The Bond Buyer’s weekly yield indexes rose this week amid a heavy onslaught of new issuance, mainly out of California, and a mostly unchanged secondary market.

“I think there has been decent activity in the secondary, but without a doubt, with the big calendars, the focus has been on the new issues,” said George Strickland, managing director and portfolio manager at Thornburg Investment Management. “But that doesn’t preclude stuff happening in the secondary.”

Strickland said demand for the new issuance this week has been “solidly OK,” and “sort of depends deal to deal.”

The week’s largest transactions included a $1.3 billion California general obligation sale, priced by E.J. De La Rosa & Co., along with a $908 million state issuance of taxable Build America Bonds.

The BAB deal was priced by Citi, and was announced one day prior to pricing, after a “reverse inquiry” led the state to sell the debt.

Of the total, $750 million were sold to a private investor, with the remainder offered during institutional pricing.

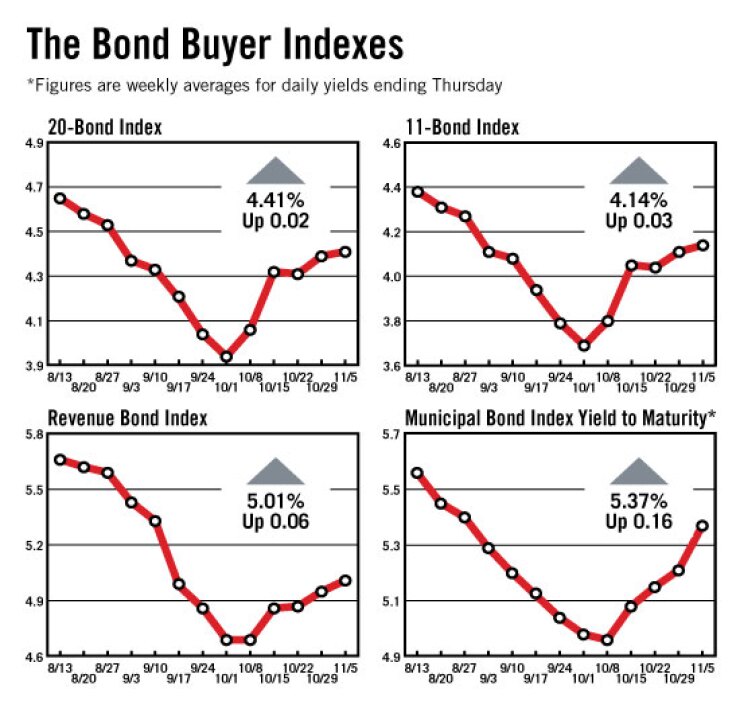

The Bond Buyer 20-bond index of 20-year GO yields rose two basis points this week to 4.41%, which is the highest level for the index since Aug. 27, when it was 4.53%.

The 11-bond index of higher-grade 20-year GO yields increased three basis points this week to 4.14%. This is the index’s highest level since Aug. 27, when it was 4.27%.

The revenue bond index, which measures 30-year revenue bond yields, gained six basis points this week to 5.01%, which is the highest the index has been since Sept. 10, when it was 5.33%.

The 10-year Treasury note rose three basis points this week to 3.54%, which is the highest level since Aug. 13, when it was 3.60%.

The 30-year Treasury bond jumped six basis points this week to 4.41%. This is the highest the yield has been since Aug. 13, when it was 4.42%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose one basis point this week to 0.56%, which is the highest it has been since Oct. 14, when it was 0.57%.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 5.37%, up 16 basis points from last week’s 5.21%.