Nearly all The Bond Buyer’s weekly yield indexes declined this week, as the municipal market spent much of the last week either in unchanged or slightly firmer territory.

“The market has been grinding higher [in price], and credit spreads have been grinding tighter along the belly of the curve,” according to Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

“There’s been a continuance of lack of supply, and also, from the perspective of where the market might be a few years from now, the fact that taxable influence appears here to stay is putting people on the short duration on the defensive,” he added.

“Most people understand March to be a problematic month — at best, it’s likely to be sideways in price,” Pietronico said. “However, we would view the coming 30 days or so to be a good opportunity to add some paper before the summer months, which could see very thin supply.”

Leading the primary market this week, Maryland sold $595 million of general obligation bonds Wednesday, while Miami-Dade County priced $589 million of water and sewer system revenue bonds Tuesday.

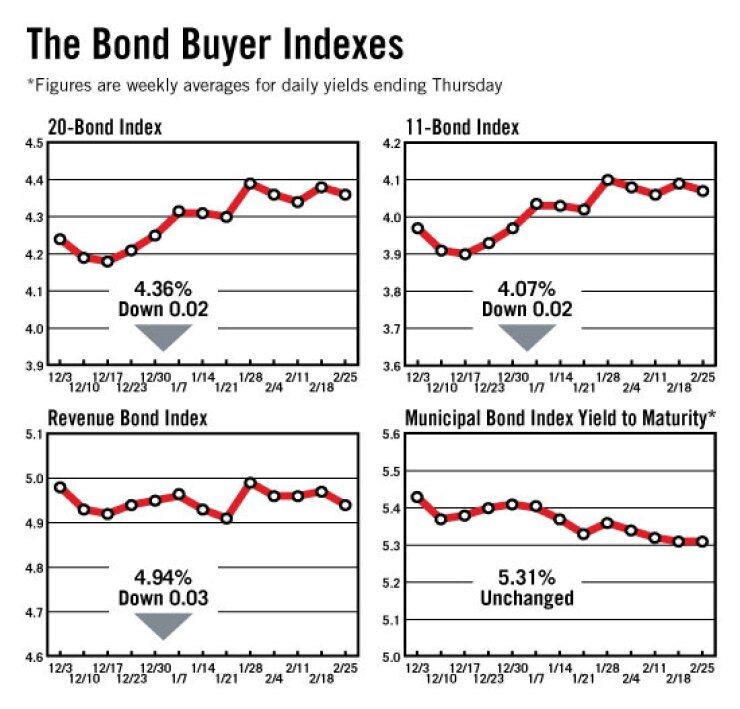

The Bond Buyer 20-bond index of 20-year GO yields dropped two basis points this week to 4.36%, but remained above its 4.34% level from two weeks ago.

The 11-bond index of higher-grade 20-year GO yields also fell two basis points this week to 4.07%, while remaining above its 4.06% level from two weeks ago.

The revenue bond index, which measures 30-year revenue bond yields, declined three basis points this week to 4.94%, which is the lowest the index has been since Jan. 21, when it was 4.91%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, declined seven basis points this week to an all-time low of 0.41%. The previous record low for the index, which began on July 12, 1989, was 0.43% on Jan. 13.

The yield on the 10-year Treasury note declined 16 basis points this week to 3.64%, which is the lowest the yield has been since Feb. 4, when it was 3.60%.

The yield on the 30-year Treasury bond dropped 15 basis points this week to 4.59%, which is its lowest level since Feb. 4, when it was 4.53%.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 5.31%, unchanged from last week.