The University of Connecticut plans to market tax-exempt bonds to institutional investors tomorrow in a $138.8 million offering that began a two-day retail order period on Friday.

The deal includes $105 million of new money and a $33.8 million refunding, though that the amount of the refunding could increase depending on market conditions.

On Friday afternoon, UConn manager of treasury services John Sullivan said roughly a third of the bonds had already been sold, but would not disclose the pricing of those bonds.

“We have more refunding we could throw into it, so maybe Monday we’ll throw more in — depends where the market is,” he said.

The new-money bonds will help finance the construction of a new social sciences building on its main campus in Storrs, renovations to a health research facility, and deferred maintenance projects.

Wells Fargo is lead managing the fixed-rate deal, which has serial maturities of up to 20 years.

Pullman & Comley LLC and the Law Offices of Joseph C. Reid are co-bond counsel. P.G. Corbin & Co. and First Southwest Co. are financial advisers.

Though the bonds are the general obligation of the university, they are secured by a lien on state funds. The University of Connecticut 2000 Act, a 10-year, $1.25 billion infrastructure program enacted in 1995, authorized the university is issues GO bonds to be repaid by the state. The program has since been extended to 2016 and expanded to $2.26 billion of bond issuance. UConn had about $932 million left in the program, including the current deal, Sullivan said.

Last week, the General Assembly passed a bill that would extend the program to 2018 and add an additional $207 million of debt capacity to help establish the UConn Health Network, a partnership between area hospitals to provide patient care and conduct medical research. Gov. M. Jodi Rell proposed the legislation but has not yet signed it.

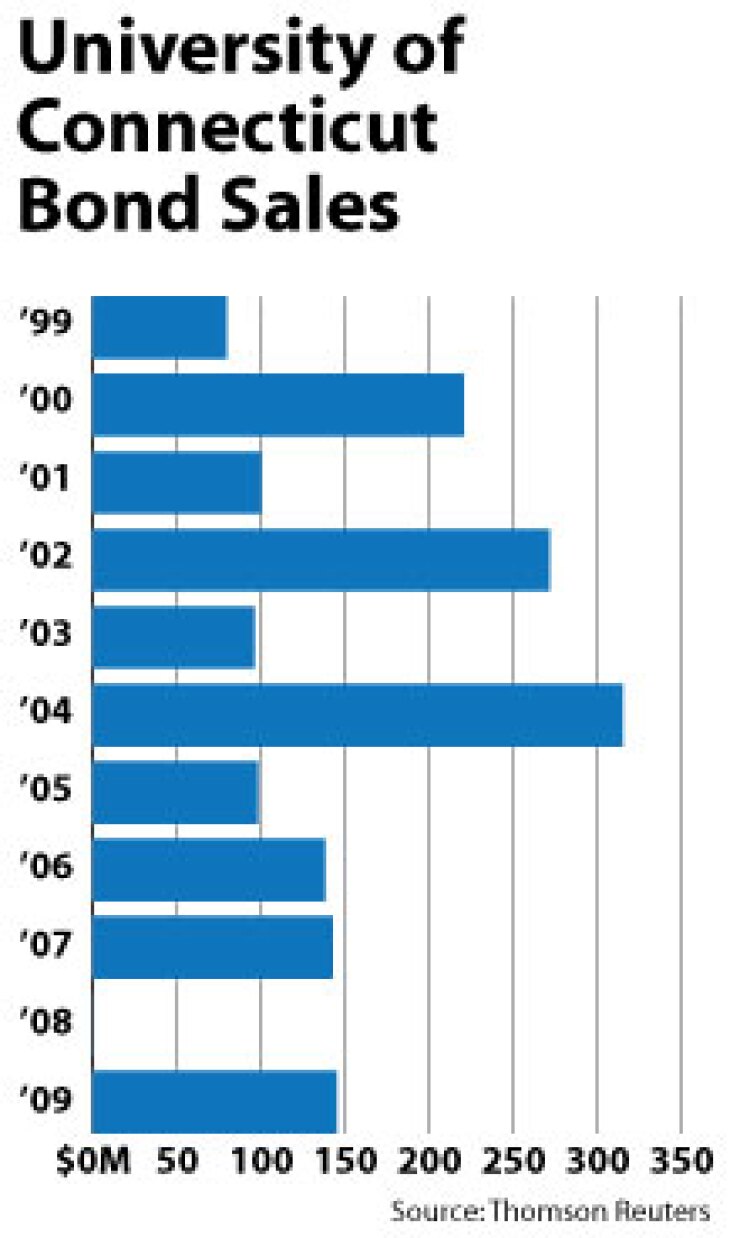

The university has sold $1.61 billion of bonds since 2000, according to Thomson Reuters. About three quarters of the 21,496 students currently enrolled at the university attend classes on the main campus while the remainder are spread among seven other campuses.

Moody’s Investors Service rates the bonds Aa2 with stable outlook citing the “strong legal security provided by the state debt service commitment, pursuant to the UConn 2000 program, which is deemed appropriated in amounts sufficient to pay debt service from the state of Connecticut’s general fund.”

Fitch Ratings rates it AA with negative outlook and Standard & Poor’s rates it AA with stable outlook.

The university has $780 million of parity debt outstanding.