SAN FRANCISCO — Some large West Coast issuers are making plans to join a growing Build America Bond parade that surpassed $9 billion in issuance this week.

The BAB program, created as part of the federal stimulus legislation, could help Washington execute its sizable transportation bonding plans, state Treasurer Jim McIntire said this week.

“We’re teed up to do probably $2 billion of debt over the next two years, possibly more, for transportation,” he said in a phone interview. “So I think that at least maybe there’s a potential for using them (BABs) for somewhere on the order of one-and-a-half billion.”

In California, the Bay Area Toll Authority’s chief financial officer, Brian Mayhew, said he has rearranged his issuance plans to make all of the agency’s 2009 toll revenue bonds into Build America Bonds. The BATA board has approved a $1.2 billion BAB issue this fall to finance the ongoing replacement of the east span of the San Francisco-Oakland Bay Bridge.

Under the BAB program, governments issue taxable bonds to finance projects that qualify for tax-exempt treatment. They can choose between a 35% direct interest subsidy from the federal government, or offering investors a 35% tax credit.

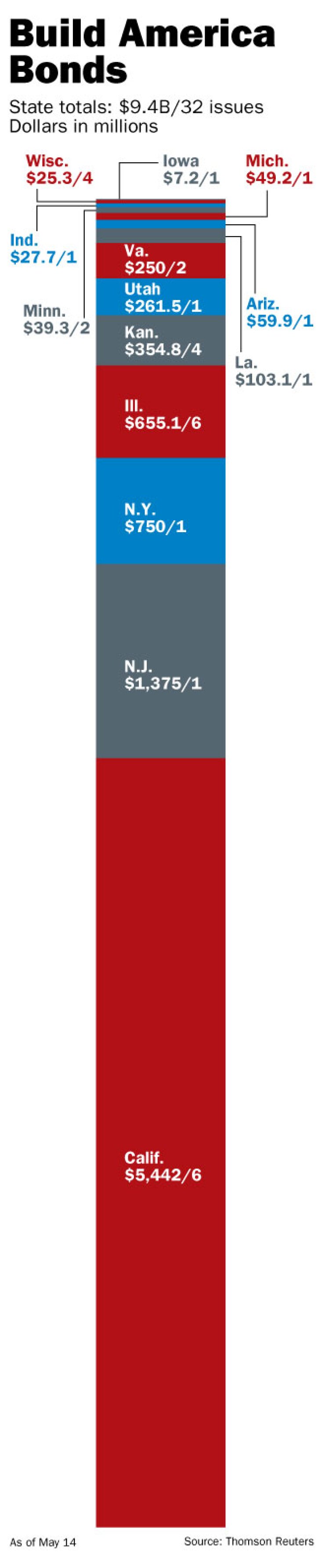

So far all issuers have gone with the direct subsidy. As of Wednesday, exactly four weeks after the first Build America Bonds were priced, there have been 30 issues for more than $9.1 billion, according to Thomson Reuters data.

This year, Washington state lawmakers cut the operating budget while also approving a two-year, $7.5 billion transportation budget that will be financed in part with the $2 billion in bonds, repaid with revenue from fuel taxes and also supported by the state’s general obligation pledge.

The state also plans to issue about $1.8 billion in straight-ahead general obligation bonds. McIntire said those bonds are not good candidates for BAB issuance, because they are subject to the state’s constitutional debt limit, and there are concerns that the gross interest costs of taxable BABs would impact the debt limit.

The fuel-tax backed bonds, however, are not subject to that debt limit, according to McIntire, who added that his office and advisers have more studying to do before making any decisions.

“We still need to answer some questions about those bonds and precisely how they’re going to work,” he said.

There are questions about structure. As BAB deals roll out, many of the larger issues have featured corporate-style maturity structures, with long-dated bullet maturities and “make-whole” call provisions that limit issuers’ ability to refund the debt economically.

Other BAB issues, all on the smaller side, have preserved traditional municipal-style serial structures and call provisions.

BATA’s Mayhew said some of the tradeoffs are worth it to access a new base of corporate bond investors.

“There’s things you sacrifice for it, call options and things like that,” he said, but in return there is increased investor access and market depth. “If you look at the deals that have gone out, they’ve been oversubscribed enormously; and when you net down the rate with the federal subsidy, they’ve been either at or below the tax-exempt market,” he said.

BATA runs seven state-owned toll bridges in the San Francisco Bay Area, and it has financed a massive project to upgrade or replace them for earthquake safety.

The BAB program will help keep the money flowing, Mayhew said. He’s unsure if the traditional tax-exempt market could absorb all the debt that issuers have been holding back on since the financial crisis hit.

“It really does allow us to get out in large sizes that we could do in, say, 2007, but that we haven’t been able to do since then,” Mayhew said.

In Washington, McIntire said the method of sale is also an important question that needs to be answered.

The state has sold all its bonds competitively since McIntire’s predecessor as treasurer, Michael Murphy, took office in 1997. McIntire took office in January following Murphy’s requirement.

“Were watching to see how many of these get issued competitively since that has always been an issue in this state,” McIntire said, noting that issuers in Kansas and Arizona this month sold BABs through competitive auctions, allowing bidders the option of BABs or tax-exempts.

“It’s been a policy stance of the state for some time and we’d need a clear and convincing reason for stepping away from it,” he said.

Other issuers are taking a more cautious approach to Build America Bonds and some of the other bond-related options created in the stimulus package.

“We’re considering all of these new tools that are out there but we don’t have any immediate plans to use them,” said Seattle finance director Dwight Dively.

Time is on the city’s side — it has sold more than $750 million in tax-backed and revenue bonds since the beginning of 2008, but doesn’t have any immediate need to return to the market.

“We’re not likely to be in the market until probably first quarter next year,” Dively said. “There’s just nothing pending that would be a reason we’re heading to the market in the next nine months.”

Officials in Seattle need to ask if BABs are appropriate for a city with double-A-plus to triple-A level ratings.

“For us, with a high credit rating and ready access to the market, a lot of these tools don’t really give us anything we don’t already have,” Dively said, adding that he’s willing to sit back and learn as others pioneer the new market.

“Other people are going to test some of these tools and we’ll have the opportunity to learn how they work,” he said.