DALLAS — Top-rated Utah will offer risk-averse investors a second chance this year to acquire the state’s gilt-edged debt, issuing $111 million of general obligation bonds in a competitive sale May 5.

Zions Bank Public Finance serves as financial adviser on the bonds, which will be auctioned through Ipreo’s Parity electronic bidding system a week from today. Bids are due by 9:30 a.m. Mountain Daylight Time, and the State Bonding Commission will review the offers at a 3 p.m. meeting the same day.

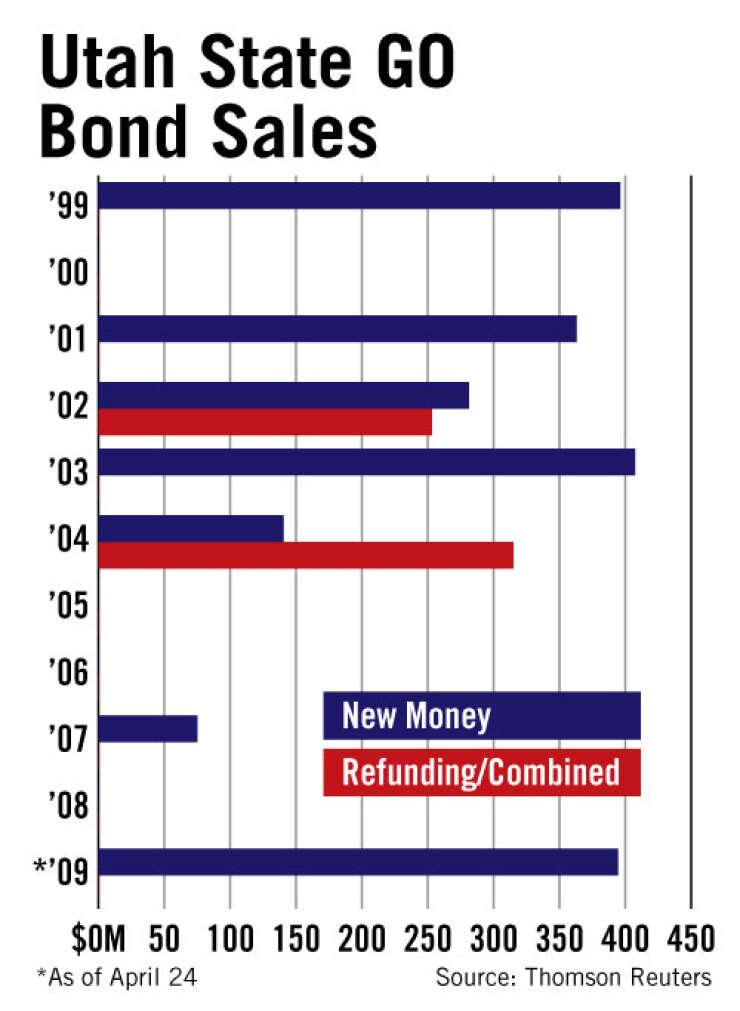

This sale is the second GO issue for Utah this year. The state sold $398 million for its highway construction program in March, a sale that drew strong retail interest, said Treasurer Richard K. Ellis, who also heads the Bonding Commission.

The upcoming issue, which should provide investors better yields than they would get with Treasuries, is expected to draw similar retail interest.

“We’re really positive about this deal,” Ellis said. “It’s a really short maturity of seven years. We’re expecting a really good sale.”

All three rating agencies have affirmed the state’s triple-A rating.

Bond counsel Ballard Spahr Andrews & Ingersoll has confirmed the bonds’ double tax-exempt status.

Proceeds of the sale will go toward the state’s capital construction and higher education projects.

With this issue, Utah will have only $1.5 billion of GO debt outstanding, a low debt burden with short maturities, according to Standard & Poor’s. With revenue bonds and lease debt, the government’s total debt burden comes to about $3 billion, or $548 per capita, Ellis said.

“Our policy has been for building bonds like this, we’ve kept them to six or seven years and for highway we go out to 15 years,” he said.

This year, Utah is boosting its debt program to accelerate construction of projects such as expansion of Interstate 15.

“We’ve got some major transportation projects that we’d like to get completed in four years instead of 10 years,” the treasurer said.

In their legislative session that ended March 12, Utah lawmakers closed a $1 billion budget gap through a combination of spending cuts, increased borrowing, and application of federal stimulus funds.

The state was able to maintain its rainy-day fund for the general fund and education with a combined balance of about $414 million, or 8.5% of the budgeted outlays, while retaining $100 million set aside during the 2008 general session for future education growth.

“Because the [rainy-day fund] receives 25% of any surplus in the general fund, and an education reserve receives 25% of annual education fund surpluses, we believe the state entered this period of economic stress with strong financial reserves,” analysts at Standard & Poor’s wrote. “Additionally, the state has also actively closed budget gaps as they emerged throughout the year.”