North Carolina is expected to sell $400 million of limited obligation bonds next week in the state's first negotiated sale since 2007.

North Carolina joins other triple-A rated states that have recently sold bonds through negotiation to better capture retail demand, and because underwriters have been unwilling to risk competitive bidding given current unsettled market conditions, market participants said.

Maryland, Georgia, and Utah are triple-A states that have sold general obligation bonds this year in negotiated deals, which are traditionally more expensive for issuers.

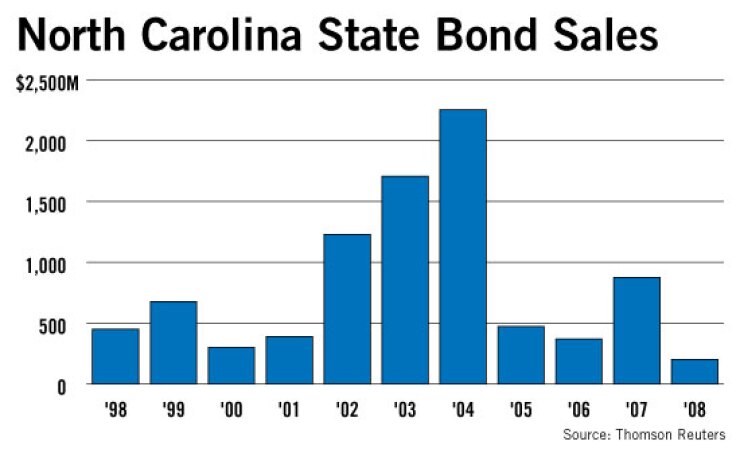

North Carolina has only issued four negotiated deals in the last 20 years, according to data from Thomson Reuters.

The Series 2009A bonds will provide funds for state universities, land conservation, prisons, and other state projects. Bond maturities will range from one to 20 years.

The underwriters are expected to take orders from retail investors on Wednesday and price the bonds for institutions on Thursday.

The limited obligation bonds are rated AA-plus with a stable outlook by Standard & Poor's and Fitch Ratings, a notch below the state's triple-A rating for general obligation bonds. The bonds will not be insured.

The limited obligation bonds are backed by the state's general fund, not the taxing power of the state, and therefore carry more risk.

The bonds were approved by the General Assembly and "will be sold due to the need to act quickly rather than wait for a referendum," which is needed for general obligation bonds, said Heather Franco, a spokeswoman for the state treasurer's office.

Under the terms of the deal, the state legislature is not obligated to appropriate money for the bonds and the governor can reduce appropriations for principal and interest if state revenue cannot pay the expenditures.

North Carolina first issued limited obligation bonds in July 2008 with a $200 million sale. The state will continue to use limited obligation debt in future sales instead of certificates of participation and other lease-backed securities, Standard & Poor's said.

Banc of America Securities LLC will serve as lead underwriter with BB&T Capital Markets, RBC Capital Markets, Loop Capital Markets LLC, and Wachovia Securities as co-underwriters.

Robinson, Bradshaw & Hinson PA will serve as bond counsel and First Southwest Co. will serve as financial adviser.

Market conditions have made negotiation the most cost effective way to sell the bonds, said Franco, as retail demand has been strong in recent months, especially for high-grade issuers.

In a negotiated deal a syndicate of underwriters is used to establish a price for the bonds and then distributes them to buyers. In a competitive transaction investment banks bid for the offering with the winning bidder becoming the owner of the bonds.

Underwriters can usually sell bonds to retail buyers at a higher price than they could to institutional buyers - a benefit that can be passed on to the issuer in order to help reduce the cost of a negotiated transaction, said a market participant familiar with the deal.

Even as a triple-A rated state, North Carolina might not have been able to find enough underwriters for a competitive bid in the current market, he said. Facing market volatility and strapped for capital, underwriters have been reluctant to bid on large competitive deals. Underwriters are able to spread risk among the syndicate of firms involved in a negotiated sale.

Underwriters were selected based upon services provided in prior sales, Franco said. The state will issue a request for qualifications to establish a pool of underwriters if limited obligation bonds are sold by negotiation in future deals, she said.

North Carolina's financial conditions have weakened amid the recession. The state faces a $2.2 billion budget shortfall in fiscal 2009 and general fund revenues are $1.2 billion below budget through February - a 9.2% decline from expected levels, according to Standard & Poor's. Gov. Beverly Perdue's biennial budget estimates a $3.4 billion shortfall for fiscal 2010, which starts July 1.

The state has reined in spending and is relying on federal aid to offset declining revenue. All agency budgets, except education, have been cut 9%. Officials expects to receive $1.7 billion in stimulus funds in fiscal 2010 and $1.2 billion in fiscal 2011. About $1.5 billion of the stimulus aid will fund Medicaid expenses. North Carolina has already hired contractors for some infrastructure projects with federal funds.

Unemployment has become a growing problem. North Carolina's jobless rate jumped to 10.7% in February, the fourth highest rate in the country, according to the U.S. Labor Department.

The state's unemployment rate was 5.2% in February 2008 and jumped the most among states in the 12-month period. The construction, manufacturing, and business sectors have led the unemployment declines, Standard & Poor's said.

In March, North Carolina Treasurer Janet Cowell met with lawmakers to discuss the budget for 2010 and emphasized the need to preserve the state's triple-A rating.

"Typically, no single factor is responsible for a downgrade in the state's bond rating," Cowell said in a statement. "However, a combination of short-term fixes like delaying debt payments, ordering furloughs, and rapidly depleting reserve funds will negatively affect the state's bond rating."