the curve.”

Pietronico noted that the market reached a level this week on the short end where rates could not go much lower, prompting some participants to reconsider longer maturities.

“We’re range-bound,” he said. “It feels like there’s a fair amount of investors who missed the rally and would like to buy as yields come back up, but the selling pressure is just not there. It’s a very difficult environment to put cash to work.”

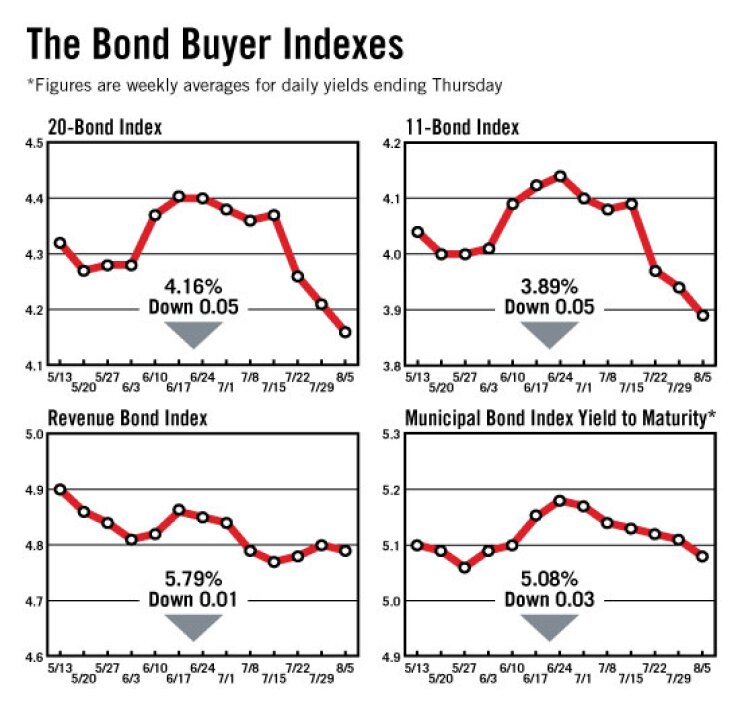

The Bond Buyer 20-bond index of 20-year general obligation bond yields declined five basis points this week to 4.16%. That is the lowest the index has been since Oct. 8, 2009, when it was 4.06%.

The 11-bond index of higher-grade 20-year GO yields also dropped five basis points this week, to 3.89%, which is the lowest level for the index since Oct. 8, 2009, when it was 3.80%.

The revenue bond index, which measures 30-year revenue bond yields, declined one basis point this week to 4.79%, but remained above its 4.78% level from two weeks ago.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose seven basis points this week to 0.55% — its highest level since hitting 0.59% the week ending July 7.

The yield on the 10-year Treasury note declined nine basis points this week to 2.91%. That is the lowest the yield has been since the week ending April 16, 2009, when it was 2.84%.

The yield on the 30-year Treasury bond declined two basis points this week to 4.06%, but remained above its 3.95% level from two weeks ago.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term muni bond prices, finished at 5.08%, down three basis points from last week’s 5.11%.