New York City continues to gush water bonds with a $400 million deal expected to price tomorrow and another $327.1 million next week.

The New York City Municipal Water Finance Authority will market the first deal as taxable Build America Bonds. The New York State Environmental Facilities Corp. will market the next deal on behalf of the MWFA — likely a mix of BABs and tax-exempt bonds.

The structure of the MWFA issue had not been finalized last week, but according to the preliminary official statement the deal is expected to consist of two term bonds.

When the authority last sold BABs, in October last year, it marketed them as two term bonds that matured in 2041. One tranche, for $403.4 million, was sold with a 5.75% coupon, while a smaller tranche, for $100.9 million, was sold with a 6.25% coupon.

The difference between the two tranches was the make-whole provisions. The issuer paid a higher rate to include a 10-year par call provision on the smaller tranche. Though the length of the par call was not included in the POS, tomorrow’s deal appears to be repeating the two-tranche approach to make whole provisions.

Ramirez & Co. will lead manage the deal, which will include a syndicate of 23 investment banks.

Orrick, Herrington & Sutcliffe LLP is bond counsel. Lamont Financial Services Corp. and MFR Securities Inc. are financial advisers on the deal.

The authority plans to use the bond proceeds to pay ongoing costs associated with its capital program.

The MWFA has taken a diverse approach to recent issuances. In October, it sold BABs as well as $218.8 million of tax-exempt refunding bonds. In December, it sold $200 million of tax-exempt variable-rate bonds.

“We look at where it make sense to sell BABs, where we can get the best and lowest interest rate, and then we draw a line between the tax-exempts and the BABs,” said authority executive director Thomas Paolicelli. “Currently on the shorter end of the curve it makes sense to sell tax-exempt bonds; on the longer end, it makes sense to sell BABs because you get a better rate.”

Siebert Brandford Shank & Co. will lead manage the EFC deal. Public Financial Management is financial adviser and Hawkins Delafield & Wood LLP is bond counsel.

Next week’s offering from the MWFA will be issued as second general resolution bonds, which are subordinate to its first general resolution bonds, but still garner double-A level ratings. The EFC deal also will consist of second general resolution debt issued as clean water and drinking water state revolving fund revenue bonds.

Last month the authority sold its variable-rate deal with a standby bond purchase agreement from Barclays Bank PLC. Barclays Capital underwrote the bonds.

The high price of liquidity has made it hard for issuers to tap into historically low variable rates.

“We had an opportunity to get some liquidity in the market, which enabled us to issue variable-rate debt, which is very low-cost debt to us, especially in the current market,” Paolicelli said. “We went ahead with that. We try to maintain a certain amount of variable-rate exposure in our overall portfolio, so that was consistent with that goal.”

The MWFA has $10.8 billion of senior-lien debt and $11.6 billion of subordinate-lien debt outstanding, according to the POS. Approximately $2.44 billion of the authority’s debt is variable rate, which does not include any auction-rate debt. The authority is also authorized to have up to $1 billion of commercial paper outstanding.

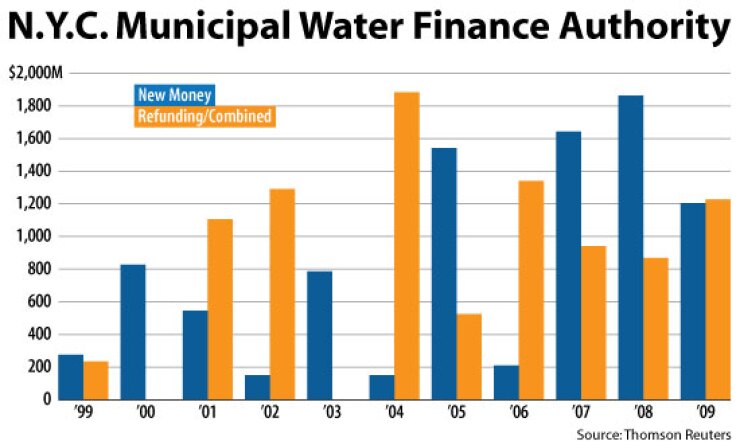

The MWFA has sold $8.92 billion of new-money bonds since 2000, according to Thomson Reuters. More than half of that, $4.71 billion, was sold in the past three years. Additionally, the agency has sold $9.18 billion of combined refunding and new-money bonds during that time. The EFC has sold $6.27 billion of new-money bonds and $1.62 billion of combined refunding and new-money bonds since 2000, according to Thomson Reuters.

The city uses the bond proceeds to fund an ambitious capital program, including projects mandated by the state and federal governments, projected to total $14.17 billion from fiscal 2010 through fiscal 2019. The authority expects to sell, on average, $1.9 billion of new-money bonds annually through fiscal 2014, according to the POS.

The water system supplies water to approximately nine million people in New York City as well as Westchester, Putnam, Orange, and Ulster counties. The system is operated by the city’s Department of Environmental Protection. Water usage fees, which back the bonds, are established by the city’s water board, which is separate from the authority board.

The board has covenanted to establish water rates that will be at least equal to 115% of debt service on first resolution bonds and 100% of all other operational costs including debt service on second resolution bonds.

The capital program has required large rate increases in recent years that have become a political issue. The board has authorized double-digit rate increases the past three years in a row and projects it will raise rates by 14.3% in fiscal 2011, according to the POS. That’s up from projections a year ago, when the rates were expected to increase 12% in fiscal 2011.

“It is a structure where the board is a separate entity and it is obligated to set the rates in order to meet the authority’s obligation, and obviously based on the double-digit rate increases that it has taken and is forecasted to take, it clearly has the willingness to do that,” said Moody’s Investors Service analyst Nicholas Samuels.

“At the same time, you can’t separate it frwom political pressure in the context of a downturn in the economy and higher costs to consumers; there could be pressure to try to mitigate rate increases,” he said.

Despite the rate increases, debt-service coverage is projected to fall to 2.29 times in fiscal 2011 from 3.07 times in fiscal 2009, according to the POS.

Moody’s rates the authority’s outstanding second resolution debt Aa3 with stable outlook. It rates the EFC bonds sold on behalf of the MWFA Aa1 with stable outlook.

Standard & Poor’s rates both the MWFA’s second resolution bonds and the EFC bonds to be issued on the authority’s behalf AA-plus with stable outlook.

Fitch Ratings rates the MWFA second resolution bonds AA with stable outlook and EFC debt being issued on behalf of the authority AA-plus with stable outlook.

Evan Rourke, portfolio manager at Eaton Vance, said his firm doesn’t typically invest in long-term BABs for its clients but that it was “very comfortable with environmental credit and the water credit.”

“You really have a monopolistic revenue stream,” he said. “People would cut off their electricity before they would cut off their water.”