WASHINGTON - The top Republican on the Senate's tax-writing committee yesterday suggested that nonprofit hospitals, which are currently tax-exempt and have the ability to issue tax-exempt bonds, should instead become taxable and receive tax deductions or credits for charitable activities.

Senate Finance Committee ranking minority member Charles Grassley, R-Iowa, floated the idea during a roundtable discussion on health care reform, after noting that it has become increasingly difficult to distinguish the work of for-profit hospitals from nonprofit hospitals.

Although the Internal Revenue Service has historically provided tax-exempt status to hospitals operating for the benefit of the poor, those hospitals no longer seem to be focused on that, he said.

"It appears that tax-exempt hospitals are more likely to provide services to those with insurance than to the poor and indigent," Grassley said, adding that the growth of federal and state insurance programs like Medicare and Medicaid and private insurance has decreased charitable care.

Although Grassley has been skeptical in the past about the broad tax exemption for nonprofit hospitals, he framed yesterday's comments within the debate on comprehensive health care reform. If universal health care is adopted, he argued, hospitals should see a large decline in uncompensated care and may no longer deserve tax exemption.

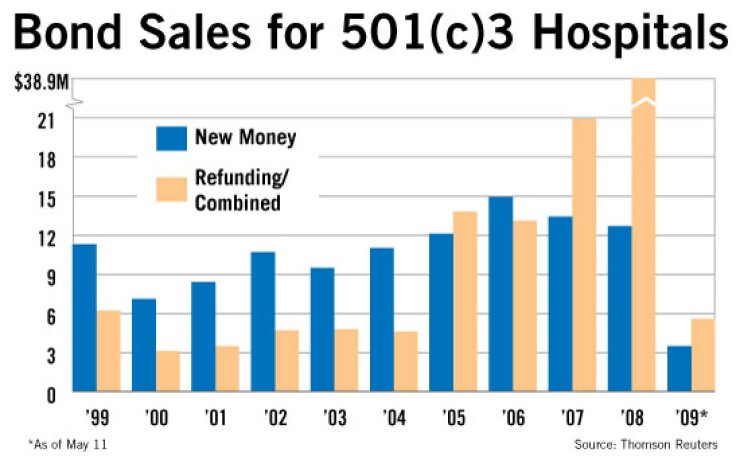

Leonard Burman, director of the Tax Policy Center, a joint venture of the Urban Institute and the Brookings Institution, who spoke at the roundtable, argued that hospitals should move away from issuing tax-exempt bonds.

"That's a really inefficient way to subsidize anything," he said. "A large share of the benefits actually goes to the bondholders rather than the entities issuing the bonds, so it would only make sense to rein that in or convert it into some kind of direct cash subsidy, in which case we could target it to the places that need help."

Many of the witnesses agreed with Grassley's assessment that the broad-based exemption should mostly fall by the wayside, but said it still will be necessary in some form.

"I think it would be a mistake to totally wipe it out, but we can substantially reduce it," said Stuart H. Altman, a professor of national health policy at Brandeis University.

At issue in the debate is the definition of charitable care. Grassley maintains it is providing health care for the poor, but nonprofit proponents say it is much broader.

Larry S. Gage, a partner at Ropes & Gray LLP and president of the National Association of Public Hospitals and Health Systems, said that tax-exempt hospitals do far more than just provide care to uninsured individuals.

"There certainly are a lot of nonprofit hospitals that provide a wide range of community services around the country that include, but are not at all limited to, just providing charity care," he said. "I think there are some pretty solid arguments that nonprofit tax-exempt hospitals will continue to be an important community resource even if and when we see health reform phased in, and that there certainly will be legitimate arguments to be made for both their status as exempt organizations and their ability to access tax-exempt financing."

Lawrence A. McAndrews, president and chief executive officer of the National Association of Children's Hospitals and Related Institutions, pointed out that serving the poor is just one measure of a contribution to society.

He noted that children's hospitals have child abuse programs, immunization programs, and other programs that serve communities. "Historically, there have been a variety of reasons organizations have been granted tax-exempt status, such as colleges providing education and YMCA's providing exercise equipment," McAndrews said. "Charity is one of the measures [for receiving exempt status], but it's just one."

McAndrews and Gillian Ray, a spokesperson for NACHRI, said if tax-exemption is pulled from hospitals, children's hospitals will be the hardest hit because typically at least 50% of the patients they serve are on Medicaid, the federal insurance program for low-income individuals, the disabled, and the elderly.

Lynn Hume contributed to this story.