SAN FRANCISCO - With eager buyers allowing California to upsize this week's general obligation bond issue to the fourth-largest municipal bond sale on record, the state has gone a long way toward easing its infrastructure financing crunch.

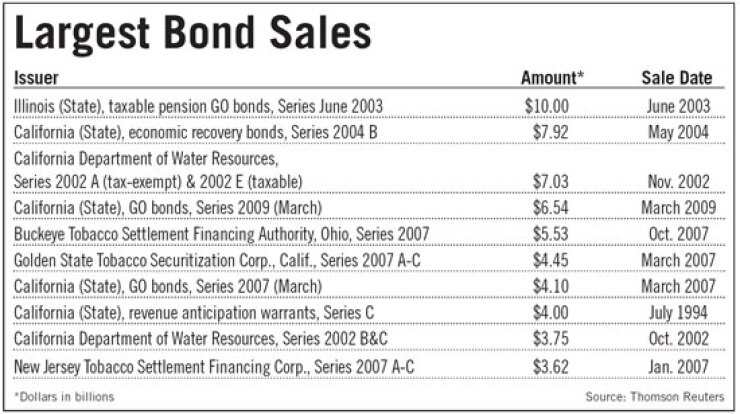

California had planned to price $4 billion of GO bonds yesterday. Buoyed by some $3.2 billion in orders from retail investors lured by yields as high as 6.1%, final pricing was moved a day ahead to Tuesday, closing out at $6.54 billion - the biggest muni deal in more than four years.

Merrill Lynch & Co. and Citi were co-senior managers for a team of 39 underwriting firms.

Participants expected strong national retail demand because of the absolute yields in the muni market relative to Treasuries, but got even more than they expected, said Dave Andersen, manager of the municipal syndicate and trading desks at Merrill.

"Most participants even in the deal expected the most you'd get is $2 billion; they ended up getting $3 billion," he said.

That put the state in a good position for institutional orders, Andersen said.

"They were able to lower the yields in the first three years where they didn't grow the deal, and where they did grow the deal they held the price," he said.

California issued such a large amount because it has been on the market sidelines since June as state lawmakers dickered over their response to a protracted budget and cash-flow crunch. Eventually, they agreed on a plan to close the $40 billion-plus budget gap with tax increases, spending cuts, and borrowing, though the state's legislative budget analyst has since warned that the weak economy will create a further $8 billion budget gap.

"If you have faith in California, that they're going to be just fine financially going forward, it's a great deal," said Alexander Anderson Jr., private client portfolio manager at Los Angeles-based Envision Capital Management Inc.

"The yields we saw on the deal were very attractive compared to other municipal paper," he said. "If you look at the scale, you could get 4% out to 2015, which is very difficult to do with other GOs, especially state GOs."

California GOs carry single-A ratings across the board. Every other state is rated higher.

"We didn't buy very much, because we have a very big exposure to California GOs already," Anderson added. "We're sticking to a lot of California essential service revenue bonds."

The state's long delay in issuance created a large backlog of bond-financed infrastructure projects. In December, financing for thousands of such projects was frozen. Even a $4 billion bond sale would not have provided much relief. The proceeds were to have gone to repay earlier project loans from the state's Pooled Money Investment Fund.

The PMIC board voted earlier this month to release only $500 million in new loans if the $4 billion sale was successful, despite hearing tales of woe from local school districts, affordable housing builders, and other organizations waiting for bond money. They warned that a continuing freeze would have consequences such as cancelled construction contracts and defaults on construction loans.

The additional proceeds from the upsizing of this week's GO bond sale will be applied to the backlog, meaning a lot more money can flow to a lot more projects, Department of Finance spokesman H.D. Palmer said yesterday.

"The situation is $2.6 billion better today than what the situation was when the sun came up yesterday," he said. "Clearly the treasurer and his staff were overachievers."

State finance officials are still tallying how much financing is needed for all eligible bond programs, he said.

"We haven't finished our work for how we propose to prioritize those dollars yet," Palmer said.

Proceeds from this week's sale will retire all $3.83 billion in outstanding loans the Pooled Money Investment Fund made to GO bond projects eligible for tax-exempt bond financing, according to a staff report for last week's PMIC meeting.

The pooled money fund is still owed about $1 billion for projects that must be financed with taxable bonds.

The state treasurer's office plans to retire those loans with proceeds from a taxable bond sale late next month, the report said.

The report said that Treasurer Bill Lockyer wants that sale to generate additional proceeds to provide upfront funding for other taxable GO projects, and also to issue taxable Build America Bonds with a federal subsidy to finance projects eligible for tax-exempt bonds.

The treasurer also plans two tax-exempt bond sales next month for the California State Public Works Board: a $400 million deal April 8 for a variety of departments, and a $200 million deal April 23 for University of California projects.