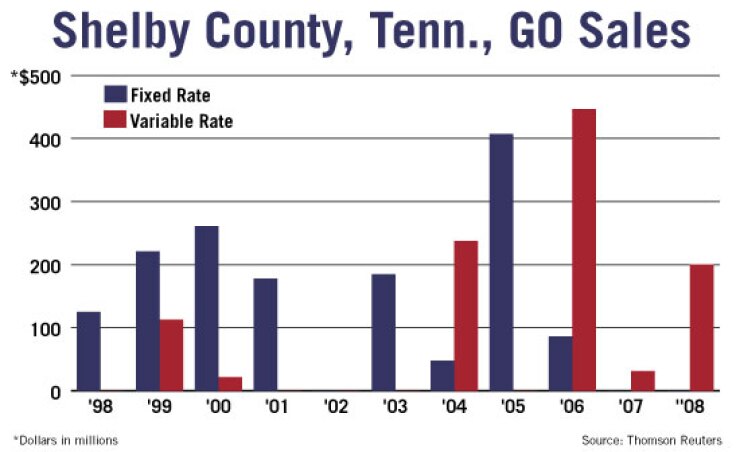

BRADENTON, Fla. - Shelby County, Tenn., today prices $235 million of fixed-rated general obligation refunding bonds to take out three recent variable-rate demand bond deals and terminate three swaps.

Proceeds of the transaction will refund $121.5 million of Series 2008A bonds, $79 million of Series 2008B bonds, and $31.5 million of Series 2007A bonds. The bonds being refunded are variable-rate demand refunding bonds with liquidity provided by Dexia Credit Local, which has seen its credit rating downgraded. Bond proceeds also will pay swap termination fees.

"It's been our intention to start reducing the amount of variable-rate debt that we have, and because of Dexia we wanted to get out of these three issues," said Michael Swift, deputy director of Shelby County's Division of Administration and Finance.

"These three issues have an average life of only about 7.5 years, so with low interest rates on the short end of the curve it's very economical to issue fixed-rate debt to take these variable-rate debt issues out," Swift said. "This actually reduces our costs, and going to fixed, we eliminate risk."

The preliminary structure calls for the new bonds to have maturities ranging from 2010 to 2022.

While the transaction was prompted by the downgrade of Dexia, Swift said costs of issuance are still comparable to prior deals. The bonds are rated in the double-A category by all three major rating agencies and won't be insured.

This is not the typical plain-vanilla deal, Swift said, because the county also plans to reduce its exposure to its liabilities associated with swaps.

This week's transaction includes terminating three swaps, including a swap not associated with the three underlying deals being refunded this week, for an estimated cost of $17.9 million.

A fourth swap, associated with one of the underlying deals, will be transferred to bonds the county previously sold.

The county is using six underwriters to market the deal.

"We expect to sell a lot of it retail," Swift said.

Retail sales began yesterday and the sale concludes today with institutional pricing, said Gavin Murrey, a managing director at Morgan Keegan & Co., the book-runner on the sale.

"Shelby is an issuer whose ratings were affirmed by all thee rating agencies with stable outlooks, and their name hadn't been in the market on a fixed-rate basis for three years," Murrey said. "We expect [the deal] to be well received."

The bonds are rated AA by Fitch Ratings, Aa2 by Moody's Investors Service, and AA-plus by Standard & Poor's.

Fitch also affirmed the county's AA rating on approximately $1.9 billion of outstanding GOs and said the rating outlook is stable. Moody's also affirmed its Aa2 rating on the outstanding GOs.

Shelby County includes Memphis and is considered a major financial, industrial, and health center in western Tennessee.

Moody's said its rating reflects the county's regionally important tax base, sound financial operations, an above-average but manageable debt burden, and moderate swap exposure.

"Moody's expects the county to maintain stable financial operations given five years of surplus operations, as well as an additional surplus expected for fiscal 2009, which have built reserves back to satisfactory levels," said analyst Christopher Coviello.

The county suffered an operating deficit of $21 million in fiscal 2003 due to decreases in budgeted revenue and higher-than-expected expenses related to jail operations, according to Coviello.

Shelby County's financial position has significantly improved since a return to surplus financial operations in fiscal 2004, and continuing through fiscal 2008, increasing the general fund balance from $25.2 million to $65.5 million, Coviello said.

"Positive results since fiscal 2004 reflect stabilization of spending pressures in the areas of corrections and health care, and management's demonstrated willingness and ability to take necessary actions to rectify shortfalls and close financial gaps," said Fitch analyst Kelly McGary.

The county's overall debt burden is well above average at 5.1% of taxable market value, or $3,415 per capita, but should decline over time with a recent cutback in planned capital borrowing, given projections of minimal population and school enrollment growth, McGary said.

Other underwriters on this week's deal are Banc of America Securities LLC, Duncan-Williams Inc., Loop Capital Markets LLC, Morgan Stanley, and Rice Financial Products.

Public Financial Management Inc. and ComCap Advisors are financial advisers.

Edwards Angell Palmer & Dodge LLP is bond counsel. Charles E. Carpenter is underwriters' counsel.