The Long Island Power Authority in New York plans to return to the municipal bond market next week with its first-ever Build America Bond deal.

LIPA expects to price $210 million of new-money taxable BABs on May 5 and $200 million of tax-exempt refunding bonds on May 4 on its senior-lien credit. The deal follows an upgrade last week from Fitch Ratings.

Citi will lead manage the BABs portion of the deal and Morgan Stanley will lead manage the refunding.

Hawkins Delafield & Wood LLP is bond counsel. Public Financial Management Inc. is LIPA’s financial adviser on the deal.

LIPA plans to refinance variable-rate demand bonds to remove existing liquidity providers and a bond insurer that authority chief financial officer Herb Hogue said exposed them to risk, even though those bonds have done well.

“We have risk that the effective interest rates on those bonds will go up,” Hogue said. “We wanted to take some of that risk off the table by refinancing $200 million of that.”

LIPA spokeswoman Vanessa Baird-Streeter declined to identify the liquidity providers and insurer on the bonds being refunded.

Hogue said he expected the refunded bonds would be issued as variable-rate debt with maturities of up to five years but that the final structure had not been determined. He did not provide additional details.

The outstanding variable-rate bonds were swapped to fixed rate, but the CFO said the swap has been transferred to other debt and does not have to be unwound.

The final structure of the BABs has yet to be determined. Hogue said the taxable bonds would be issued on the long end with maturities of up to 30 years.

LIPA plans to use the new-money proceeds for ongoing capital improvement and maintenance of its power transmission and distribution system.

“There aren’t any big projects in there,” Hogue said. “It’s mostly a continuation of our reliability capital investments.”

The bond proceeds from the deal will cover most of LIPA’s budgeted $277.1 million of capital spending for 2010.

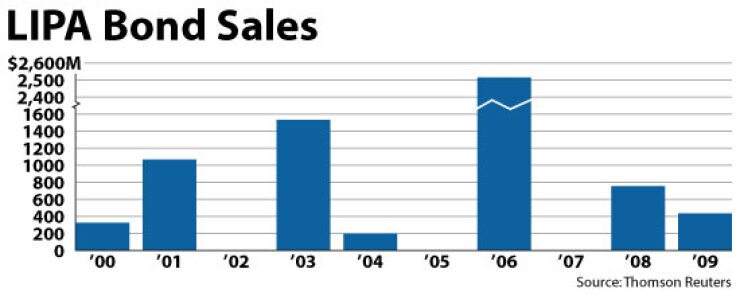

Since 2000, utility has sold $6.83 billion of new-money and refunding bonds, according to Thomson Reuters.

The authority owns and operates the electric transmission system in Nassau and Suffolk counties as a well as a small part of Queens, serving 1.15 million customers. LIPA also owns a 18% stake in the Nine Mile Point 2 nuclear power plant in upstate New York.

The deal comes on the heels of a Fitch upgrade on LIPA’s senior debt to A with a stable outlook from A-minus with a negative outlook.

“One of the more important things that we noticed is their management and governance and strategy going forward seemed to be a lot more cohesive and directed,” said Fitch analyst Christopher Jumper.

“They had a big buildup of a lot of cash and liquid investments as well as they’ve got an unused commercial paper capacity that’s sitting available to be used,” he added. “We felt that their operations were doing better, the amount of interruptions, the amount of outages definitely improved.”

Among the positive developments, he said, was a reduction of LIPA’s variable-rate portfolio and swap exposure.

“They’ve continued to winnow it down, which is, I think, something that the committee felt was definitely moving in a positive direction,” Jumper said.

LIPA has contracts with National Grid PLC that total $714.8 million and include a power purchase agreement. Those contracts are up for renewal in 2013, and the authority is in a better negotiating position.

“They’re currently in a position of renegotiating or renewing their licenses with National Grid, and it was just felt that they were in a favorable position as far as some of the options that were open to them, and some of the flexibility for whether they sign up again with National Grid or explore other power resources or power providers,” Jumper said.

LIPA took on billions of dollars of debt when it acquired the Long Island Lighting Co.’s electric transmission and distribution systems in 1998. The takeover required federal approval. LIPA sold $6.73 billion of bonds in 1998 to acquire LILCO and its debt obligations, including $4.1 billion associated with the decommissioned Shoreham Nuclear Power Plant.

The authority’s high debt level is a concern because it reduces flexibility, Jumper said.

“However, within that large amount of debt … they have been managing very well and they have been demonstrating strong debt-service coverage at the senior debt level,” the analyst said.

LIPA projected it will have 2.3 times debt-service coverage on its almost $6 billion of outstanding senior-lien debt, according to a Fitch report. It also has $577 million of subordinate-lien debt.

Standard & Poor’s rates the deal A-minus and Moody’s Investors Service rates it an equivalent A3, both with stable outlooks.

In 2008, Gov. David Paterson vetoed legislation that would have required LIPA to seek approval from the state Public Service Commission for rate increases of 2.5% or greater over a 12-month period. The PSC is an oversight body that regulates the state’s electric, gas, steam, telecommunications, and water utilities.

The bill’s passage in 2008 prompted Fitch and Standard & Poor’s to change their outlooks for LIPA to negative from stable, citing the possibility that it could have lost its ability to raise rates. Standard & Poor’s returned LIPA to stable several days after Paterson’s veto, but Fitch waited until last week to lift its outlook.

“The governor has repeated the pledge to veto the PSC legislation if it was presented to him,” Jumper said. “It just didn’t seem to have the same strength or momentum that it did in 2008, especially when fuel prices were escalating and rates were increasing significantly.”

Last month the Assembly again passed the bill, A. 8441, and it was referred to committee in the Senate.

“If we got the impression that it was likely to pass, we probably would put [LIPA’s rating] on a negative outlook again,” Jumper said. “At this point we felt that it didn’t have the momentum to warrant the negative outlook anymore.”