All The Bond Buyer’s weekly yield indexes rose this week, as tax-exempts weakened in nearly all the past few sessions, particularly on the long end of the curve.

“All the deals have been crowded up front and vacant out long,” said George Strickland, managing director and portfolio manager at Thornburg Investment Management. “There’s been a little pickup in the secondary market, but it’s still somewhat sleepy. Maybe people are still a little hung over from New Year’s.”

Strickland also said the market could see a pickup in secondary trading “maybe not next week, but the week after” as the “calendar will build” and “hopefully more secondary trading will be going on.”

Leading the new-issue market this week, Citi priced $1.84 billion of sales tax bonds for the Puerto Rico Sales Tax Financing Corp. on Wednesday, and Barclays Capital yesterday priced $1 billion of general obligation bonds as taxable Build America Bonds for Illinois.

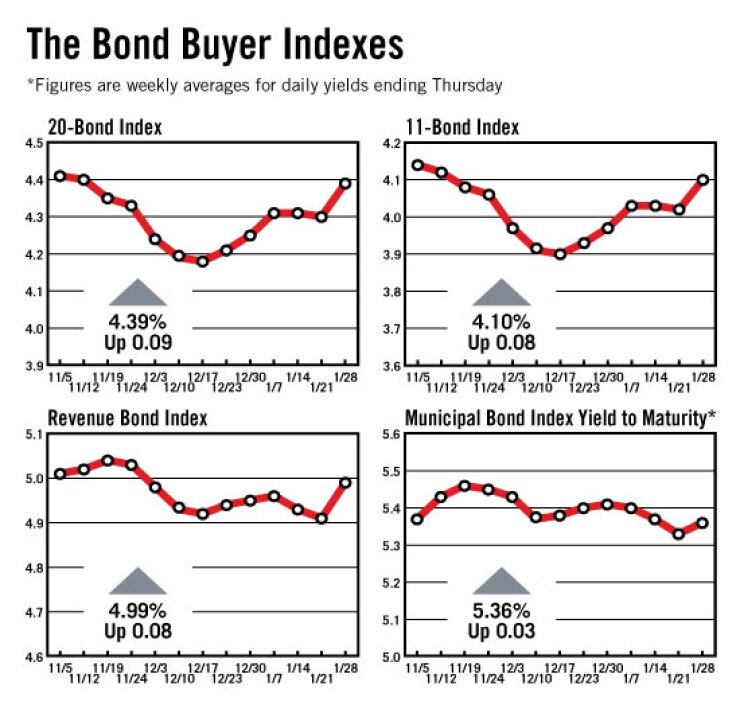

The Bond Buyer 20-bond index of 20-year GO yields rose nine basis points this week to 4.39%, which is the highest level for the index since Nov. 12, 2009, when it was 4.40%.

The 11-bond index of higher-grade 20-year GO yields increased eight basis points this week to 4.10%. This is the highest the index has been since Nov. 12, when it was 4.12%.

The revenue bond index, which measures 30-year revenue bond yields, gained eight basis points this week to 4.99%. That is the highest level for the index since Nov. 24, 2009, when it was also 4.99%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose two basis points this week to 0.49%, up from last week’s all-time low of 0.43%. It is the highest the index has been since Dec. 30, 2009, when it was also 0.49%.

The yield on the 10-year Treasury note rose six basis points this week to 3.66%, but it remained below its 3.74% level from two weeks ago.

The yield on the 30-year Treasury bond increased eight basis points this week to 4.58%, but it remained below its 4.63% level from two weeks ago.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 5.36%, up three basis points from last week’s 5.33%, but remained below the average of 5.37% for the week ended Jan. 14.