CHICAGO — South Dakota lawmakers will attempt to hash out a final $4 billion budget for fiscal 2011 next week after suspending debate earlier this month to see if the state would receive up to $36 million in federal stimulus money that could be used to eliminate a deficit that’s roughly the same size.

The budget debates come after a year in which the usually durable state saw a decline in its sales tax revenue for the first time in decades.

State fiscal analysts have projected the revenue — which makes up most of its general fund — will begin climbing again next year, but that the state could still face an accumulated deficit of up to $107 million by 2012.

Lawmakers will return to the capital in Pierre Monday to consider a series of amendments to the general budget bill, and are expected to finalize the budget Tuesday.

It’s the first time in years that the Legislature, long dominated by Republicans, has left budget deliberations until March 29, a day usually reserved for handling the governor’s vetoes.

“In my 18 years [in the House], we have never left the second-to-last day of session without a budget in place,” said Rep. H. Paul Dennert, a Democratic member of the Appropriations Committee for 14 years.

“It’s unprecedented for me, but I can understand some of the method in the madness. But we’re still looking at a 2012 budget that, without stimulus money, will see a deficit of about $100 million.”

Republican Gov. Mike Rounds has proposed dipping into the state’s reserves to balance the fiscal 2011 budget, reminding lawmakers that cutting spending to balance the budget would render the state ineligible for more federal aid.

Rounds’ 2011 spending plan relies on general tax revenues totaling $1.2 billion, $1.9 billion of federal funds, and $968 million of other revenue sources.

A special session is possible but unlikely, as the Legislature needs to approve a final budget 90 days before the start of the fiscal year on July 1.

All the state’s lawmakers face re-election in November, and voters will also pick a new governor as Rounds nears the end of his eight-year term limit.

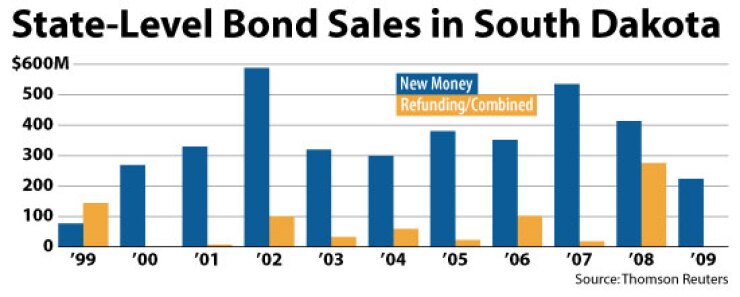

On the borrowing side, the state’s largest issuer, the South Dakota Housing Development Authority, expects a return to normalcy after a year in which it struggled to recover from the market collapse of 2008.

The housing authority expects to issue around $300 million this year — all through the federal government’s new-issue bond program, said finance director Mark Lauseng. As an independent agency, the authority is not affected by the state budget.

The state’s second-largest issuer, the South Dakota Building Authority, won legislative approval for about $15 million in debt, roughly the same amount as approved in last year’s budget.

The borrowing includes $10 million for a new Board of Regents building in Sioux Falls and $5.6 million for a human services center in Yankton, said authority director Don Templeton.

On Monday, lawmakers are set to introduce a series of new spending amendments that assume the state will gain the new federal aid.

The additional $36 million could undo the Legislature’s earlier vote to freeze K-12 school spending, paving the way for a 1.2% increase. As well, the state’s six public universities, which were bracing for cuts under original budget proposals, could be spared if new federal dollars come into the state.

Tuesday lawmakers are expected to vote on a final budget bill.

Separately, lawmakers might consider ways to increase badly needed highway funding through a mix of gasoline tax and fee increases. A bill to increase the fees and taxes to generate more revenue for the state highway system failed in February.

Sales tax revenue, which makes up nearly 60% of the general fund, last year dipped for the first time after years of steady growth.

For the first eight months of fiscal 2010, sales tax collections totaled $438.4 million — a decrease of roughly 4% from the first eight months of fiscal 2009, the state budget office said.

Budget analysts and lawmakers forecast that the revenue will rebound this year — increasing by about 3% over last year to total $666 million — but even with that growth, South Dakota still faces a structural deficit of up to $100 million.

Despite declines in many of its revenue sources, coupled with the highest unemployment rate since 1985, the state could be turning a corner, according to local economists.

“The economic expansion that spanned approximately seven years in South Dakota came to an abrupt end in 2008 as the national recession and financial crisis pulled South Dakota’s economy into a recession,” the Council of Economic Advisers, which helps craft the state economic forecast, said in a report included in Rounds’ 2011 budget.

“Overall, the South Dakota economy is expected to recover slowly into 2010 and 2011 as consumers and businesses recover from one of the longest and deepest recessions since the Great Depression.”

South Dakota does not issue general obligation debt. Fitch Ratings rates the state’s lease-backed debt AA-minus. Standard & Poor’s assigns an issuer credit rating of AA. Moody’s Investors Service has no underlying rating on the state.