SAN FRANCISCO — It is back to the drawing board for California lawmakers and leaders after voters Tuesday delivered a drubbing to five special election ballot measures designed to reform the state’s budget process and bring in revenue to close the state’s gaping deficit.

Voters rejected the five measures by wide margins, with between 62.6% and 66.4% voting “no.”

The only measure to pass was Proposition 1F, which allowed voters to vent their frustration. The measure bans lawmakers and state constitutional officers like the governor from getting pay raises in years when the state is running a deficit.

Bankers can put their California lottery bond marketing plans back on the shelf, thanks to the defeat of Proposition 1C, which would have had the biggest immediate budget impact by authorizing $5 billion in lottery revenue debt.

The state’s 2010 budget assumed 1C would pass, and counted that $5 billion as revenue for fiscal 2010. It also assumed passage of propositions 1D and 1E, which would have directed a combined $840 million to the general fund by diverting taxes that has been previously designated by voters for specific programs.

Voters also rejected Propositions 1A, which would have reformed the state’s budget process and created a new spending cap, as well as 1B, which would have directed funds to schools if 1A had passed.

The ballot measures and the special election were the product of negotiations that resulted in February’s budget deal, a combination of tax hikes, spending cuts, borrowing, and payment deferrals to close what was then projected to be a $42 billion budget deficit for the combined 2009 and 2010 fiscal years.

Since then, the gap has grown by $15 billion, according to the state’s budget forecasters, with a further $6 billion deficit created by the defeat of the budget ballot measures.

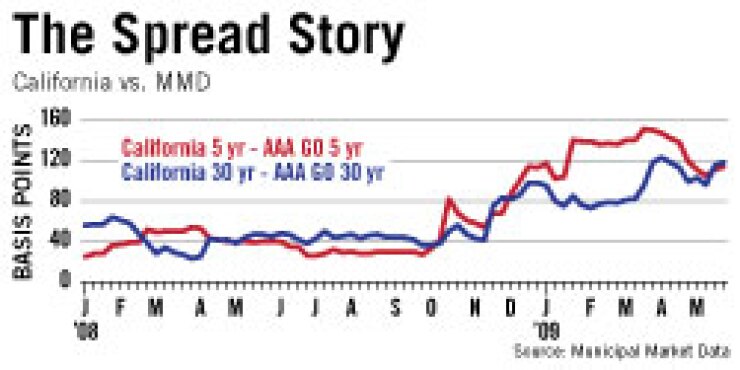

Despite the sense of continuing crisis emanating from Sacramento, California yield spreads have tightened since earlier in the year, largely because of broader market trends, said Matt Fabian, managing director at Municipal Market Advisors.

“Our market has had tremendous rejuvenation in its appetite for risk,” he said, reflected by inflows to municipal bond mutual funds.

“That money, that will help protect California spreads,” he said. “It will limit the damage to California spreads.”

How easy it will be to cut $21 billion from a budget with $90 billion in projected revenue remains to be seen.

Given the shrinking size of the revenue pie and the composition of state spending, there is no realistic way to enact substantial cuts without hitting K-12 education and social and health programs for the poor and senior citizens.

Both options are highly unpalatable to most members of the Legislature’s Democratic majority as well as the party activists who support them.

Tax hikes are all but inconceivable, since they would require some Republican votes to gain the necessary two-thirds majorities, and GOP backbenchers tossed aside their leaders in each house for their roles in negotiating the February budget and tax hikes.

Senate president pro tempore Darrell Steinberg, D-Sacramento, admitted as much in a statement after the election results were posted.

“The voters have spoken and they are telling us that government should do the best it can with the money it has,” he said. “We will immediately and responsibly get to work to balance the budget and head off a cash crisis in July”

Moody’s Investors Service issued a special comment yesterday, noting that its March downgrade of California’s rating to A2 from A1 assumed the possibility the ballot measures would fail.

“If the state’s cash-flow borrowing needs continue to increase, and either reach or exceed the reported $20 billion mark, that may raise questions about the state’s longer-term credit profile,” the Moody’s comment said. “Additionally, how effectively the state manages its cash flow shortfalls in the current fiscal year and in fiscal year 2010 will impact our analysis.”